Welcome to part one of our three-part Australian Investors Podcast mini-series on ethical investing in Australia, sponsored by Australian Ethical — a leader in ethical managed funds and superannuation.

In Part One I speak with Dr Stuart Palmer, Head of Ethics Research at Australian Ethical.

The Australian Investors Podcast is one of Australia’s top investor podcasts, as ranked by Apple Podcasts & Spotify, focused on investing in ASX & global markets.

Invest. better. With The Australian Investors Podcast. Subscribe on Apple Podcasts.

When you subscribe to the podcast on Apple Podcasts, Spotify, YouTube or Castbox you’ll get weekly insights on ASX & global shares, funds, ETFs and more. Let Owen be your field guide to investing profitably for decades to come.

Watch & listen now

Making the case for ethical investing

I believe that investing ethically is not a transient trend or thematic. It should be talked about in the same vein as your risk tolerance or return expectations.

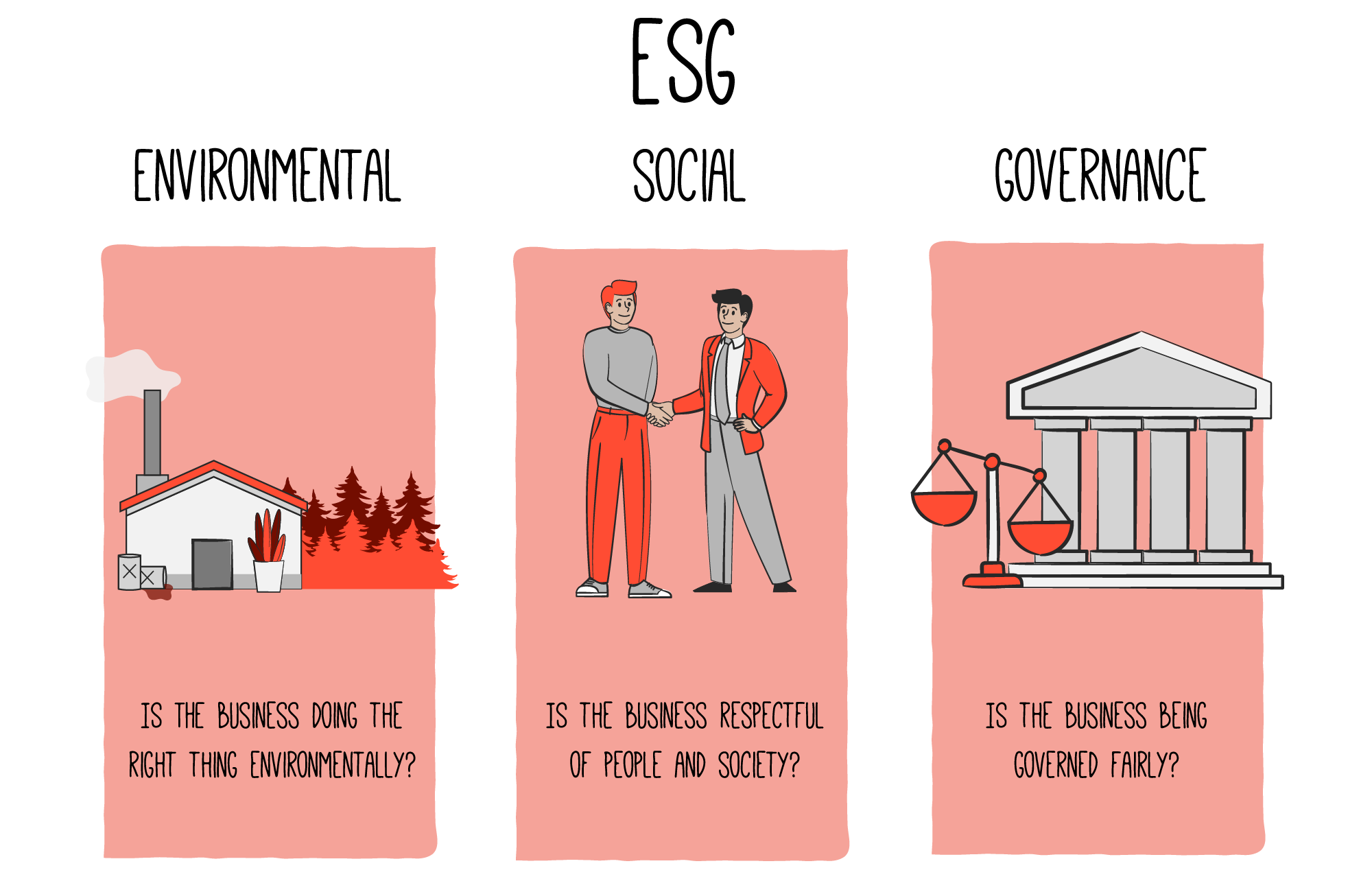

ESG, which stands for Environmental, Social & Governance, is rapidly emerging as one of the most important considerations for any investor. The amount of money invested in ESG-aware strategies is now over $10 trillion globally and rising quickly.

As I discovered when I was creating the Rask Ethical Investing course in 2021, according to a paper by Wynes & Nicolas (2017), choosing a high impact sustainable investment over a standard index fund option would result in a reduction of your annual carbon emissions totalling 7 tonnes.

To put that into perspective, it’s the equivalent of more than 5 families switching to a hybrid car or 7 people becoming vegan. Even a more conservative ESG investing strategy, can result in a CO2 reduction of 2 tonnes – equivalent to a return flight from New York.

Here at Rask’s Australian Investors Podcast, we’re all about finding businesses that can scale fast with lower incremental costs. Bigger returns, less effort.

Let me break this down. Switching to a proper sustainable investing option is by far the highest impact per unit of your effort that you will find. Anywhere.

As I hope we’re both going to discover, ethical, ESG, responsible or sustainable investing does not mean sacrificing returns. There are no hard and fast rules, so don’t be perturbed by people saying that something you’re investing in is unethical.

Here’s how I draw a distinction between ethical and sustainable investing: in my opinion, ethical investing is about your personal values, while sustainable investing can be objectively measured by carbon footprints, social impact measures, incentives and things like corporate governance ratings.

Highlights from this episode

In part one of this mini-series on Ethical Investing in Australia, you’re going to hear from Australian Ethical’s, Dr Stuart Palmer.

Stuart walks us through the evolution of ethical investing, the Australian Ethical Charter, the core tenants of the Australian Ethical investing process, and how the ethical filter creates a universe of investible companies.

Finally, I ask for Stuart’s response to owning Westpac Banking Corp (ASX: WBC) and Facebook / Meta Systems Inc (NASDAQ: FB) stock — then I run 5 ASX companies past him and his ethical filter:

- Guzman y Gomez. A private company involved in Mexican fast food.

- National Storage REIT (ASX: NSR). A self-storage REIT, which offers a dividend.

- Tyro Payments (ASX: TYR). A card terminal payments business.

- ARB Corporation (ASX: ARB). The 4×4 accessories company.

- Aussie Broadband (ASX: ABB). A company that provides low-cost NBN with good customer service.

In part two and part three, I’ll be joined by Australian Ethical’s Head of Australian Equities, Mike Murray, who walks us through the investing pillar of Australian Ethical and then offers us 3 ethical investment ideas from Australian Ethical’s Australian Shares High Conviction ETF (CBOE: AEAE).

I hope you enjoy this conversation with Dr Stuart Palmer of Australian Ethical.

Date recorded: 8th of February 2022.