The Transurban Group (ASX: TCL) share price has gone nowhere so far today despite the company announcing its first HY22 results.

Keep up to date with the February 2022 reporting season calendar.

Transurban share price unmoved

Currently, the Transurban share price is up just 0.08% to $12.89.

Key financial results for the half ending 31 December 2021 include:

- Revenue of $1.3 billion, down 8.6% year-on-year (YoY)

- Free cash of $459 million, a 1.7% fall YoY

- Loss of $106 million, down from $311 million on the prior corresponding half

- Interim distribution of 15 cents per security, unfranked

While the business recorded another accounting loss, a better proxy for Transurban’s profitability is free cash as it excludes non-cash items.

Across its toll network, average daily traffic (ADT) decreased by 4.8%. Despite the fall in daily traffic, toll revenue decreased by just 0.2%.

The 8% fall in revenue was largely attributed to lower construction activities in the half.

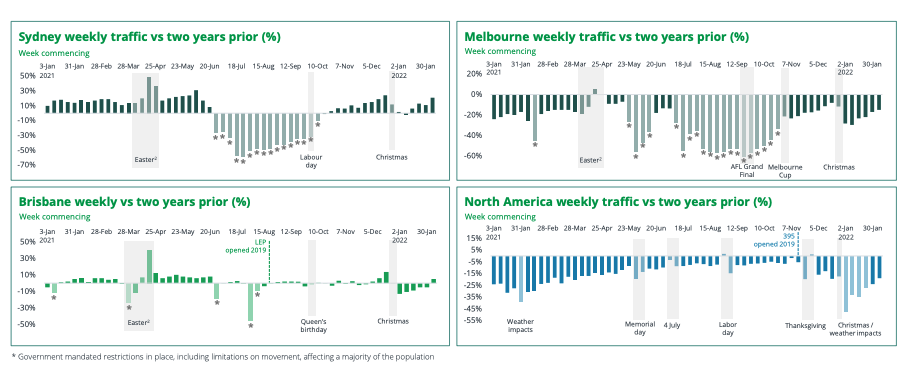

Transurban’s key markets of Sydney and Melbourne – which make up 72% of its revenue – continued to be impacted by COVID-19 restrictions on mobility.

Subsequently, ADT in Sydney plunged 25.6% while Melbourne fell 20.6% over the half.

North America was the standout, with ADT growth just shy of 30%. Brisbane ADT increased by a modest 4%.

“Traffic is impacted when government restrictions are put in place but tends to recover quickly as they are eased and people start to move about the cities again”

Inflation protected

The Transurban share price would be a net beneficiary from rising interest rates in the near term.

68% of its network is linked to consumer price indexes, inferring that when inflation does rise Transurban will pass through those costs to vehicles.

The remaining 27% is fixed at a 4.25% annual increase, with just 5% on dynamic pricing.

As for its considerable debt load of $23.1 billion, the company noted a 1% increase in interest rates would be more than offset by the rise in revenue.

What next for Transurban shares?

The Transurban share price will continue to be impacted by pandemic restrictions.

January and February suffered from spiking Omicron cases. However, cases look to have peaked and traffic should return thereafter.

Positively, Transurban shares will be supported by the recent resolution of the West Gate Tunnel Project and acquiring the remaining 50% of WestConnex.

The company expects to pay a final distribution in line with free cash excluding capital releases.

“We are investing in transportation networks that will be in operation for decades”