ASX growth shares have been crushed over 2022 as cyclical companies steal the show.

But over the long-term, we know earnings growth drives share prices.

Here are 3 ASX growth shares that have had a temporary setback but over the longer term could be big winners.

1. PEXA Group Ltd (ASX: PXA)

PEXA is relatively new to public company life, only listing in July last year.

But in its two earnings results since, management has beat and then upgraded guidance.

The business provides the digital infrastructure for property transactions.

When a seller transfers a house or apartment – conveyancers, lawyers and financial institutions log on to the PEXA Exchange and submit all the relevant documents.

It’s a monopoly asset, which has no direct competition.

It’s one of the rare ASX growth shares with mandated inflation price increases and has growth prospects in adjacent and international markets.

The PEXA share price is now below its IPO price, despite being a better ASX growth share eight months later.

2. Pinnacle Investment Management Group Ltd (ASX: PNI)

Funds managers aren’t exactly the hottest ticket in town at the moment – just ask Magellan Financial Group Ltd (ASX: MFG).

But Pinnacle differs in too way from traditional money managers.

One – they aren’t limited to a single fundie. The business has 16 affiliates, with the largest accounting for only 14% of funds under management (FUM).

Second – Pinnacle has exposure to a variety of asset classes such as credit, bonds, shares and private equity. This gives it more resilience than a typical fund manager through the cycle.

The share price is down over 50% from its highs and trading on about earnings multiple of 23.

Given its grown FUM 24% for the past ten years, I don’t think this is an onerous price to pay if it can execute on future growth.

But buyer beware. Pinnacle is still correlated to the market cycles. If ASX growth shares crash, so will the Pinnacle share price.

3. (ASX: REA)

REA Group is best known for its realestate.com.au property portal.

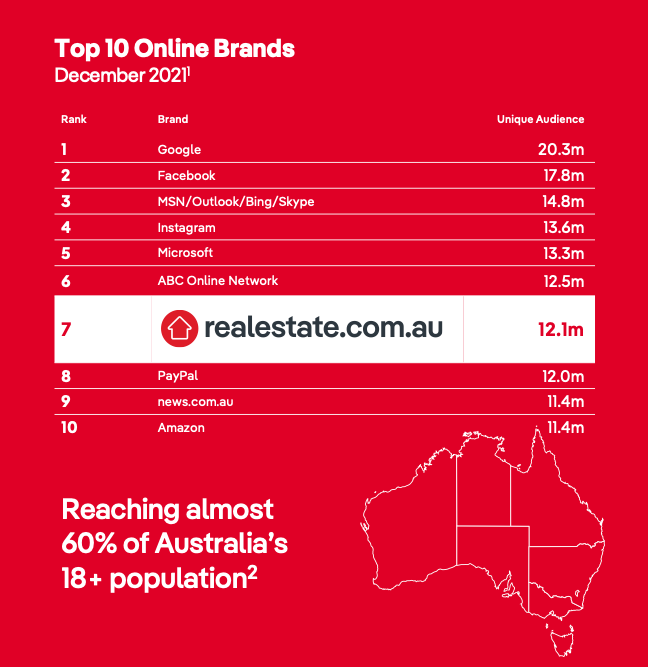

Fun fact: it’s the seventh most visited site in Australia behind only the likes of Google and Facebook.

But REA Group also owns stakes in a stable of other property businesses:

- PropertyGuru (18%) which has property portals in Malaysia, Singapore, Thailand and Hong Kong

- Move (20%) which owns North American based realtor.com

- REA India (100%)

- Mortgage Choice (100%) which provides mortgage broking services

The established Australian portal acts as a cash cow for management to expand abroad.

The business is by no means cheap, trading on an EBITDA multiple of 33.

But given the growth outlook and quality of this ASX growth share, it’s one I’m looking to nibble at over March.