The Santos Ltd (ASX: STO) share price has fallen today despite the business announcing a 48% jump in earnings in FY21.

Elevated energy prices lead to bumper Santos dividend

Currently, the Santos share price is down 2.57% to $7.21.

Key financial results from the year ending 31 December include:

- Sales revenue of US$4.71 billion, up 39% year-on-year (YoY)

- EBITDA before exploration of US$2.81 billion, up 48% YoY

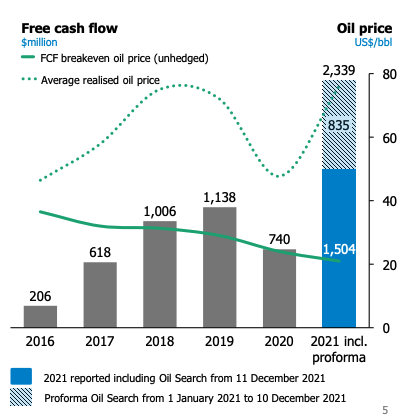

- Free cash flow of US$1.50 billion, up 103% YoY

- Interim dividend of US8.5 cents per share, 70% franked

A lack of investment in new projects in addition to recovering energy demand from the pandemic provided the backdrop for significantly higher oil and gas prices compared to the prior year.

This has also benefitted other major oil producers Woodside Petroleum Limited (ASX: WPL) and Beach Energy Ltd (ASX: BPT).

“It is vitally important that investment in new supply occurs and in a sustainable way. At Santos, we are focussed on supplying critical fuels more sustainably to meet society’s demand”

Santos also benefitted from three weeks contribution from the recent Oil Search acquisition.

“Had the merger been in place for all of 2021, the combined asset portfolio would have generated more than US$2.3 billion in free cash flow for the year”.

The big profit jump reflects Santos low cost operating model, which delivered a free cash flow breakeven of US$21 per barrel.

Further upside in the Santos share price

The Santos share price will be supported by US$2 billion to US3 billion in asset sales in the near term.

Ownership of projects in Papua New Guinea and Alaska are under the spotlight in addition to Australian infrastructure assets.

Proceeds will be used to lower debt as well as potentially additional capital returns to shareholders.

What’s next for the Santos share price?

The Santos share price will benefit from a production increase of 100 to 110 million barrels of oil, primarily driven by the Oil Search merger.

In total, the business expects to sell 110 to 120 million barrels, leaning on its existing reserves.

Capital expenditure is expected to be US$900 million while restoration spending will be US$200 million.

Major growth projects will cost between US$1.15 billion to US$1.30 billion. An additional US$400 million could be required pending future investment decisions.

At an average oil price of US$65 per barrel, Santos expects sufficient free cash to flow to cover all growth projects.

Currently, the Brent crude price is $93.12 per barrel.