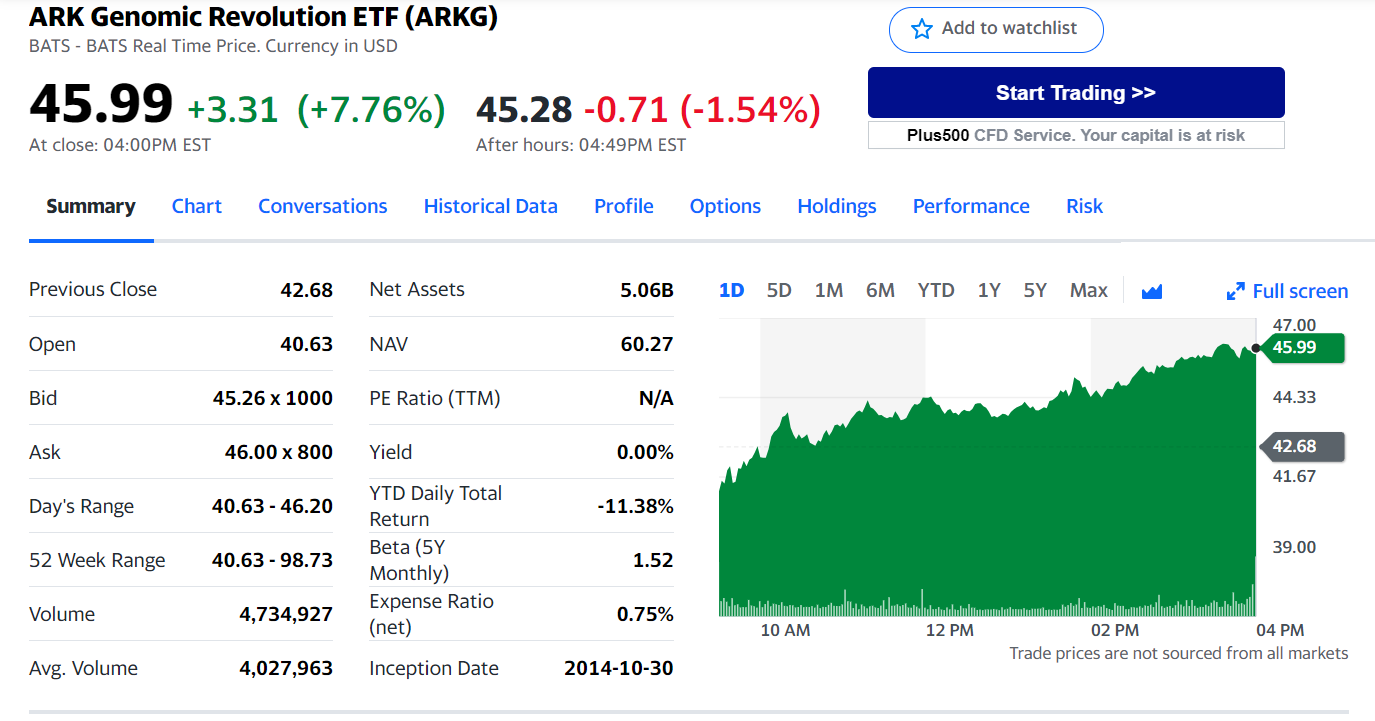

Cathie Wood’s ARK Genomic Revolution ETF (BATS: ARKG) and ASX-listed biotech stocks have been beaten up mercilessly for a year. The ETF peaked at US$112.23 on the 8th of February 2021, and is down 60% to US$45.99.

Healthcare as a megatrend

Cathie Wood and ARK invest in megatrends, and healthcare is no different. Longevity and quality of life years are improving for most people in the world, driven by technological and scientific developments.

This includes improved data analytics, medical devices, pharmaceuticals, therapeutics (e.g. mRNA, RNAi, etc) diagnostics (e.g. genomics, proteomics, multiomics, etc), telehealth, and much more – what a great time to be alive.

Valuations matter

A significant criticism by some quarters has been the lack of consideration for valuations. Valuations matter, and they are predicated on the future cash flows of a business. The faster a business grows its cash flows and the cheaper the price, the better the value.

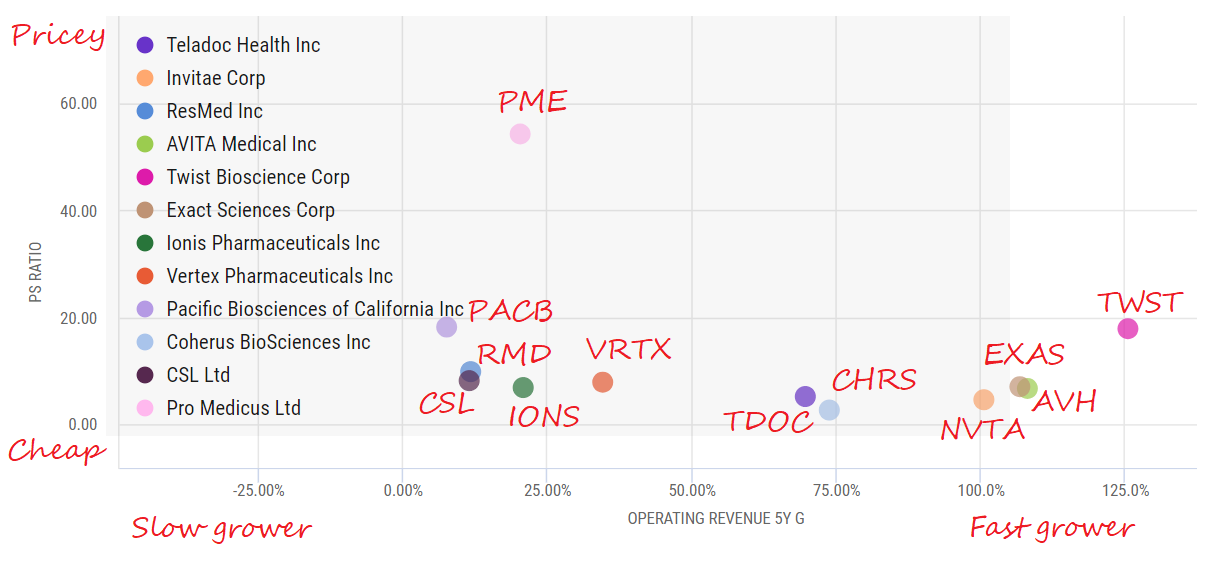

To find value amongst the wreckage, I plotted the operating revenue growth over 5 years versus the price to sales ratio. Neither metric is perfect. Growth could be slowing, or increasing, but five years is a decent performance history. Meanwhile price to sales doesn’t account for margins or operating leverage, so it’s an imperfect proxy for companies that don’t earn profits.

Let’s look at a sample of the wreckage from Cathie Wood and the ASX:

Quality Growth At A Reasonable Price (QGARP)

Twist Biosciences (NASDAQ: TWST) manufactures DNA and is down 72% from its peak, while growing revenues at a phenomenal rate from a low base. However, at 20x price to sales, it’ll need to keep growing.

Readers may be surprised by the second fastest growing company, Avita Medical (ASX: AVH) known for ReCell for burns victims. The stock is down 83% from its highs, trading at a reasonable valuation of 4x sales, though questions remain about management.

Exact Sciences (NASDAQ: EXAS) is famous for ColonGuard, a do-it-yourself stool sampling for DNA testing of bowel cancer. Invitae (NYSE: NVTA) is an AI-infused DNA testing company driving down prices of testing through its network and scale. They are down 52% and 83% respectively as sales growth has slowed recently, though both have a decent pipeline of new developments.

Teladoc (NYSE: TDOC) is the world leader in telehealth, particularly for chronic diseases (e.g. cardiovascular disease, mental health, etc). They recently acquired Livongo to get the flywheel working with wearables and medical devices such as diabetes. Teladoc is down 78% while sales growth has increased to 100% year-on-year or 80% in the last quarter, and is now trading at less than the Livongo acquisition price.

Quality Growth At An Un- Reasonable Price (QGAURP)

Pro Medicus (ASX: PME) is an IT service provider for the health sector. Owen recently wrote that it may be one of the highest quality companies on the ASX, though its valuation is stretched at 45x sales despite a 30% drawdown recently.

CSL (ASX: CSL) is a world-leading blood company and we should all be thankful they are Australian and many of us, or our parents, have them in our superannuation funds. Similar to Resmed (ASX: RMD) for sleep apnea and respiratory diseases. But they continue to be priced as fast-growers despite the law of large numbers working against them.

Final thoughts

Health tech investing is not for the faint-hearted. Beyond revenue growth, one needs to make bold assumptions on the operating leverage and the length of the runway, while any misses are being punished heavily. But if you liked ARKG at $112, you’re going to love it at $45.