Dear Budget Heroes,

Kate here, co-host of The Australian Finance Podcast, and the person ready to help you invest your money and time, better!

It’s time to lay down your financial foundations and set yourself up for financial success in the year ahead.

I’m going to dive into how to organise your bank accounts like an adult, the importance of knowing where your money is going and how to balance spending and saving (while still living your best life).

Ready to get your financial sh*t in order?

Sometimes it sucks being an adult, particularly when you realise just how expensive life is. But taking control over your finances is an empowering feeling.

First things first, it’s time to sort out your bank accounts.

I’m talking about your transaction accounts (where you pay for Maccas and rent from) and any linked debit cards, along with your savings accounts (where you save for your next Tassie adventure).

Kate’s tip: Make a list of all the transaction and savings accounts alongside any cards in your name.

Catch them before they catch you

Keep in mind that some of these accounts have different features, so it’s time to take that list to the next level and make sure you understand the product.

What are some key things you should look for?

- Accounts with low/no fees

- High interest rate on your savings

- Low/rebated international transaction fees

- ATM rebates

Budgets sound like homework for adults 🤷🏽♀️

Now that you’ve sorted your bank accounts, it’s time to create a customised budget that works with you, rather than adding to your already full plate.

Although budgeting isn’t a magic solution to your spending, knowing where your money is currently going is an important step to re-aligning your spending with your goals.

So how about we build a budget that actually works?

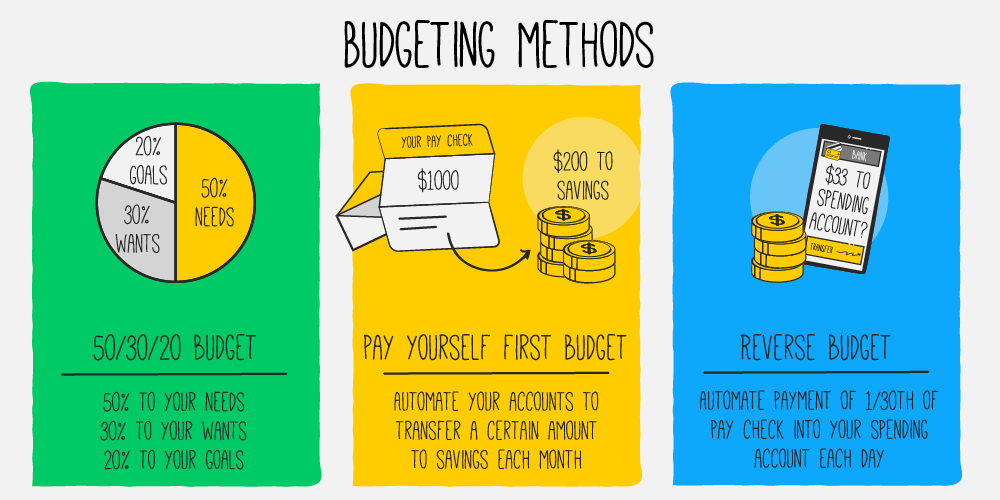

50/30/20 budget

This is a very adaptable budgeting method and can be maintained as your income changes. For more tips on managing multiple jobs and incomes, read this.

- 50% to your needs (e.g. rent, electricity & transportation)

- 30% to your wants (e.g. seeing the new Batman movie)

- 20% to financial goals (e.g. paying off debt, Christmas holidays or FIRE)

This is a basic framework. If you can save more or less, adjust the percentage figures to suit you.

Pay yourself first budget

In this method, you don’t have to set budget categories. You simply decide each pay cheque that you’re going to save $200, and you automate your accounts to transfer this amount each month once your pay hits your bank account.

Reverse budget

Instead of dishing out all your spending money for the month as soon as you’re paid, move the money into a separate account and automate the payment of 1/30th of the money into your spending account each day. Then every day is payday!

For example: If you’ve got $1,000 for discretionary spending each month, you would transfer around $33 into your spending account each day.

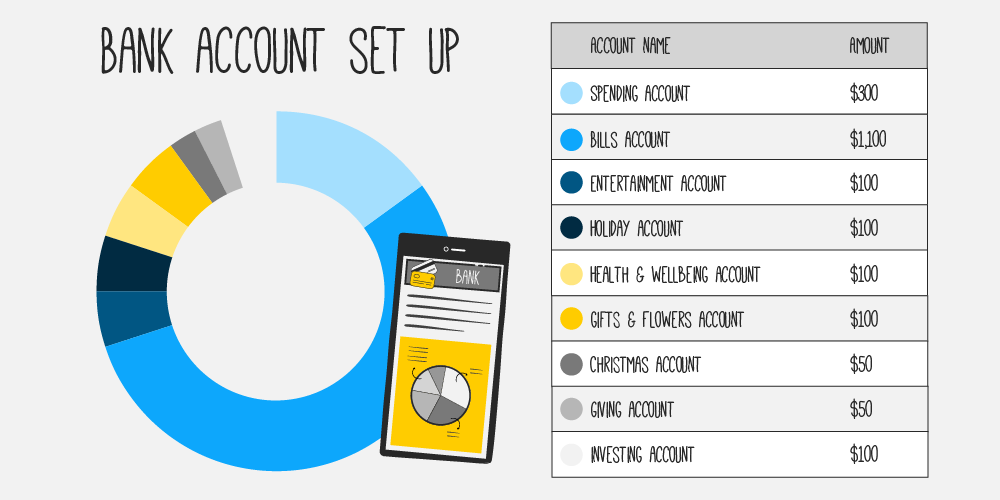

💸 Example: bank account set up

Here’s an example of the way you could structure your spending and saving accounts, with a bank like Up, after receiving your $2,000 pay cheque.

You’ll need to change it up to suit you, but having separately labelled accounts might help you more easily keep track of your goals and money.

Is it time to break up with your budget?

Like all good things, sometimes your budget comes to a natural end. This might be because you’re now able to manage your money effectively with fewer rules, it’s not working anymore or your circumstances change.

This is okay! A budget is just one tool you can use to manage your money. It shouldn’t be making you miserable or taking control over your life.

Spending vs saving: you only live once

Another important part of this puzzle is finding the balance between living in the moment and looking after future you.

On one hand, our brain is shouting to use the money now, don’t lock it away, what if we don’t live that long or the world explodes before then!

And the practical side of our brain knows that it’s highly likely that we’ll live long enough to need our savings. Unfortunately, that side often gets drowned out.

It doesn’t take much when you’re young to change the direction of your financial future, but you actually have to do something about it, not just think about it.

Being mindful and intentional about the way you spend your money can be done by giving yourself some spending frameworks.

Whether that’s by setting a 24-hour delay on purchases over $50 or reducing your spending on lunches out to save up for a trip, it’s important to find your own balance between spending and saving and figure out which budgeting method works best for you.

Want more stuff?

You asked and we delivered! We have courses, podcasts, and even investing memberships to help you take that first step.

Money basics on the go? Tune in today!

Retire by 40? You betcha!

Want to start investing in ETFs? We got you!

How do you manage your money? Jump into our FB Community to let me know!

Cheers to our financial futures,

Kate