The Domino’s Pizza Enterprises Ltd (ASX: DMP) share price is sinking today after failing to deliver in under 30 minutes to impress the market with its first-half results.

Keep up to date with the February 2022 reporting season calendar.

Domino’s owns and franchise stores in France, Germany, Belgium, Netherlands, Denmark, Luxemburg, Japan, Taiwan, Australia and New Zealand.

Domino’s share price whacked by earnings reversal

Currently, Domino’s share price is down 12.57% to $87.59.

Key financial results for the half ending 31 December include:

- Revenue of $2.01 billion, up 11.1% year-on-year (YoY)

- EBITDA of $212.8 million, down 2.5% YoY

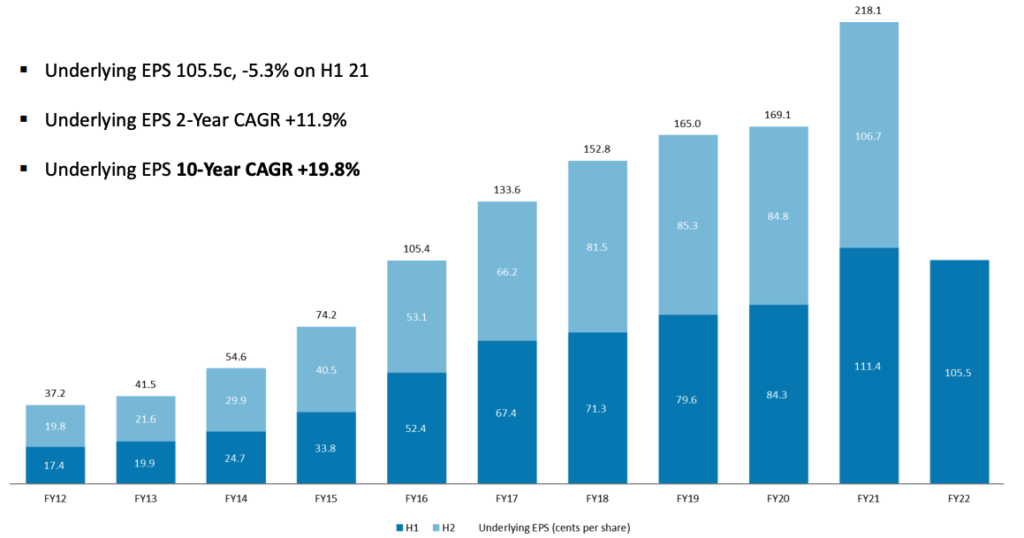

- Net profit after tax of $91.3 million, down 5.3% YoY

- Interim dividend of $0.884 per share, flat YoY

Europe has been the standout performer, with sales and earnings both increasing over 11%.

The region opened 47 new stores bringing its total network to 1,329.

Conversely, both Australia and New Zealand (ANZ) and Asia record negative profit growth.

ANZ division is currently undertaking Project Ignite, which is aimed at improving the profitability of underperforming corporate stores by transferring ownership to franchisees.

New Zealand stores were also shut for four weeks during the half due to COVID-19 lockdowns.

Asia added 99 new stores and also acquired 156 as part of onboarding Taiwan to its network.

Management noted the state of emergency in Japan as a major headwind.

Moreover, Domino’s has been accelerating its new store rollout, which places pressure on margins given the immaturity of new stores.

Overall, the fall in earnings and profit looks to be a short-term blip.

But the market was expecting more therefore Domino’s share price has been whacked.

Dealing with inflation

Retailers such as JB Hi-Fi Limited (ASX: JBH) and Temple & Webster Group Ltd (ASX: TPW) have noted inflationary pressures.

Domino’s is no different. But to counter rising prices, the business is focused on providing “more for more”.

Rather than simply hike prices, the business is adding extra value to its product and thus shielding margins.

For example, the “Value Max” range in ANZ provides customer favourites, extra toppings and value, whilst also delivering higher sales and margins to stores.

What next for Domino’s share price?

It’s been a poor start to the year for Domino’s share price, down 30% since January 1.

For the first six weeks of 2022, network sales have grown 6.0% while same-store sales have increased 1.7%.

The business is on track to open 500 new stores in FY22, including the recent Taiwan acquisition.

In summary, it was a soft result. But expect earnings to return to growth in the short-term as management executives on its growth strategy