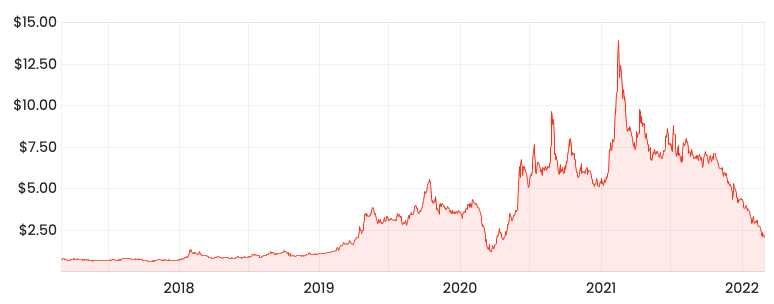

The Zip Co Ltd (ASX: Z1P) share price is down 80% over the past year as the buy-now-pay-later (BNPL) sector loses its shine.

Excluding the March 2020 market crash, the Zip share price is at levels April 2019 (nearly three years ago!).

Will the recent acquisition of US-based Sezzle Inc (ASX: SZL) turn things around?

Let’s find out.

Z1P share price

Bigger and better?

One of the major benefits of the Sezzle merger is the enlarged payment ecosystem of 13.3 million customers and 128,800 merchants.

That puts it in line with other competitors like Afterpay (16.2 million customers at June 30) and Affirm (11.2 million customers).

Zip is now able to go to bigger merchants and compete more effectively for new merchants.

“One of the reasons that we both lost out on merchant deals is because we haven’t had enough customers” – Larry Diamond, Zip CEO

Unfortunately, Zip remains well behind the likes of Paypal (426 million active customers) and Klarna (147 million active customers). It’s a similar story on the merchants side.

It’s also worth pointing out that there will be some overlap between Zip and Sezzle customers.

For example, a customer may use the Zip app for some purchases and Sezzle online checkout for others.

“…depending on how you look at it, about 25% of the app is overlap. So we’ve actually built quite differentiated customer geodemographic profiles across the US” – Larry Diamond

Changing direction

Zip shareholders will be familiar with the “global expansion strategy”.

The business has purchased small stakes in BNPL operators in India, Europe, South Africa and the Middle East to create a global footprint.

“We’re on a mission to be the first payment choice, everywhere and every day” – Zip website

But by buying Sezzle, the business looks to be doubling down on the US market.

It will account for 60% of transaction value, up from 48%.

Zip also expects to realise $130 million in revenue and cost synergies with a bigger US presence.

So why change course?

Profitability.

“We still believe in the global opportunity…[but] what we’re calling out is the investment strategy will be a little bit more focused on the core markets that are closer to profitability…slowing investment in markets that are further away from that profitability…”

Part of the Zip share price fall has been the never-ending losses its been accumulating – $961 million as of December 31.

The business now expects to be EBITDA and cash flow positive by FY24, which would be a massive achievement from the $214 million loss it achieved last half.

The move to profitability likely comes at the expensive growth in more nascent markets.

But it will mean the business no longer needs to rely on the market and will alleviate concerns over cash burn.

How will Sezzle impact the Zip share price?

Like Zip, the Sezzle share price is also down 82% over the past year.

I do believe management’s view that a bigger company will have better unit economics and future growth.

But it all comes down to execution. Can Zip attract bigger merchants? Can it retain margins? And how will competition respond?

If management delivers on the breakeven target by FY24, I’m bullish the Zip share price could move higher from here.