What do vegetables and investing have in common?

Dear Investing Champions,

Kate here, co-host of The Australian Finance Podcast and the person ready to help you invest your money and time, better!

This piece was originally shared with our Rask Education students – be sure to sign up for a money & investing course to catch the next edition directly in your inbox.

Many of you would be familiar with Exchange Traded Funds (ETFs) after taking our Beginner’s ETF Course on Rask Education. But if you’re not (or want to explain it to a friend) here are the basics.

So, what are ETFs?

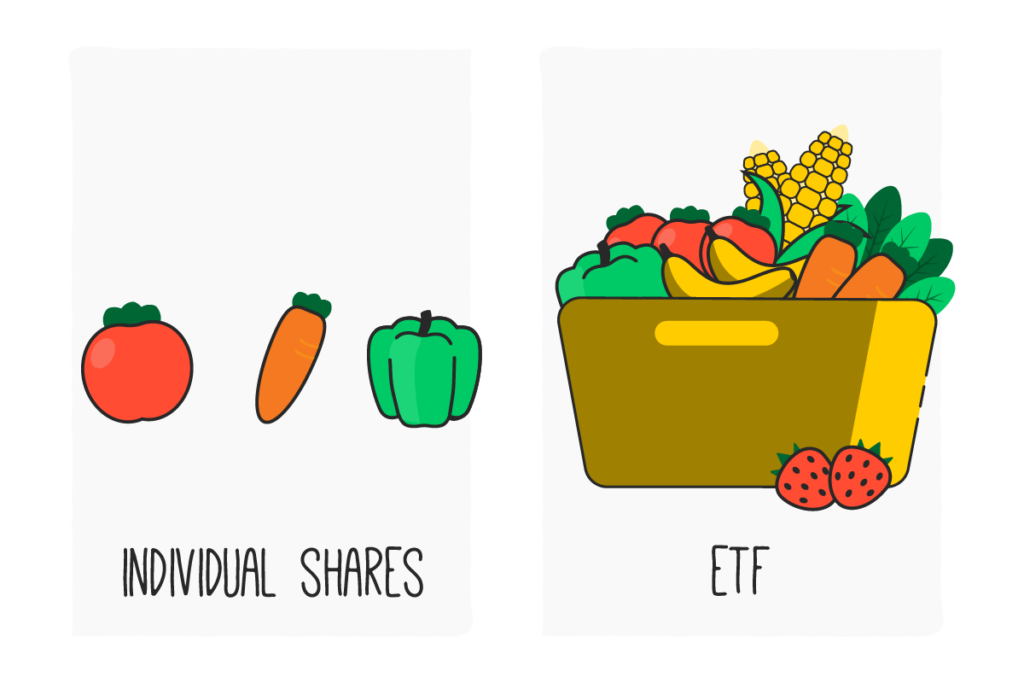

An ETF is a basket of assets that you can buy and sell in a single trade via your brokerage account. So, instead of having to decide on which individual company you want to invest in (e.g. Telstra, BHP or CSL), you can buy an ASX 200 ETF which includes the largest 200 listed companies in Australia.

It’s like when I go to Prahran Market and buy a mixed veggie box which has over 15 different veggies (including kale…sigh 🤷♀️) instead of having to pick out every individual veggie I want. But I don’t get to customise the box (I get carrots and potatoes along with the kale).

So it’s important to choose the right box (and ETF) for you.

ETFs make many things simpler when it comes to investing, but there are still choices to make. And as demand grows, so do the number of ETF managers and ETF products.

Guess what? In the US, you can even buy an ETF that’s focused purely on the consumer habits of millennials!

But how on earth do I choose which ETF to buy?

When it comes to money and investing, sometimes the hardest part comes from within. By that, I mean things like taking that first step into the unknown, feeling like an investor, and understanding your money psychology.

There are many things that can hold us back from working towards our financial future, but choosing an ETF doesn’t have to be one.

There are people dedicated to researching ETFs full-time, but for the rest of us who have lives outside of money, here’s a handful of things to look for when choosing which ETFs to buy.

What are your goals and desired end results?

This is an important question to start with because there are hundreds of ETFs out there and you’ll need to narrow down your search. Think about your investment timeframe, which asset class you actually want exposure to, and why you’re investing.

If you’re considering investing for the first time, you should spend some time thinking about your attitude to risk.

How would you feel if your investment went down 10%, 20% or even 50%? You don’t want to put yourself in the position where you freak out and sell at the bottom of the market.

Which asset class do you want to invest in?

One of the most important questions to ask yourself while working out which ETF to buy is what you actually want to invest in.

Are you trying to invest in Australian shares, gold, government bonds, global healthcare companies or even Banksy artworks?

There’s an ETF to fill every demand now, so to help filter down your search you’ll need to think about what area you want to invest in.

Who is managing the ETF?

Due to the rising popularity in ETFs both globally and in Australia, many companies have decided to try their hand at running an ETF. Once you’ve narrowed down your search, have a look into each of the managers, and investigate their track record and expertise.

Some of the largest ETF providers in Australia include Vanguard, iShares, BetaShares, VanEck and ETF Securities.

Long-term performance of the ETF

Everyone will always tell you that past performance is not an indication of future performance. But taking a look at the past performance of an ETF (by heading to the manager’s website) compared to the index it tracks gives you an indication as to whether the ETF is doing what it says on the label.

I’d also look to see if the ETF’s management fees are competitive with its peers. If it’s an active ETF, check if there are any performance fees.

You can have a look at this MoneySmart calculator to find the long-term effect that fees have of your overall return.

Are you comfortable with the ETF and aware of the risks involved?

One of the last things you’ll need to review before purchasing your first ETF is the specific risks involved with owning ETFs and the asset class you’re investing in.

Does the ETF do what it’s supposed to do, and do you understand what you are investing in?

Want more ETF stuff?

I understand just how hard it can be to take that very first step on your ETF investing journey, and sometimes you just want a hand sorting through the endless sea of options.

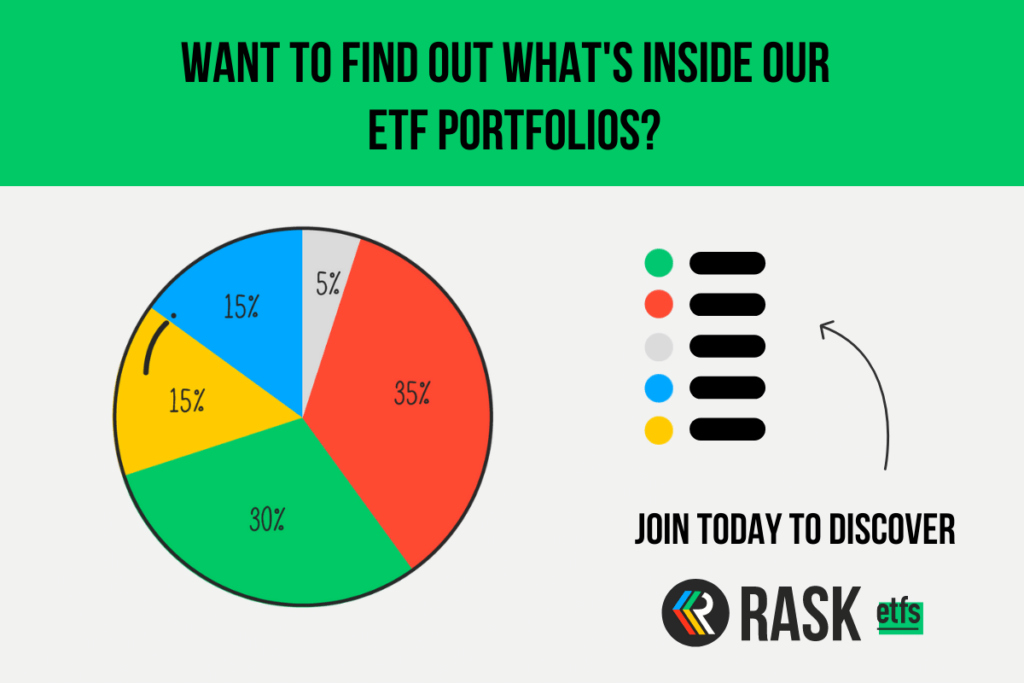

That’s why we’ve created an ETF investing membership which provides example portfolios to help you get started, with expert ETF research, how-to guides and monthly updates.

Do you have more questions about ETFs? Jump into our FB Community to let me know!

Cheers to our financial futures,

Kate