The share price of embattled fund manager Magellan Financial Group Ltd (ASX: MFG) is sinking again after announcing outflows for the second time this week.

Magellan clients have redeemed $5.5 billion from its funds since January 1.

Additionally, it has lost a further $2.9 billion in distributions and suffered a negative market performance.

As a result, funds under management (FUM) has fallen to $87.1 billion after peaking at $117.9 billion just six months ago.

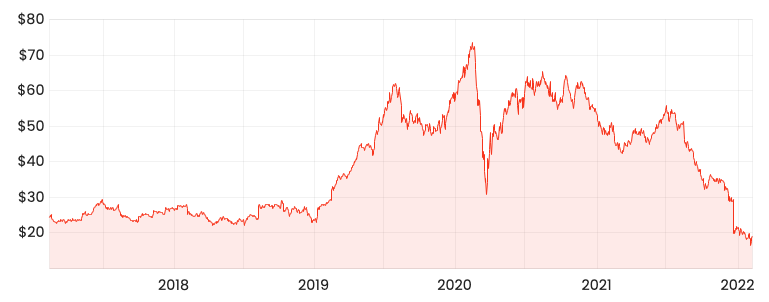

On the back of today’s update, the Magellan share price is down by nearly 6% to $17.97.

MFG share price

A disaster in investor relations

Keeping up with the latest Magellan news is becoming an exhausting exercise.

To illustrate, the country’s financial masthead has written 20 articles on the company this week – and it’s not even COB Friday.

So how did the Magellan share price lose 65% of its value over the past six months?

A brief timeline of events:

- June 30 – Flagship Magellan fund underperforms benchmark by 16.7% for FY21. Three, five and seven-year performance now below the benchmark

- December 12 – CEO Brett Cairns resigns citing ‘personal reasons’

- December 17 – Magellan’s largest client St James Place withdraws $23 billion in FUM

- February 7 – Co-founder and CIO Hamish Douglass departs citing ‘medical leave of absence’. No timeline on return.

While the above events have frustrated shareholders, the company’s (lack of) investor relations has been disastrous for the Magellan share price.

Just in October, the business stated it had no pressure on fees. Less than two months later, its biggest client departs.

“On fees, on the institutional business, which is $80 billion in funds under management, we haven’t seen any questions or pressures on fees whatsoever”.

Earlier in March, Magellan announced it would stop providing monthly flows data. Opting instead for quarterly releases.

While not a huge change, it also coincides just before outflows began to accelerate.

What next for the Magellan share price?

All of the above events have culminated in this week’s announcement that rating houses Lonsec and Zenith had downgraded Magellan funds.

Rating houses are the gatekeepers to financial advisors. A downgrade can lead to an advisor no longer adding to funds, or in a worst-case scenario pulling funds altogether.

Without a permanent CEO or CIO, Magellan is effectively rudderless.

And with outflows accelerating, the short-term outlook looks bleak.

To counter some of the bleeding, Magellan has brought back co-founder Chris Mackay and portfolio manager Nikki Thomas.

What impact that will have on the Magellan share price is yet to be confirmed.

At the end of the day, fund managers live and die on performance.