The Australian and New Zealand Banking Group Limited (ASX: ANZ) share price has fallen today after providing a first-quarter update.

Currently, the ANZ share price is down 2.27% to $26.47.

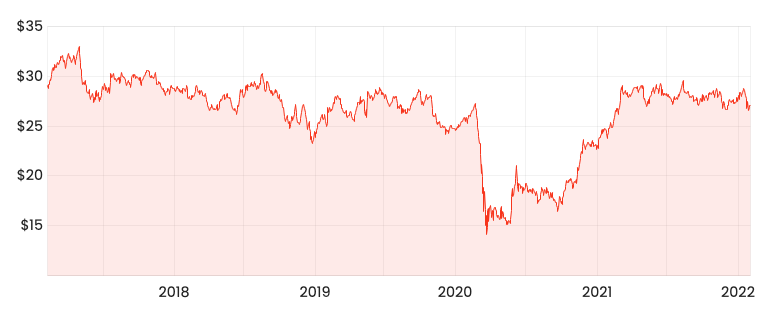

ANZ share price

What’s moving the ANZ share price today?

ANZ did not announce any financial results, instead providing an update on the operating performance of the bank.

ANZ Banking Group share price hits $27, is it good value?

NIM compresses

The bank’s net interest margin, which is the difference between its deposit and lending rate, fell 8 basis points during the quarter to 1.57%.

The largest driver of the NIM fall was New Zealand home loans due to the continuation of intense competition in the sector.

“The impact of rising rates, predominantly in New Zealand, and recent deposit pricing changes are expected to moderate these headwinds in the second quarter”

Regarding costs, ANZ expects run-the-bank expenses to remain flat.

Cost savings have been offset by increased investment across the Retail, Commercial and ANZx divisions.

Back on par

After improving its systems and process, ANZ home loan application times are now back on par with other major lenders such as Commonwealth Bank of Australia (ASX: CBA) and Westpac Banking Corp (ASX: WBC).

Subsequently, ANZ’s home loans book increased marginally over Q1.

Management noted high levels of refinancing, with households looking to lock in record-low interest rates.

Revenue hit

ANZ noted weaker revenue in its markets facing business as a result of weaker trading conditions.

Additionally, the bank has made changes to its Retail and Commercial businesses, creating simpler and lower-fee products.

What is good for the customer, is not so great for the ANZ share price. Subsequently, ANZ expects a $140 million operating income drop from the changes.

Buyback on track

ANZ has bought back just over $1 billion of shares in the business with a further $500 million to go.

Management flagged it may opt to increase the size of the buyback in the near term subject to capital requirements.

Currently, ANZ has a Tier One capital ratio of 11.65%.

How does the buyback impact the ANZ share price?

The purpose of the buyback is to increase the earnings and thus dividends per share.

The bank currently has a fully franked yield of 5.4%. Increasing the buyback will increase the yield on each share, which in turn improves the dividend investors receive.

ANZ will announce its first-half results and dividend on May 4.