The ASX 200 has fallen 5.5% in 2022 as inflation fears spook investors.

Inflation reached 7.9% in the United States. It’s not nearly as bad in Australia, but 3.5% is still well above what economists prefer.

Here are three ASX 200 shares to buttress your portfolio against inflation.

1. Woolworths Group Ltd (ASX: WOW)

Woolworths is arguably the best ASX 200 inflation hedge.

Everyone needs groceries. The business has the largest buying power of any operator. And it’s leveraged to price-sensitive customers via the Big W

network.

Any price increases can be passed onto consumers. Even if the company feels it can’t, Woolworth’s economies of scale mean it can absorb margin pressure better than competitors.

Finally, if household budgets are squeezed, this will likely increase demand for eating from home.

With a reliable 2.6% fully franked dividend, Woolworths is a bottom draw company when inflation bites.

2. Transurban Group (ASX: TCL)

Transurban owns toll roads across Australia and North America.

Most of Transurban’s travellers don’t have a second option.

Customers must travel and pay tolls, or the alternative is to be stuck in traffic on suburban roads.

Similar to groceries, it’s an unavoidable expense.

The ASX 200 business has 68% of tolls linked to inflation, with a further 27% rising at 4.25% per annum.

This means Transurban can pass on the impact of inflation onto customers, irrespective of whether they like it or not.

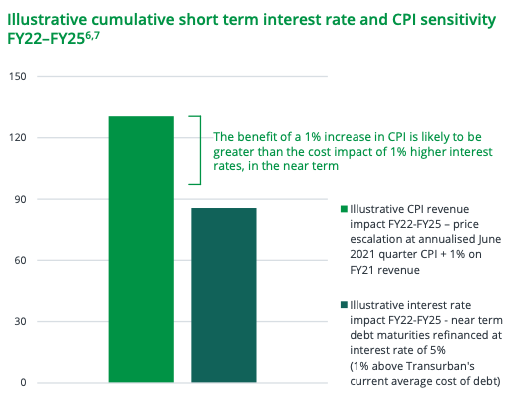

One concern investors may have is the $23 billion in debt. If rates rise, won’t Transurban’s interest cost skyrocket?

Yes, finance costs will go up. But this will be more than offset by the price increases.

Transurban even pointed this out during their most recent financial results.

3. Xero Limited (ASX: XRO)

Since the start of the year, the Xero share price has fallen 34% compared to just 6% for the ASX 200.

So how could Xero be an inflation hedge?

Xero is the last expense that is turned off for a business. It’s mission-critical for recording and managing finances, accounts and payments.

Pretty much the only reason a business would turn off Xero would be if the business itself went kaput.

Moreover, the business hasn’t even begun to flex its pricing power. Ask any small business owner how much they would be willing to pay more for their Xero monthly subscription.

Most would say multiples of their current plan.

No doubt rising rates will impact its valuation in the near term. But if inflation persists, I expect Xero to be able to weather any price pressure.