Recently, I discussed with my 87-year-old father-in-law (let’s call him Fil Downunder) his high growth equity investing style in light of increasing interest rates and inflation.

“Volatility isn’t the price of admission, it’s the prize for admission”.

As a bit of context, Fil has been an aggressive equities investor for decades. As an economist, he has never made a macro bet nor had an interest in stock picking. He simply puts his money into the most aggressive equity option of a generic fund manager.

This has worked for well over thirty years, and he has no intention of changing now.

Increasing interest rates won’t dampen his appetite for equities

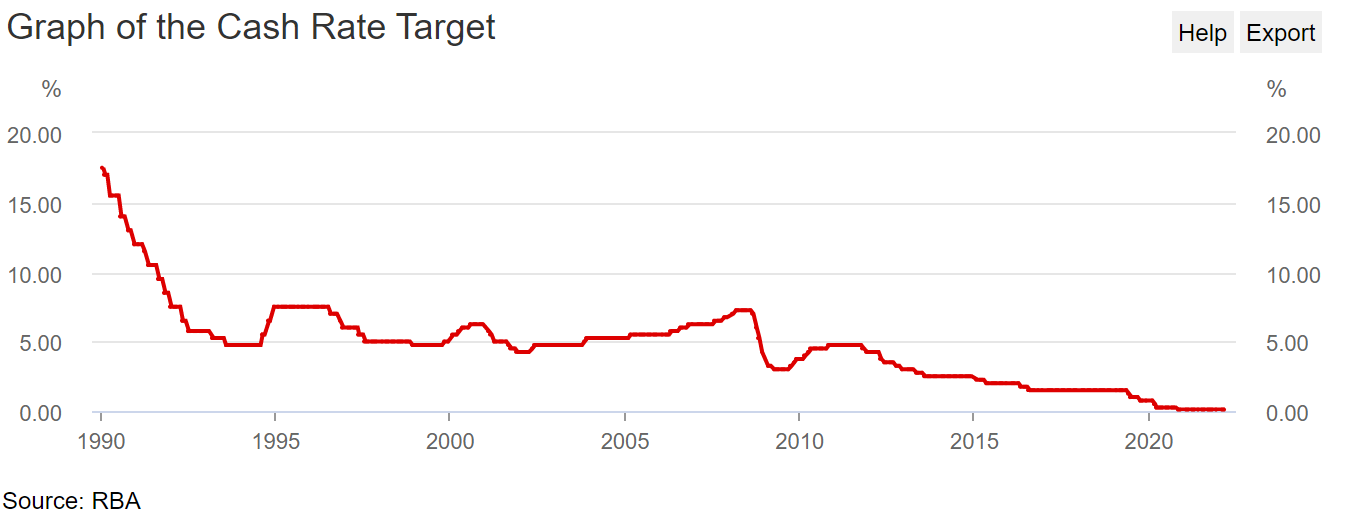

Fil reckons interest rates are likely to go up from here. Since the “1991 recession we had to have”, we’ve only experienced declining interest rates. Asset prices during this period typically have increased faster than economic growth. Conversely, rising rates will put downward pressure on equities, but Fil isn’t in a rush to change his portfolio.

Fil and I talked about Commonwealth Bank (ASX: CBA) as an example. If you buy it today for $105, you’ve locked in a 3.3% fully franked dividend yield. That’s around a 3.2% risk premium on top of the 0.1% RBA cash rate. If the RBA increases interest rates to say 1% – as guided by the CBA economists in February

– then the yield on CBA shares could increase to 4.2%, resulting in a 22% share price decline to $82. And, only the new shareholders buying in at $82 would get that 4.2% fully franked dividend yield – existing shareholders would still be locked in at the yield they bought in for.

Fil then goes on to discuss the 40c per share dividend in 1991 when CBA was listed at $7. While the yield may have been 5.7% then, the yield on cost today is closer to 50% with a 15x in the share price. His fund has owned CBA throughout that whole period.

Inflation, not hyperinflation, is manageable

Fil can afford his bread, milk, and even avocado on toast with a mortgage fully paid off. He’s not worried about the long-term impact of inflation on equities unless he reckons hyperinflation is setting in – far from where we are today.

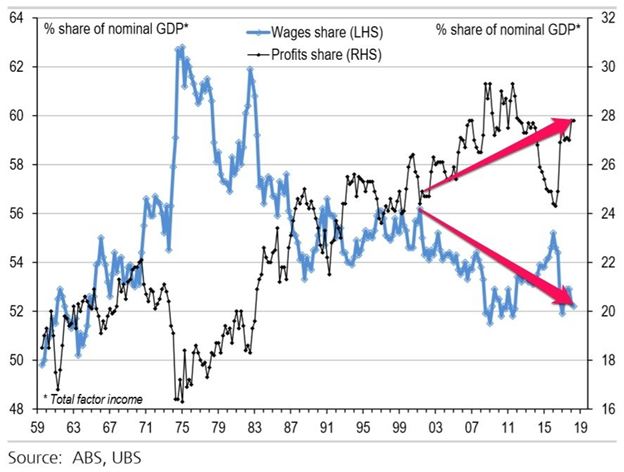

Fil reminisced about when inflation peaked at 15.4% in 1974, and the share of income for labour (wages) started to rise while capital income (profits) declined. We’re seeing today the inflationary pressures on profit margins, which Rask Media contributor Lachlan wrote extensively about during the 1H22 earnings season.

Fil is forever an optimist, “even if wage-earners capture more of the profits, this is probably a good thing for our economy and ultimately, good businesses will find new ways to grow in any conditions”.

Final thoughts

Fil has never asked for financial advice. He’s not a gambler or typically a risk-taker, and money management is not something that has concerned him. In over 20 years, for the first time, I offered him some advice: “Fil, time to take some chips off the table”.

Fil reckons he’ll still be eating avocado on toast even with a 30% drawdown. I tried to convince him that at the age of 87, with his short runway, he can’t afford the volatility, “If you worry about interest rates and inflation, then you need time to ride out these big waves”.

But his faith in the long-term compounding of equities is unshaken. “You may think my runway is short, but my capital will live on with the grandkids, so I have no intention to shift out of equities”. Touche.