It’s been a choccas first week of reporting by ASX shares.

The big guys flexed their muscles.

Investors remain perplexed about e-commerce.

And the market short-terminism was on full display.

Here’s your 2-minute guide of the key results this week.

Keep up to date with the February 2022 reporting season calendar.

Tops dogs flex their muscle

When markets get a little jittery, investors start to question even the most revered ASX shares.

When will my ASX shares stop falling?

But realestaete.com.au owner REA Group Limited (ASX: REA) and Commonwealth Bank of Australia (ASX: CBA) reminded the market why these two have long been considered number one in their respective sectors.

REA boosted revenue 37%, profit by 31% and its dividend by 27%.

It’s now the 7th most visited website in the country, illustrating its grasp over Australia’s obsession with property.

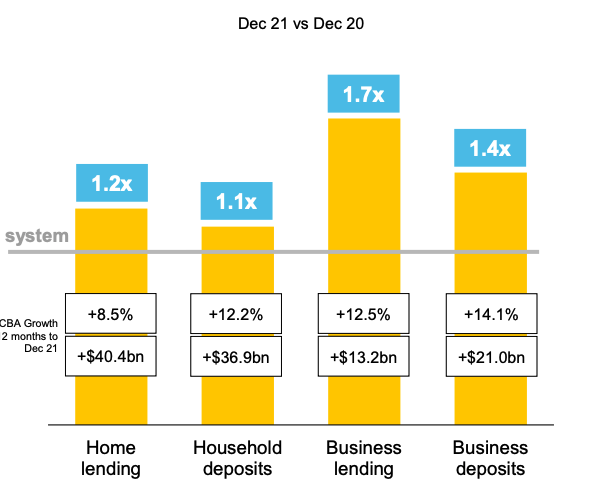

CBA operating performance improved 4%, while it announced an additional $2 billion buyback.

The headline result isn’t flash, but Australia’s biggest bank is outpacing its big four peers in every lending category.

Transitory or permanent?

Transitory and permanent are words usually reserved for discussing inflation.

But there’s been another battle going on between investors.

Is the exponential growth in ASX shares such as Temple & Webster Group Ltd (ASX: TPW) and Cettire Ltd (ASX: CTT) sustainable?

Both reported stellar top-line growth, with Cettire increasing sales by 192% and TPW revenue rising 46%.

But marketing costs for each exceeded gross profit growth. This indicates each company is spending more to acquire the same amount of customers.

Will shoppers go back to the local Westfield in a post-pandemic world? Or have consumer habits shifted?

That’s the million

billion question on everyone’s lips.

Short-term pain for long-term gain

As the market often does, short-term pain was punished despite the long-term benefits.

Alliance Aviation Services Ltd (ASX: AQZ) profit turned negative, as the business invested in extra staff and operations to triple the business over the next 12 months.

Similarly, Nanosonics Ltd

(ASX: NAN) said it would increase its direct-to-consumer distribution channel leading to a short-term hit to revenue but better margins over time.

Both ASX shares suffered share price falls of more than 10%, despite becoming better businesses.

Any investor with even a moderate time horizon could see that both decisions by management were sound and shareholder accretive.

Yet the market is impatient. This is is one of the many benefits of being a long-term investor.