The Redbubble Ltd (ASX: RBL) share price has more than halved in 2022 as the market tires of its never-ending losses.

But it was only a year ago that the share price was flying high and an ASX tech darling.

So what is it? A subscale cash-burning machine? Or a marketplace yet to flourish?

As with most things, the truth lies somewhere in between.

Here I’ll provide the glass half full case for the Redbubble share price.

Why is Redbubble so unique?

In very simple terms, Redbubble provides an artist with the opportunity to monetise their work.

You create the design. We’ll provide the product, customer support, and fulfilment.

“We are the owner and operator of the world’s largest marketplaces for independent artists”

Two things are underrated about the Redbubble model.

Firstly, the sheer amount of artist intellectual property that sits on the platform.

Redbubble houses 60 million different designs, with little incentive for an artist to remove content.

It’s essentially building a library of content for future use, which deters future competitors.

The second is negative working capital.

This is fancy finance jargon for we get paid by our customers before we have to pay costs.

What’s cool about that?

It means the business needs little incremental capital to scale.

A glimmer of what’s to come

The number one bear case for the Redbubble share price is that the business model is unsustainable.

It has to pay millions in rent per year to Facebook and Google for digital advertising space.

After taking into costs artist fees and fulfiller costs, margins aren’t that flash.

As a result, for its entire publicly-traded life it’s never made a material profit.

That is except for when the company did reach scale in 2020.

The business achieved an EBITDA of $48.8 million and a free cash flow of $75.3 million in the first half of FY21.

Possibly that was a one-off.

The COVID-19 mask buying frenzy gave Redbubble a freekick. It also benefitted from a positive working capital cycle.

But since then it has remained cash flow positive despite not recording accounting profits.

An optimist would say when the business achieves scale, it can spin money.

In Redbubble we trust

So how is it going to achieve scale? Customer engagement.

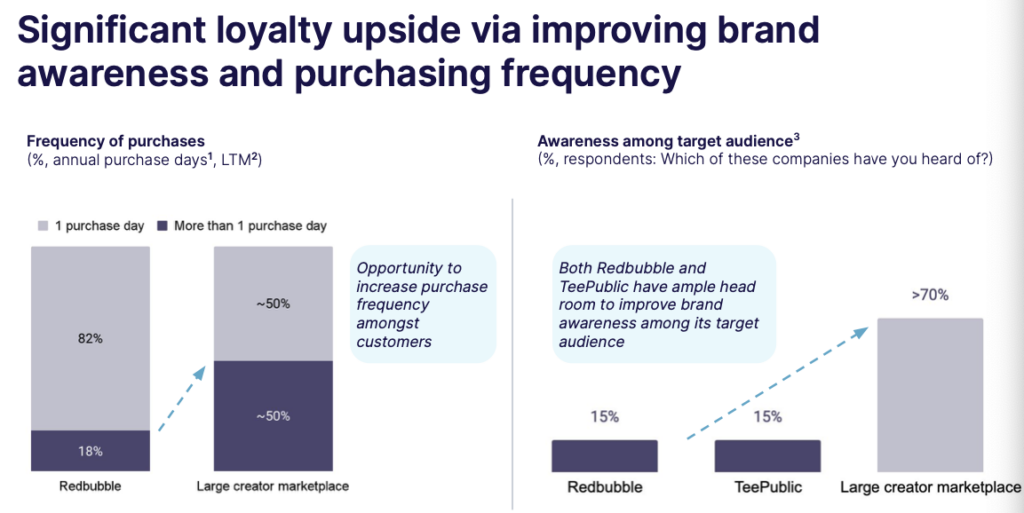

Redbubble’s own investor presentation shows the under penetration of its marketplace against a large competitor (assumed to be Etsy).

A bear would shout “BAD!” and “told you it was rubbish!”.

But a bull would see the enormous upside potential.

To reach the scale it needs to reinvest into brand and customer retention. And management is doing just that.

It won’t be a quick fix. You don’t build a brand overnight. Hence why the market has sold off Redbubble shares.

But if the company reaches its goal of $1.5 billion revenue by 2024 with EBITDA margins of 13-18%, this implies earnings of $195 million to $270 million.

If management can execute these goals, Redubble is trading on an EBITDA multiple of just 2.

Not a sure bet

What investors need to recognise and keep front of mind is that Redbubble is not a sure bet.

It has a small chance of becoming an absolute money-spinner. And a decent chance of failing.

The CEO of Etsy summarised this best:

“You can probably count on 2 hands the number of two-sided marketplaces you can think of at scale. In any given year, venture capitalists fund thousands of companies who aspire to become a two-sided marketplace. And statistically speaking, roughly 0 succeed. But once they’re vibrant, once you’ve got the flywheel going, they take on a life of their own, and they’re very durable. They’re wonderful businesses“

It’s high risk, high reward.

But if management executes, today’s Redbubble share price looks undervalued.

The key emphasis is on if.

If you enjoyed the bull case, be sure to return back to the Rask Media site tomorrow for the bear case on Redbubble.