The WiseTech Global Ltd (ASX: WTC) share price is rising today after upgrading FY22 guidance in its first-half results.

Keep up to date with the February 2022 reporting season calendar.

Supply crunch underlines WiseTech share price growth

Currently, WiseTech share price is up 3.01% to $44.08.

Key financial results for the half ending 31 December include:

- Revenue of $281.0 million, up 18% year-on-year (YoY)

- EBITDA of $137.7 million, up 54% YoY

- Net profit after tax of $77.4 million, up 74% YoY

- Interim dividend of $0.903 per share, up 85% YoY

WiseTech is one of the few ASX shares to benefit from the global supply chain crunch.

Other companies like Pilbara Minerals Ltd (ASX: PLS) have reported big step ups in freight costs.

“The ongoing growth of eCommerce and strong demand for goods, coupled with the challenges posed by outbreaks of new COVID variants, has resulted in continued capacity constraints, port congestion, supply chain labor shortages and higher freight rates”

Increased freight and shipping costs do not directly correlate to WiseTech revenue growth.

But it does drive the adoption of WiseTech’s technology with logistics companies upgrading legacy systems to optimise productivity.

Subsequently, its flagship software CargoWise increased sales by 29% over the period.

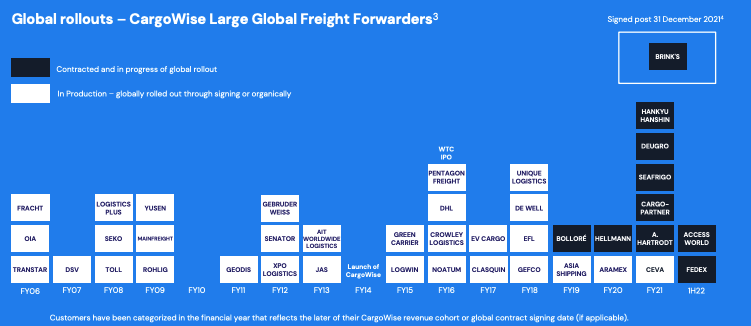

The business signed FedEx and Access World as key global accounts. It also added Brink’s Global Services after the 31 December reporting date.

Offsetting growth in CargoWise was revenue from Acquisitions, which fell 1%.

Acquired businesses typically have one-off license revenue and therefore often fall as they transfer to WiseTech’s commercial model.

Costs out, earnings up

In addition to the strong sales growth, WiseTech share price will benefit from $19.8 million in net cost reductions.

As a result, earnings, net profit and the interim dividend all increased at a faster pace than revenue.

This demonstrates operating leverage. As the business scales, more profit is dropping to the bottom line.

“The Company is on track to achieve a cost reduction run-rate of ~$45 million for FY22, exceeding its previous target of ~$40 million”

What’s next for the WiseTech share price?

The WiseTech share price will be supported in the near term by an upgrade of FY22 guidance.

The business has increased EBITDA growth forecast to 33%-43%, representing $275 million – $295 million.

Previously, EBITDA growth was expected to be from 26%-38%.

Management also reaffirmed its revenue growth guidance of 18%-25%, representing $600 million – $635 million.

WiseTech will benefit from industry consolidation, as current customers acquire smaller operators and add them to their CargoWise rollouts.