ASX shares have been out with some huge earnings reports today. Here are three that caught my eye and I’d consider buying today.

Keep up to date with the February 2022 reporting season calendar.

1. ARB Corporation Limited (ASX: ARB)

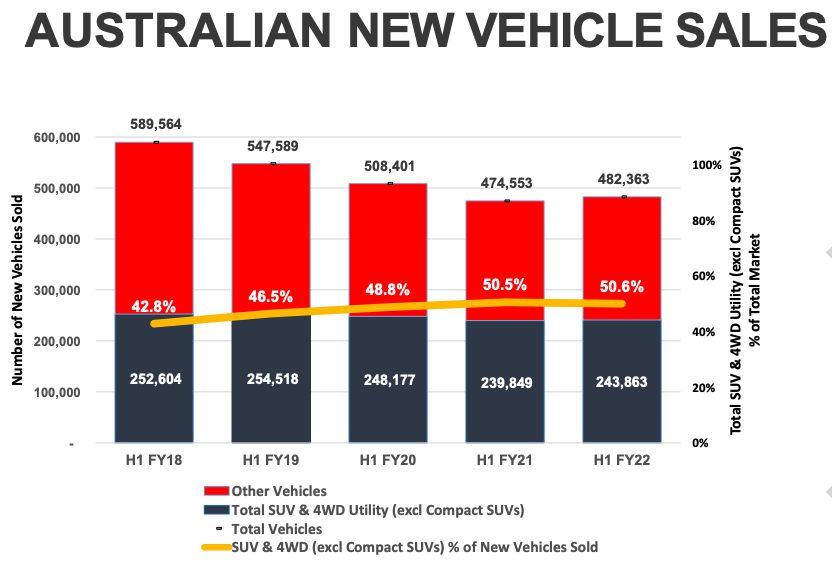

Despite new vehicle sales retracing over the half, 4×4 accessories retailer ARB announced a 27.6% jump in earnings.

All divisions recorded double-digit growth. Exports soared 39.9% led by growth in Europe, Africa and the Middle East.

Meanwhile, car manufacturers such as Ford and Toyota stocked up big time on accessories, resulting in a 50.6% jump in OEM sales.

Subsequently, the interim dividend was raised to $0.39 per share, a 34.5% improvement.

Management cautioned the market that the second half would include supply chain, shipping, retail and distribution pressures.

But taking a longer-term view, this is a quality ASX shares management team executing on a global scale with enormous potential for further growth.

2. Uniti Group Ltd (ASX: UWL)

The major competitor to the national broadband network (NBN) Uniti saw its share price slide over 11% today.

The market was likely disappointed by the absence of further news regarding a potential acquisition of the business.

But its first-half result was largely in line with guidance. It recorded an EBITDA of $70.5 million and increased its recurring revenue to over 90% of total sales.

It also accelerated future growth with an additional 51,000 premises added to its contract order book.

Uniti spends upfront to lay fibre in the ground and connect new residences.

Once construction is completed, it receives rent from ASX shares like Telstra Corporation Ltd (ASX: TLS) for accessing its network.

It’s a long duration, steady cash flow business with a tonne of future growth. I own it and would consider adding more after the share price fall.

3. Macquarie Telecom Group Ltd (ASX: MAQ)

Macquarie Telecom is one of few ASX shares to achieve 15 straight half-year results with growth.

Revenue increased 4% over the half, while EBITDA grew 11%.

One of the major reasons behind its success is the obsessive focus on the customer.

It has a market-leading net promoter score of +75 and is subsequently home to a suite of government and corporate clients requiring telecom and cloud services.

But what’s got the market excited about this company is its disciplined approach to building data centres.

Intellicentre 3 was completed on time and budget during the half. Meanwhile, it’s in the process of adding further capacity and Intellicentre Super West.

It’s not going to set your world on fire, but this steady-as-you-go business is a great bottom drawer stock.