The Commonwealth Bank of Australia (ASX: CBA) share price is up today on news the bank would divest further non-core assets.

Anchor your portfolio with these top 20 dividend growth ASX shares.

CBA share price buoyed by asset sale

Currently, the CBA share price is up 2.13% to $95.45.

CBA will sell a 10% shareholding in Bank of Hangzhou (HZB) to entities controlled by the Hangzhou Municipal Government for $1.8 billion.

CBA has played a meaningful role in HZB since its initial investment in 2005.

The bank has grown into significant retail, wealth management and commercial player in Eastern China.

“The over ten years of strategic cooperation between HZB and CBA have witnessed HZB’s rapid development and growing market influence” – HZB Chairman, Chen Zhenshan

The reallocation of CBA’s shareholding to local partners will support the further expansion of HZB going forward.

CBA will still retain a 5.57% ownership stake in HZB until at least March 2025.

This will allow Australia’s biggest bank to maintain existing relationships in the region.

The sale is still subject to regulatory approvals with completion expected by the middle of 2022.

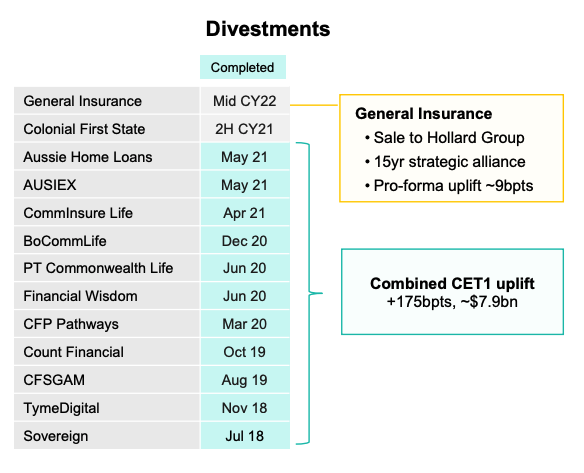

Divestments continue

Today’s announcement is in line with CBA’s ambition to simplify its banking operations:

“…the partial sale of our shareholding is consistent with our strategy to focus on our core banking business in Australia and New Zealand” – CBA CEO, Matt Comyn

Other notable divestments by CBA include the sale of Colonial First State, Aussie Home Loans, insurance divisions and international banking units.

Post completion of the transaction, CBA will recognise a $340 million profit.

This will be somewhat offset by the loss of $200 million in revenue CBA had recognised each year from HZB.

“CBA has also achieved a good return on investment, which is a win-win outcome for both parties” – HZB Chairman, Chen Zhenshan

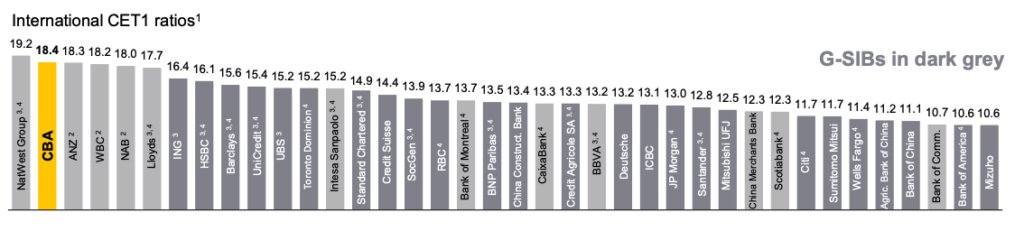

Subsequently, CBA will increase its CET1 ratio by 35 basis points.

CET1 represents the excess capital banks are obliged to keep on hand to meet regulatory guidelines and ensure liquidity.

Australian banks have some of the highest CET1 ratios in the world and are largely considered well capitalised compared to international peers.

If you’re looking for new share ideas, check out four ASX shares I’m watching in 2022.