Over the last couple of decades, many investors and economies enjoyed a low inflation environment. As a result, younger investors lack experience investing in a high inflation environment. Faced with this challenge I decided to look back over my notes on all the Berkshire Hathaway letters, to find out how Warren Buffett says to handle inflation, as an investor.

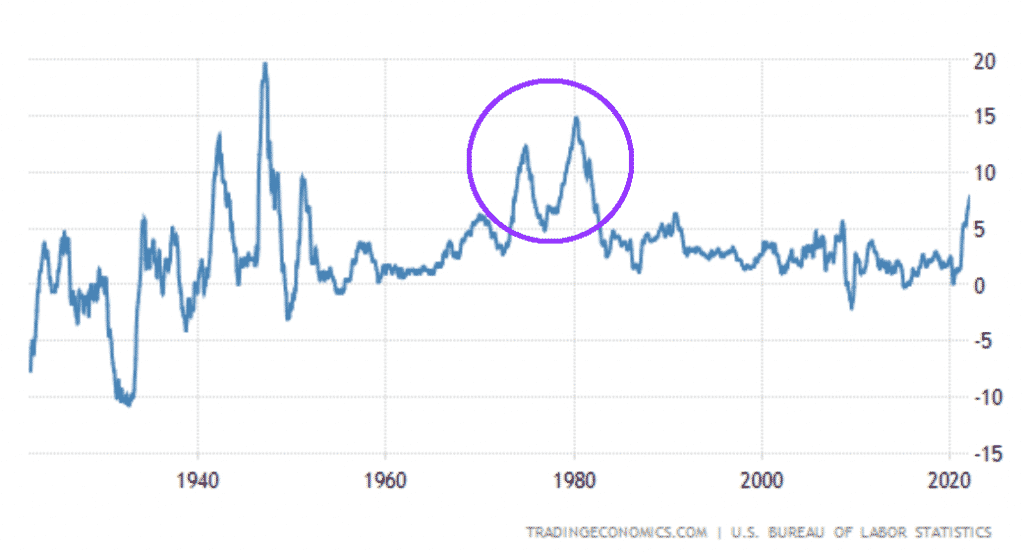

As you can see below, from the late 1960s until the early 1980s, annual consumer price index (CPI) inflation was almost always above 5% per year, whereas from the mid-1980’s until now (which includes my entire life), the same measure has almost always been below 5% per year. Inflation peaked around 15% per annum towards the end of the 1970s and early 1980s. And so it is no surprise that we find Buffett’s best treatise on inflation in Buffett’s 1981 Chairman’s letter to shareholders, while inflation was at its worst, highlighted by the purple circle in the graph below from trading economics.

Buffett Says Increased Prices Will Be Permanent

In his earlier letters, Warren Buffett would use all sorts of cheeky metaphors to describe economic concepts. In the 1981 letter he joked that “Like virginity, a stable price level seems capable of maintenance, but not of restoration.” In doing so he reminds us that consumer prices rise far more readily than they fall.

However, as you’ll read below, that wasn’t the only vivid metaphor he used to describe inflation!

The Best Business To Own In An Inflationary Environment, According To Buffett

After spending some paragraphs ruing the fact that most acquisitions by corporate acquirers are more empire-building than savvy capital allocation, Buffett goes on to describe the two types of acquisitions that make sense. He describes the kinds of businesses that fare best in an inflationary economic environment thusly:

“Such favored business must have two characteristics: (1) an ability to increase prices rather easily (even when product demand is flat and capacity is not fully utilized) without fear of significant loss of either market share or unit volume, and (2) an ability to accommodate large dollar volume increases in business (often produced more by inflation than by real growth) with only minor additional investment of capital. Managers of ordinary ability, focusing solely on acquisition possibilities meeting these tests, have achieved excellent results in recent decades. However, very few enterprises possess both characteristics, and competition to buy those that do has now become fierce to the point of being self-defeating.”

Thus we now have the two key business features to look for according to Buffett, as investors during a period of increasing inflation:

- An ability to raise prices easily

- Low working capital (capital-light)

Importantly, however, Buffett’s comment above also contains a word of warning; such businesses may be too expensive to buy because they are popular.

As an aside, I have identified this unloved ASX growth stock that I believe displays a strong ability to raise prices, and very low working capital requirements! Therefore, I think it counts as the kind of business Buffett liked in an inflationary era. I think you’ll agree that this ASX business is well-positioned to fight inflation, but if you know of a better positioned one, I’d love to hear it.

Why Inflation Is A Tapeworm, According To Warren Buffett

One of the most graphic parts of Warren Buffett’s teachings on inflation is his use of the tapeworm as a metaphor for how inflation eats away at the internal economics of bad businesses in particular. Buffett writes:

“…inflation acts as a gigantic corporate tapeworm. That tapeworm preemptively consumes its requisite daily diet of investment dollars regardless of the health of the host organism. Whatever the level of reported profits (even if nil), more dollars for receivables, inventory and fixed assets are continuously required by the business in order to merely match the unit volume of the previous year. The less prosperous the enterprise, the greater the proportion of available sustenance claimed by the tapeworm.”

“Under present conditions, a business earning 8% or 10% on equity often has no leftovers for expansion, debt reduction or “real” dividends. The tapeworm of inflation simply cleans the plate. (The low-return company’s inability to pay dividends, understandably, is often disguised. Corporate America increasingly is turning to dividend reinvestment plans, sometimes even embodying a discount arrangement that all but forces shareholders to reinvest. Other companies sell newly issued shares to Peter in order to pay dividends to Paul. Beware of “dividends” that can be paid out only if someone promises to replace the capital distributed.”

This article first appeared on A Rich Life, How Warren Buffett Says To Invest During High Inflation.