Have you ever wanted to be your own Sherlock Holmes and start investigating companies?

Welcome to Shares Month on The Australian Finance Podcast! This month is all about how to analyse stocks like a pro investment analyst.

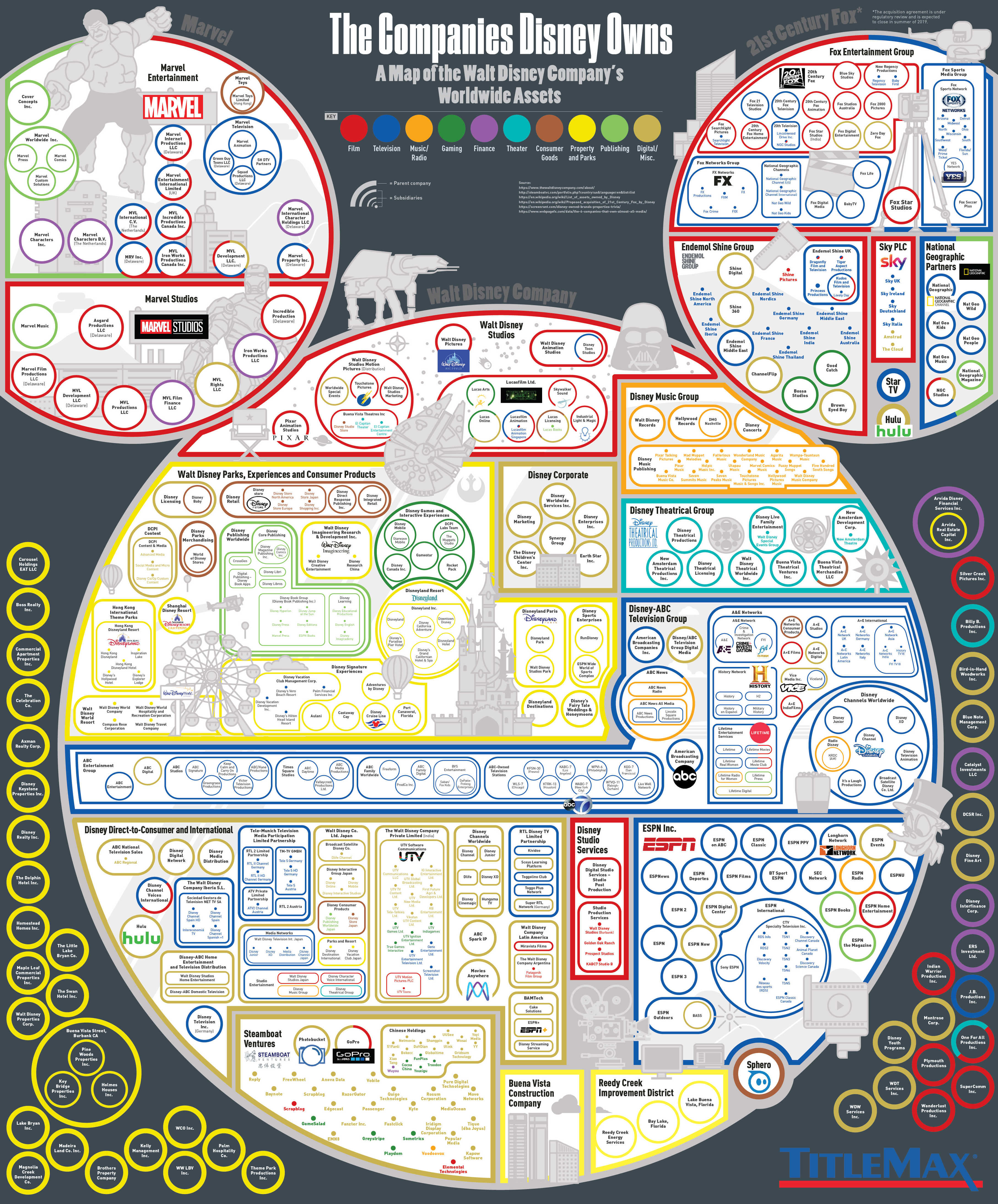

Today’s episode applies our 5-part investing checklist (that we introduced you to last week), to a company that we all know and love, The Walt Disney Company (NYSE: DIS).

It’s Cathryn Goh’s debut on the show, so Kate throws her in the deep end in analysing Disney! We chat about Disney’s revenue sources, the size of its moat, comparable companies, management, and more.

If you’ve listened to our earlier share investing episodes, dive straight into the checklist around 8 minutes.

Send your share investing questions to [email protected] with the subject line SHARES MONTH, and we’ll include them in our share analyst Q&A episode later this month.

At the time of recording, Kate owns shares in Disney, EML Payments, Spotify & Apple. Cathryn owns shares in EML Payments, Xero and Afterpay. Owen, Kate, Cathryn or The Rask Group Pty Ltd do NOT receive anything for mentioning Super funds, products, shares, bank accounts, etc.