The Carsales.Com Ltd (ASX: CAR) share price will be on watch after announcing a 30% jump in sales for the first half.

The company owns online classified websites in Australia (carsales.com.au), Asia (Encar) and the Americas (Trader

Interactive and webmotors).

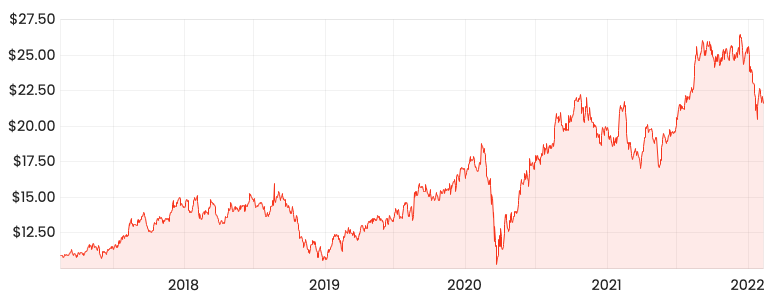

Carsales share price

Carsales share price buoyed by positive tailwinds

Carsales share price is unmoved today despite the company recording growth across the business.

Key financial results from the half-year ended 31 December include:

- Look-through revenue of $282 million, up 30% year-on-year (YoY)

- Look-through EBITDA of $149 million, increasing 15% YoY

- Adjusted net profit after tax (NPAT) of $89 million, up 20% YoY

- Interim dividend of 25.5 cents per share, up 2% YoY

Carsales has benefitted from a triple-whammy of positive tailwinds: lower public transport usage, absence of international travel and flexible working arrangements.

Demand for lifestyle assets such as boats and caravans has also been elevated due to the above factors.

Subsequently, site traffic across the network is up 12% compared to pre-pandemic levels.

“This reflects the quality of our marketplaces, ongoing investment in product and customer experience, the accelerated migration to digital platforms and changing consumer trends”

Carsales divisional update

Domestic revenue increased 16% while international revenue soared by 76%.

Carsales Australia reinforced its market leadership with traffic, vehicle inventory and customer engagement all increasing.

Private car sales led the race, which was partially offset by anemic growth in dealer sales.

Carsales International recorded contributions from all segments.

South Korea enjoyed a 19% rise while the United States achieved 12% growth. Brazil grew revenue 204%, albeit this was off a much lower base.

The recent Trader Interactive acquisition has performed strongly and is well-positioned to deliver value for shareholders.

With its growing international portfolio, Carsales could look to run the ruler over Frontier Digital Ventures Ltd (ASX: FDV), which also invests in international classified sites.

Carsales Investments division, which takes stakes in nascent car platforms, increased its revenue by 120% due to Tyreconnect.

What’s next for the Carsales share price?

Carsales share price will benefit from expected growth in revenue, EBITDA and NPAT over the second half.

All regions are forecasted to grow. Notably, Australian operations have recovered after a temporary dip over January as the Omicron variant spread.

Growth will be led by improved volumes from private advertisement, new car sales and the instant offer feature.

No further full-year guidance was provided.