Dear Wealthy Wizards,

Kate here, co-host of The Australian Finance Podcast and the person ready to help you make sense of your finances! Be sure to enrol in one of our free courses on Rask Education to catch these stories in your inbox each fortnight.

If I asked you how to actually “get rich”, you might suggest anything from getting a sweet inheritance, robbing a bank, working for (or starting) the next Apple or winning the lotto.

But for most of us, the reality of any of those things happening is fairly low, and we generally categorise the rich people we hear about in this “other” category, a category we’ll never be a part of.

🦄 Do you want to look rich or be rich?

If I can be honest with you right now, there’s a way to build wealth that doesn’t require any unicorn-like feats. But, it requires you to start learning straight away because time is an essential ingredient to this method.

You might have noticed the switch from the word rich to the word wealth. There’s a big difference between those two words. It’s fairly easy with a credit card, car loan and massive mortgage to look “rich”, but that doesn’t mean you’re actually wealthy.

As Morgan Housel puts it, wealth is what you can’t see. There are plenty of Instagram accounts to help you if your goal is to look outwardly “rich”, but it’s also possible to build real wealth over time and change the direction of your financial future.

Real wealth gives you control over your time, but there’s a catch:

Firstly, you have to get started today, no matter how much of life you’ve already lived.

And secondly, you have to stop the goal posts from continuously moving once you do (or you’ll never be satisfied).

🛋 How to build wealth without leaving the couch

Wealth is built by getting and staying out of nasty debt (think personal loans and credit cards), spending less than you earn (and increasing your income when possible) and investing in assets (think property and businesses).

You can start investing in great companies with less than $50 right now, through platforms like Stake, Raiz, Sharesies, CommSec Pocket, Superhero & Spaceship 🚀

Open an account, learn the basics of share and ETF investing (we’ve got free courses for that) and just have a go buying a company you love (we’ve even created a checklist).

Investing becomes a lot more interesting when you’ve put some money on the line.

🌳 Compound interest might just change your life

Money doesn’t grow on trees, but it can grow. This magic trick is commonly referred to as compound interest, and the great thing is – it doesn’t require any knowledge of magic.

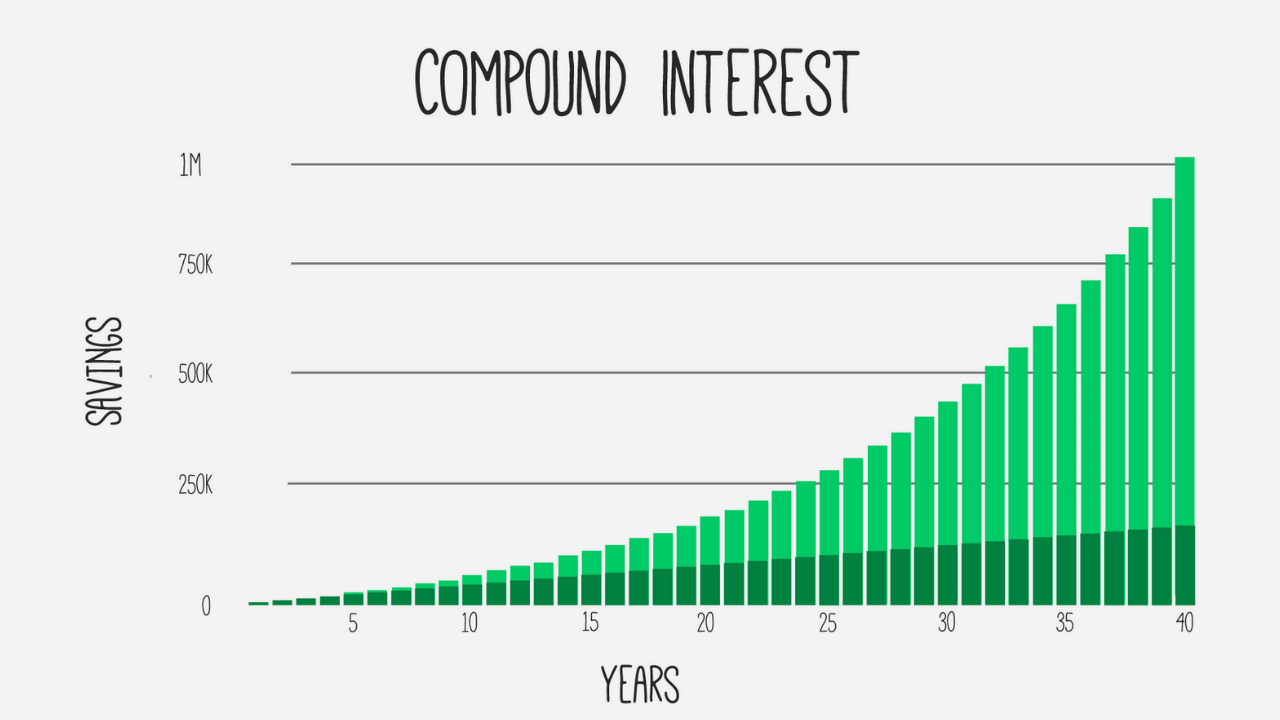

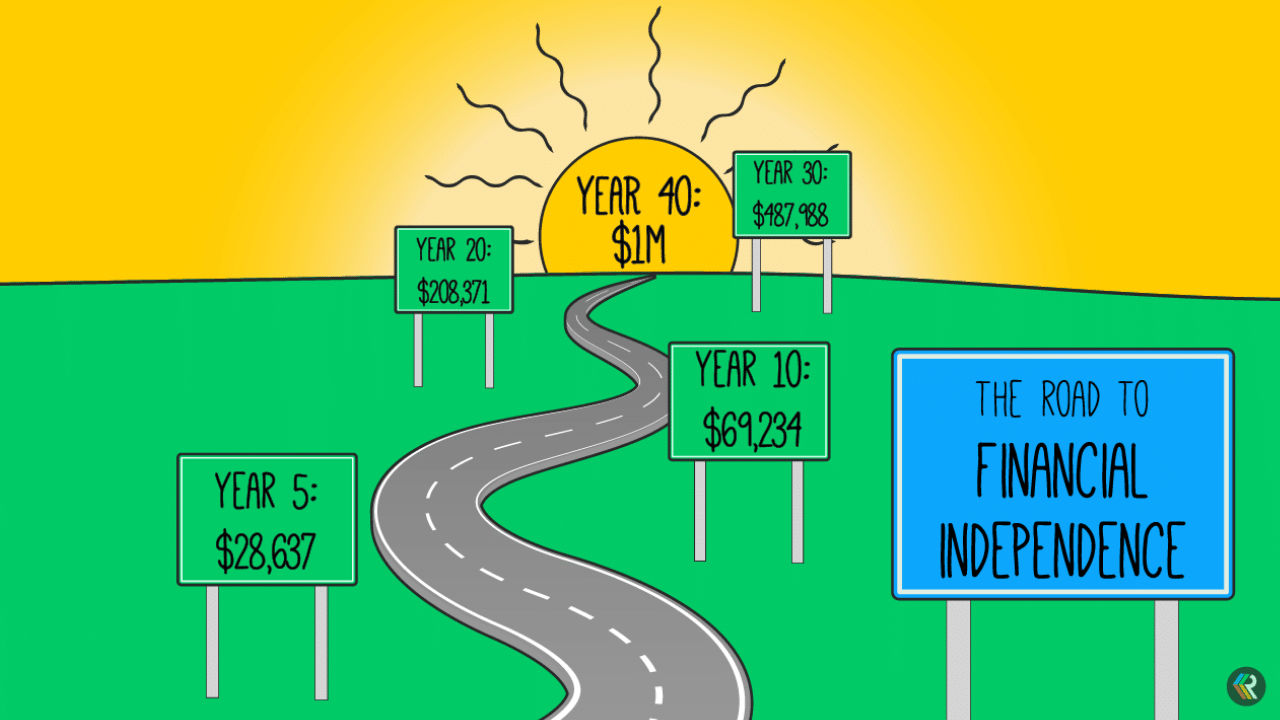

The essence of compound interest is that your money grows over time as the income and capital growth on your investment compound.

It’s often depicted as a snowball: the longer you let it roll down the hill and the more snow you feed it, the bigger it gets.

Here is an example of how you could reach $1,000,000, by investing $400 every month (at 7% annual return) for 40 years.

As you can see above, breaking down a crazy goal like being a millionaire into small manageable components can turn a ridiculous financial goal into a life-changing reality.

Just imagine what you could do with a million dollars (I know I have)!

So, are you ready to give investing a go?

📋 Where to learn the basics in three easy steps

If this has inspired you to give investing a go, here are three simple things you can do today to change the direction of your financial future ↩️

1) Get a weekly dose of money insights straight to your phone by subscribing to our popular podcast, The Australian Finance Podcast.

2) Supercharge your journey by starting a free investing course on Rask Education. They’re free and you’ll be in the company of 13,000+ other awesome Aussies.

3) Ask all your money and investing questions by joining our super encouraging FB community.

20 years later: did you start investing?

If you made it this far, congrats. Now consider what you’re planning to do to get started today. Whether that’s learning what ETFs are or opening a brokerage account, it’s important to take a small (but significant) step in the right direction.

😂 A joke and a quote

At the office I’m starting to get a reputation for sharing bad money jokes, so I thought I’d share the love and leave you with something to laugh about, and something to make you think.

I bought a book titled “How To Scam People Online” about three months ago… It still hasn’t arrived.

“Don’t expect to magically become the person you want to be when you hit a certain net worth, start becoming that person today.” ~Kate Campbell

Want free stuff?

You asked and we delivered…we have not one, not two, but seven jam packed free courses waiting for you to take right now.

Want to learn about ETFs? We got you!

Shaking up your super? Hit us up!

Retire by 40?! You betcha!

Cheers to our financial futures,

Kate