You’re going to hear from Redbubble

(ASX: RBL) bulls that the recent share price pullback has created an investment opportunity of a lifetime, and the operating leverage as they scale will drive up margins. Well, today I’m going to debate with Lachlan’s bull thesis as to why I think that’s a furphy.

If you liked Redbubble at $6.70, you’re going to love it at $1.61

Being an investor in Redbubble over the past 15 months has been a difficult ride for the faithful as the share price has dropped ~77%. I can only presume that the investor day presentation was akin to being invited to the Game of Thrones’ Red Wedding.

However, another way to say “$1.61 per share” is “a market capitalisation of $464 million”. Regardless of what valuation, the exuberant Mr Market put on Redbubble in January 2021, the current valuation is what we need to consider.

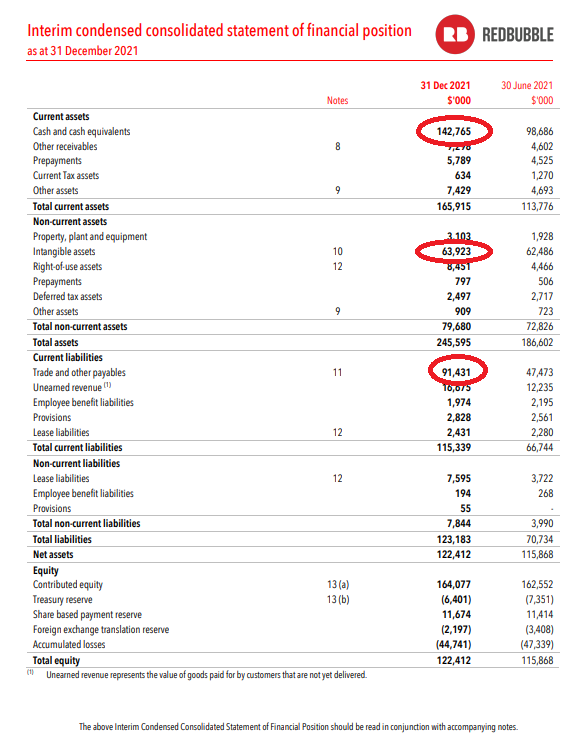

Flush with cash, question mark?

It’s often noted that Redbubble is flush with cash, having $143 million on the balance sheet. Redbubble receives the cash payment from you and me, makes the t-shirt, sends it off, and then takes 90 days to pay its suppliers. So most of that cash – $91 million – is owed to its suppliers. To be fair, its net cash balance is ~$50m. And its net asset value, if you remove their intangibles (i.e. goodwill from their acquisitions) is around $60 million.

So, I reckon its fair enterprise value is ~$400 million. This compares with $8 million of EBITDA in 1H22, or ~$15 million average net income per annum over the past three years smoothing for Covid tailwinds.

Operating leverage at the cost of quality

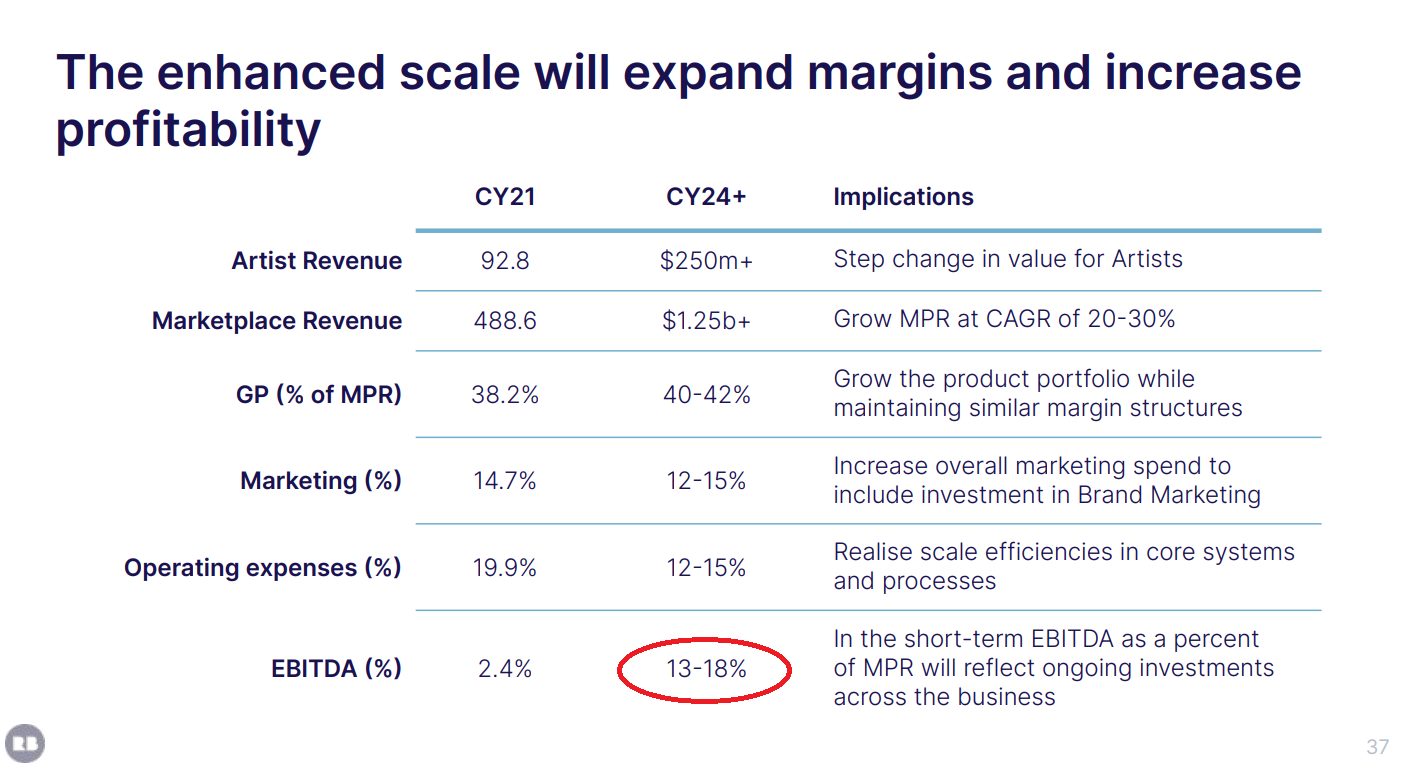

The main bull argument for Redbubble perpetrated by management is operating leverage: as it scales its revenues, the underlying costs will increase at a slower rate, and margins will expand.

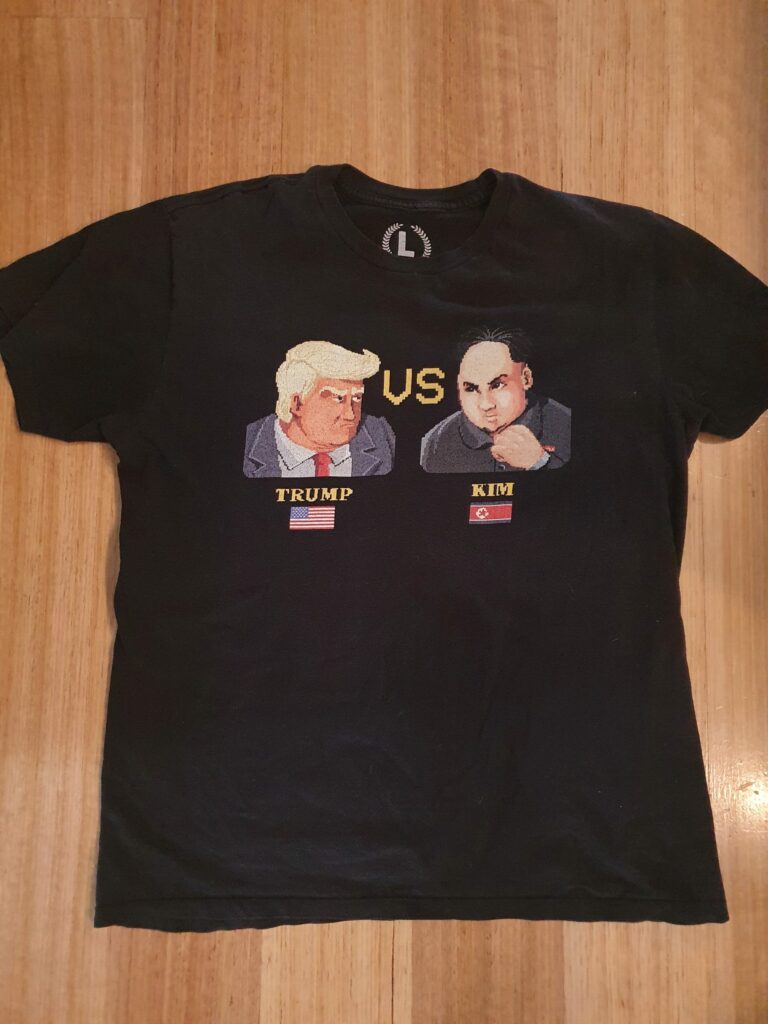

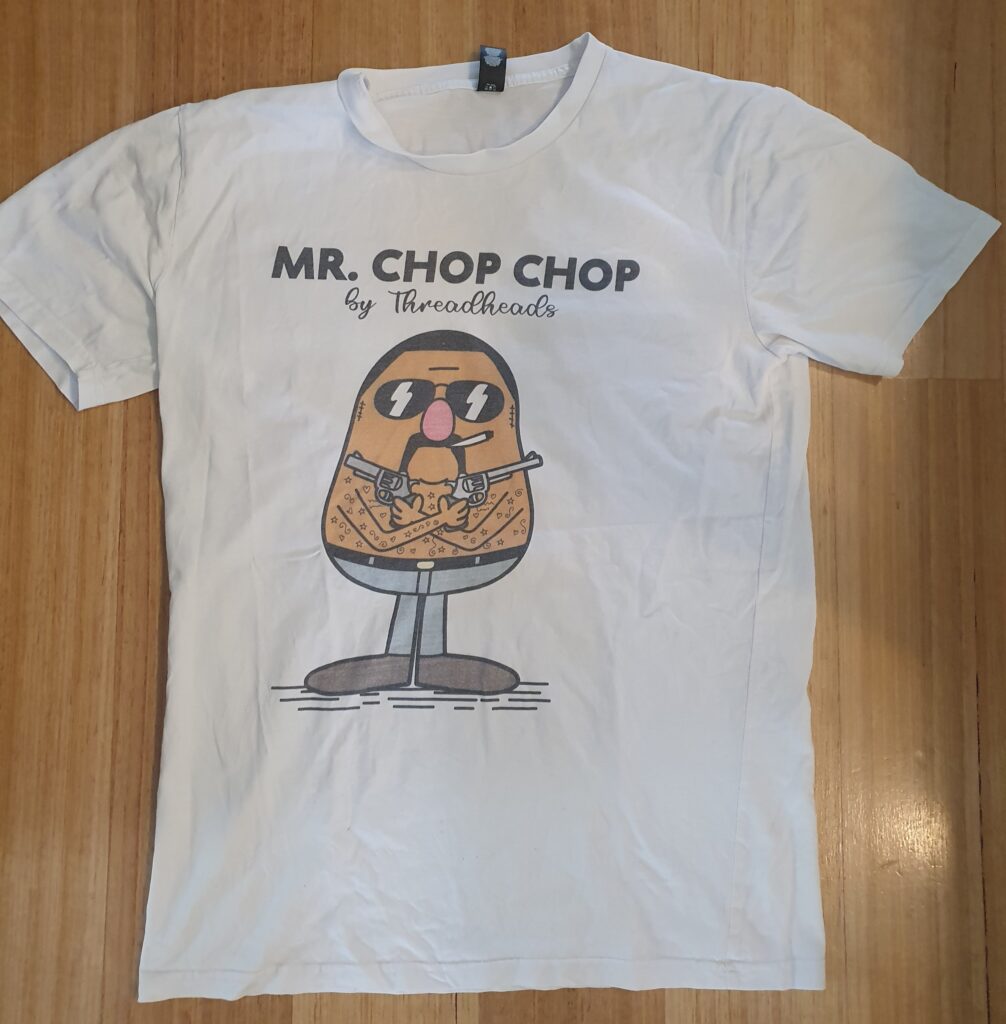

Redbubble has been lowering its operating expenses over time to improve gross margins. One way of doing that has been shifting from screen printing t-shirts to on-demand (a.k.a. direct-to-garment) printing. Since 2017, forums have been awash with complaints of the quality of t-shirts: designs flaking off, inconsistent size and weight, and even smelling like “rotten fish” on arrival. I 100% agree. The shirts I bought pre-2017 remain in my high rotation, while those bought during Covid are already facing the chop.

These gains seem to be unsustainable, and while t-shirts are only 41% of its sales, it’s the business model of lowering quality that represents red flags.

2017 Donald Trump vs Kim Jung Un Street Fighter II T-shirt (maintained quality)

2020 End of the World Toilet Paper Runout T-shirt (flaking design, printed off centre)

2021 Mr Chop Chop a.k.a. Mark ‘Chopper’ Read T-Shirt (fading since first wash)

The platform for artists

While the artists’ revenue is lauded as a ‘step change’, the reality is the percentage of revenue going to artists will increase from 15.96% to 16.66%. Meanwhile, there are concerns flagged around the intellectual property rights infringements by artists selling products on the Redbubble platforms.

Redbubble has argued in court they are not responsible for the art, just the marketplace. While in some cases, Redbubble has won, some they have lost, and the Hells Angels are now joining in the legal affray. This is a continual challenge to the fundamentals of its business model.

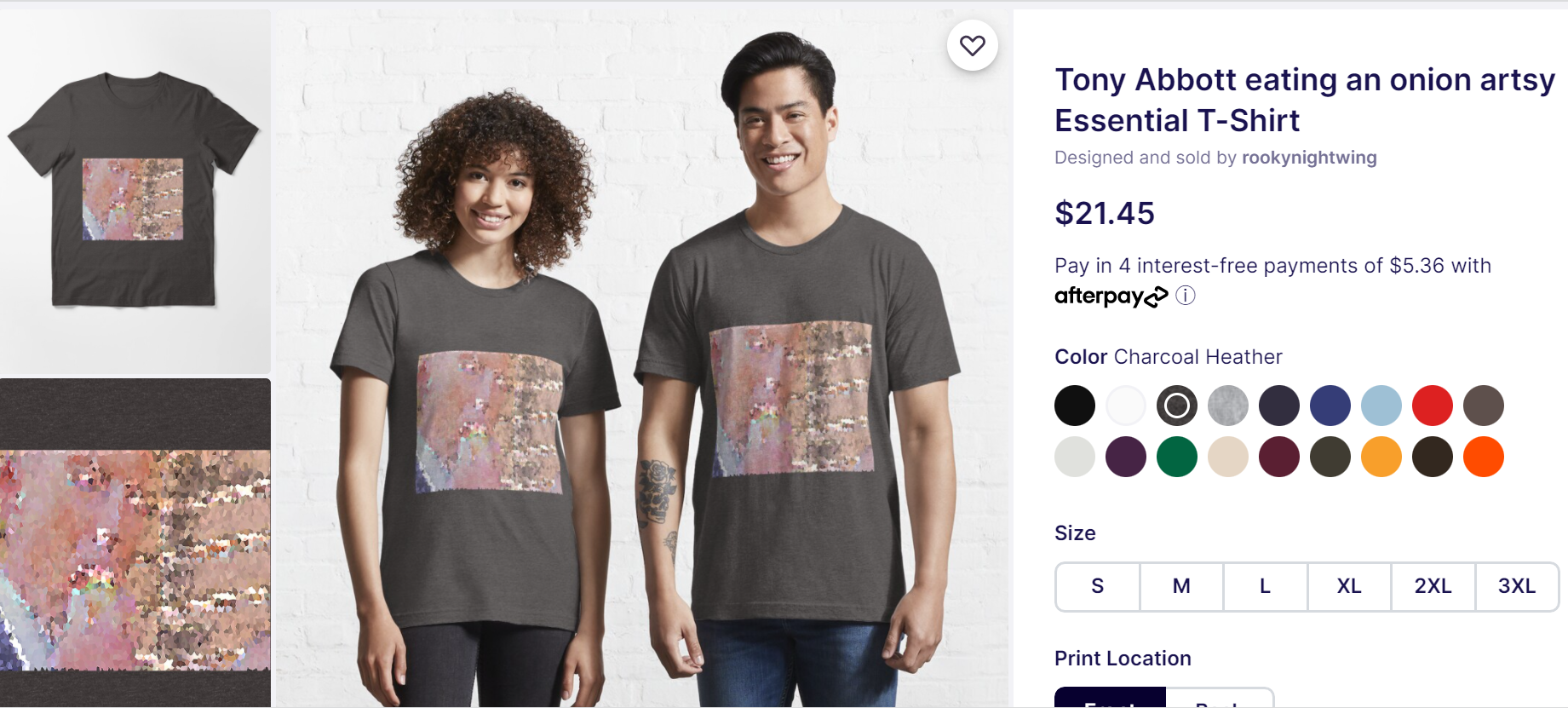

One way for Redbubble to placate artists’ demand for a larger share of the pie is to cut them out. Redbubble is developing new AI technology to scour the internet for unlicensed photos to print on t-shirts that respond to individual searches. So recently, when I was looking to buy a t-shirt of my favourite Tony Abbott moment, Redbubble was the #1 result on the search engine with a terrible AI-created design using a low-resolution Google photo. Maybe this will improve over time, or maybe this is another question mark on the business model.

Final thoughts

Even at today’s prices, there’s a lot of optimism baked into the share price. Redbubble may grow revenues as it branches out across new verticals, but the overall concerns I have with the quality of the product and the business model still makes this a risky investment in my mind.