The Bapcor Ltd (ASX: BAP) share price will be on watch today after announcing a 14% decline in earnings for the first half of FY22.

In the opening hour of trading, the Bapcor share price has fallen 3.97% to $6.78.

Bapcor provides vehicle parts and accessories to mechanics and households across its Burson, Autobarn, Midas and Precision Automotive Equipment brands.

Pandemic restrictions hit the brakes on Bapcor

Key highlights from the half ending 31 December 2021 include:

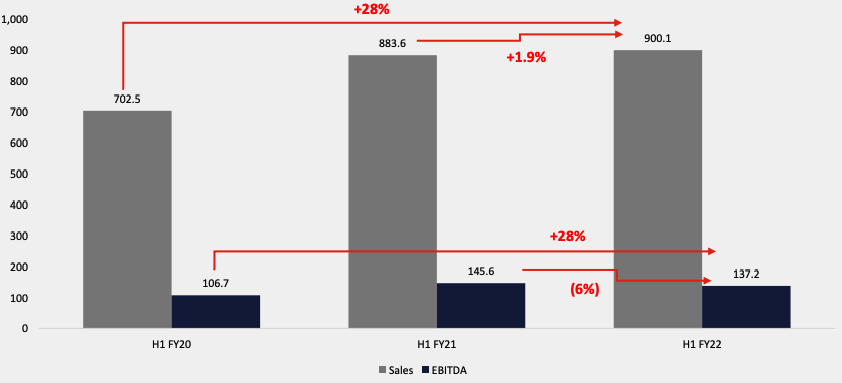

- Revenue of $900.1 million, up 1.9% year-on-year (YoY)

- Pro forma EBITDA of $137.2 million, down 10.5% YoY

- Net profit after tax (NPAT) of $57.7 million, down 14.7% YoY

- Fully franked dividend of 10 cents per share, up from 9 cents per share YoY

Despite the ongoing disruption of COVID-19, Bapcor eeked at a marginal uptick in sales led by new store openings.

The business opened eight new retail stores, four Burson branches and six specialist wholesale providers.

Special Wholesale, New Zealand and Trade all recorded positive growth compared to the prior half.

Conversely, Bapcor Retail revenue fell 5.4%, largely a result of a strong comparable period that benefitted from government stimulus.

While this half revenue growth is minor, zooming out over a two-year period and the company is much bigger today than pre-pandemic.

Profitability was impacted by the transition to a central Victorian distribution hub and team support such as paid pandemic leave when stores were forced to shut.

Noel Meehan – who was appointed as the permanent CEO yesterday following the controversial departure of Bapcor’s previous CEO – said:

“We continue to make solid progress on executing our strategic targets, with a focus during the half on network growth, realising operational efficiencies, expanding our own brand product range and growing in Asia”

The company also confirmed it has not been approached regarding a takeover offer.

What’s next for the Bapcor share price?

Bapcor expects to deliver pro forma earnings at least in line with FY21.

The business achieved EBITDA of $279.5 million and NPAT of 130.1 million last year.

Pending no more material pandemic impacts, the second half is expected to be stronger than the corresponding period.

Bapcor will also benefit from two acquisitions made in 2022, which will add $50 million in annualised revenue.

The appointment of a permanent CEO and restrictions easing should benefit the Bapcor share price in the near term.