The Megaport Ltd (ASX: MP1) share price will be on watch today after announcing a 42% increase in first-half revenue for FY22.

Currently, the Megaport share price is up 1.28% to $13.42.

ARR exceeds critical $100 million mark

Key results from the half ending 31 December 2021 include:

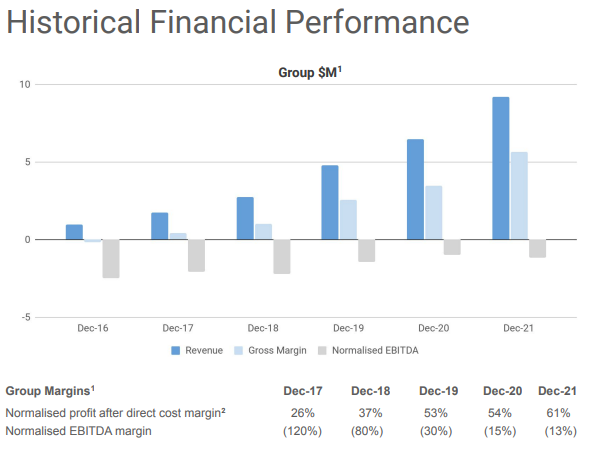

- Revenue of $51.2 million, an increase of 42% year-on-year (YoY)

- Gross profit of $30.0 million, a 69% YoY improvement

- Net loss of $20.2 million, down from a loss of $38.3 million

- Cash on hand of $104.6 million

North America led the revenue gains, recording an uplift of 55% and now accounts for half of Megaport’s revenue.

The Asia Pacific and Europe also recorded solid growth, up 28% and 35% respectively.

The revenue increase was largely led by the addition of 170 new customers in this half. The business also increased the number of services by 12% and ports by 11%.

Customers are also spending more with Megaport, with average revenue per port up 10%.

Subsequently, Megaport has surpassed the critical $100 million mark, with annualised recurring revenue of $110.4 million.

The $100 million milestone is largely considered as proof of product-market fit and validates the business model.

Notwithstanding the revenue uplift, Megaport’s losses remained largely the same once accounting for a non-cash foreign exchange loss in the prior period.

The business burnt through $29.8 million in its normalised activities. This infers about 18 months of remaining cash on hand.

Megaport One

At the half-year result, Megaport released a new product dubbed ‘Megaport One’.

It stems from the acquisition of InnoveEdge in August and is a white-label platform for managing the cloud.

The product allows managed service providers such as Macquarie Telecom Group (ASX: MAQ) and Over The Wire Holdings Ltd (ASX: OTW) to oversee customers through one platform.

“Partners are able to use Megaport ONE to integrate their own unique services into Megaport’s NaaS environment and offer holistic IT solutions”

What’s next for the Megaport share price?

Further sales growth appears on the horizon after Megaport released its PartnerVantage in November.

It allows channel partners to resell a variety of Megaport products, widening the company’s distribution capacity.

The company will also launch into Mexico through a partnership with KIO

networks.

“We have aligned our business, through innovation, network footprint, product positioning, and partner-building to be The Edge. The team will stay focused for the remainder of the fiscal year on executing our plan and achieving our revenue and EBITDA targets”