Brookfield Asset Manager (NYSE: BAM) and Mike Cannon Brookes (MCB) of Atlassian (NASDAQ: TEAM) have lobbed an unsolicited bid at AGL Energy Ltd (ASX: AGL) for a reported $8 billion. AGL is Australia’s largest energy retailer with 4.2 million customers and a network of poles, wires, coal powerplants, gas plants and some renewables.

MCB is a renowned environmentalist, futurist and technology whizz. BAM is one of the world’s largest alternative asset managers based out of Canada. So why would they be interested in buying distressed coal assets, and what should we as investors be looking out for?

AGL the value trap

If you had invested in AGL at any stage over the last five years, you’d be only too aware that it’s been a value trap. Jaz wrote about the bump in the share price after their recent earnings, but it’s fair to say the trend has not been their friend.

AGL share price

It wouldn’t surprise many Australians that this period has coincided with regulatory uncertainty – and a clear agenda to drive down household energy budgets, which essentially has transferred value from shareholders to households.

Demerger to unlock shareholder value.

AGL ($7.16 per share, $4.7 billion market cap) trades at a ~23% discount to its net asset value ($6.1bn). This discount reflects the market sentiment that AGL is a melting ice cube.

AGL announced its intention to demerge, with RemainCo saddled with the coal assets and liabilities, while NewCo would have the customers, retail networks, and new age renewable assets. This was seen as a way to unlock shareholder value, however, the bid by BAM and MCB would reverse that strategy.

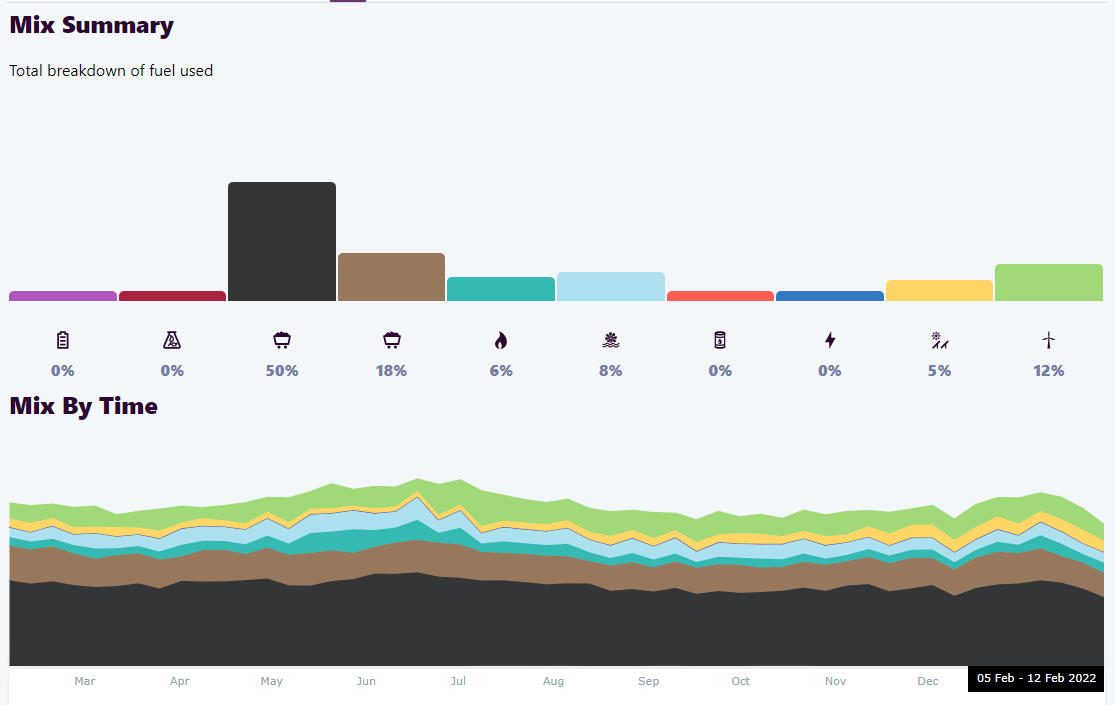

Coal on the nose

Black and brown coal combined is 68% of Australia’s energy mix, though this has been declining. AGL and Origin Energy (ASX: ORG) have been rushing to get rid of their ailing coal assets – which are becoming more expensive to run each year, and have significant liabilities associated with environmental rehabilitation and restoration.

Origin announced last week their intention to close Australia’s largest coal power plant early. The response from Minister Angus Taylor was far from positive, noting this would drive up energy prices. Well, perhaps that’s the point?

Increasing Energy Prices

Any valuation of AGL needs to factor in future energy prices and margins. Wholesale energy prices over the past few years have been particularly low, though expectations are for this to increase. Households and industry will bear the brunt of this as retail margins expand – ABS data shows only 2.17% of household income is spent on electricity and 0.87% on gas. This may go up, increasing the value of all energy-producing assets.

If MCB can provide an overarching strategy to reshape the energy mix of AGL towards renewables in a market with increasing energy prices, that could be quite valuable.

We value your custom(ers)

AGL has been aggressively acquiring customers and now serves 4.2 million businesses and households. On the books, these intangibles are worth $2.4 billion. The recent Click acquisition valued customers at $543 ($2.2 billion), though these have already started being impaired. This is ~11% higher than Origin’s $487 per customer in their WinConnect acquisition.

Interest rate arbitrage

BAM recently secured 3.53% for US$500 million of senior notes for 30 years. Compare that to AGL, which secured 5% for five years in December 2021. Considering AGL’s $3.5 billion of debt, the capital restructure with BAM’s balance sheet would save over $50 million per annum.

Final thoughts

The bid by MCB and BAM is as much about capital allocation, as it is the belief that Australia and AGL will successfully transition to a lower-carbon economy. For the sake of our future, I hope they’re right, but I will be watching from the sidelines.