The CSL Limited (ASX: CSL) share price has stormed out of the gates this morning up 6% after announcing its first-half results.

Keep up to date with the February 2022 reporting season calendar.

CSL share price weighed on by pandemic impacts

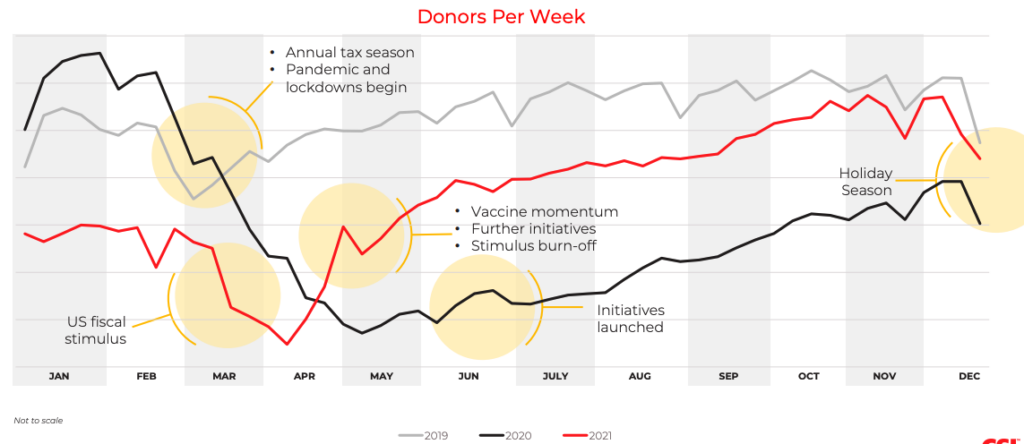

Pandemic impacts have continued to weigh on the CSL share price, with plasma collection still below pre-pandemic levels.

Key financial highlights for the first half ending 31 December include:

- Revenue of US$6.04 billion, up 4% year-on-year (YoY) in constant currency

- Net profit after tax (NPAT) of US$1.76 billion, down 3% YoY in constant currency

- Interim dividend of AU$1.46, up 8% YoY

CSL Behring

Despite total collections increasing by 18%, CSL’s core immunoglobulin portfolio remained impacted by limited plasma supply, a key input into the development of therapies.

CSL cited pandemic impacts, low unemployment and the closure of the Mexico-US border as the key drivers of reduced supply.

Manufacturing also has a nine to eleven-month lead time, therefore increasing supply will only flow through in future periods.

Subsequently, immunoglobulin revenue fell 9%.

Positively, products not reliant on plasma collections performed strongly.

CSL’s recombinant haemophilia B product, IDELVION, increased sales by 17%. Additionally, KCENTRA, a peri-operative bleeding product, grew 15%.

Overall, division earnings fell 22% on the corresponding half.

Seqirus

The fall in earnings from CSL Behring was somewhat offset by growth in the influenza division.

Seqirus achieved a 24% profit jump, driven by seasonal demand. Over 110 million vaccines were distributed, a record half for CSL.

Vifor acquisition on track

The recently announced $17 billion acquisition of Vifor Pharma is on track.

CSL expects the deal to be finalised by the end of 2022 pending regulatory approvals.

Vifor Pharma will expand CSL’s product range into renal disease and iron defiance, complementing its existing product range and pipeline.

What’s next for the CSL share price?

CSL said FY22 sales would be skewed heavily towards the first half, with 80% of revenue falling in the current period.

Expenses however would be spread move evenly across the year. Therefore CSL’s second half-result will likely be a loss.

Management has guided for FY22 NPAT between US$2.15 billion to US$2.25 billion for the second half in constant currency.

The forecast includes US$90 million to US$110 million in costs relating to the Vifor Pharma acquisition.

Commenting on CSL’s outlook, CEO Paul Perreault said:

“Over the last 6 months of visiting our operations around the world and talking to staff and patients, I’m very encouraged by seeing increased social mobility and the beginnings of a return to a more normalised environment”