Let’s take a look at the numbers behind your financial goals.

Dear Future Millionaires,

Kate here, co-host of The Australian Finance Podcast and the person ready to help you invest your money and time, better! This article was originally shared in the Rask Education student newsletter. Simply sign up to a course on Rask Education (like our ETF investing course) to get this directly into your inbox each fortnight.

Have you ever fantasised about being a millionaire? Not a crypto or property millionaire. An actual millionaire?

Isn’t it funny how we get so stuck on the idea of having a $1 million? Like it’s a sign someone has really made it. We get served up with plenty of news articles about so-and-so person becoming a millionaire in a handful of years through trading crypto, a 20-strong property portfolio or my favourite, starting with $1 million!

Because of this sensationalism, it’s easy to lose sight of the everyday reality: most millionaires in Australia are regular middle-aged Aussies who’ve got most of their wealth tied up in the family home and superannuation. They aren’t jetting off on private yachts anytime soon, but boy do they have a great portfolio of assets.

The one thing I like about the $1,000,000 goal is it’s easy to break down the numbers and use it as an example of building wealth over time.

For example, if you have a 20-year investment timeframe, how do you get to $1 million?

Let’s dive straight into the numbers before we unpack the how and why behind all this.

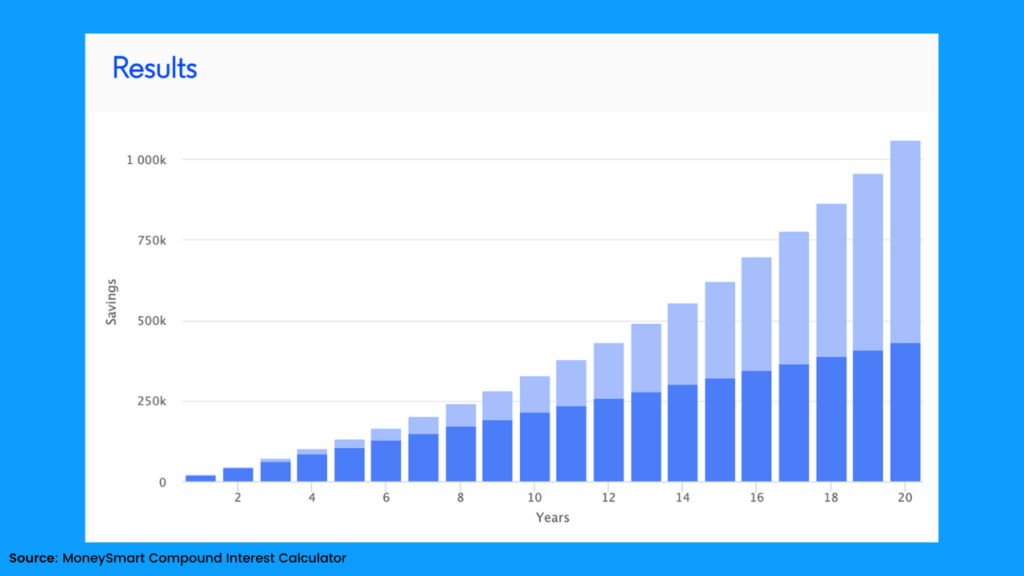

If you start with $0 today, and invest $1,800 a month into a diversified portfolio (with an 8% average annual return, excluding taxes), you’ll be hitting the millionaire mark in just over 20 years.

“Kate, $1,800 a month is just ridiculous…give me some more realistic numbers?”

Okay okay… before you start throwing rotten tomatoes at me, let’s cut the monthly investment down a little bit — but increase our investment timeframe.

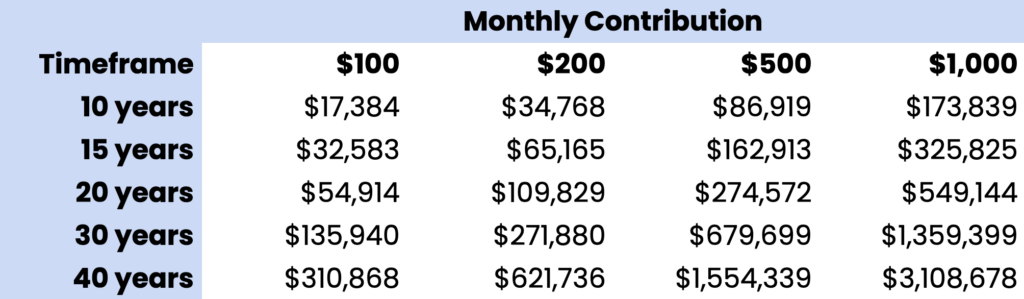

As you can see in the table below, the longer you give your investments to compound, the less capital intense your monthly contributions have to be. Sure, you might not hit the million dollar mark next year investing $100 per month, but it shows just how important the small amounts you can put away each month are over time.

The next question to answer is where does the money come from?

You might now be wondering where all this money to just invest comes from? Some Rask readers will be in a position right now where they have money left over after all their expenses each month to start putting it away for their future. But I acknowledge that this is definitely not the case for most Aussies & Kiwis.

There are plenty of websites and books that will help you cut costs in your budget (including Rask’s brand-new (and free) money courses!). Or you could sell stuff from around the house. Finally, many resources will help you strategise ways to increase your income.

However, the biggest thing I want to leave you with today is this: start small (but start right now). I think I’m plagiarising myself here when I say, money doesn’t grow on trees but it can grow.

Becoming an investor is daunting, a new skill and habit all at once. It’ll take time to learn the basics and start seeing the impact of compound interest, but I challenge you to find even $5 to put away for your future.

It’s a massively positive mindset shift to go from a consumer of the economy to an owner of the economy. This shift will give you the motivation to keep investing and building wealth.

Where can I invest my money for a good return?

This question certainly can’t be answered properly in the space of one newsletter, but if you’re interested in knowing more about where to start, check out our free Get Started Investing Course on Rask Education.

But…what if my plans change?

This what if question is a big one for investors.

There are so many things that are out of your control as an investor (e.g. investment returns, inflation, and macroeconomic events like what’s going on in the Ukraine). Therefore, it’s important to be laser focused on what you can control (e.g. fees you pay, the amount you invest each month, and the way you allocate your investments).

Remember…

- You can always adjust course

- There’s no one right way to invest

- People have hit the million dollar mark through many different strategies

What if it doesn’t work and I miss the goalposts?

Not achieving your money goals is a real fear. But just think about this for a second…

Even if you don’t reach your goals, you’re still going to be in a much better position if you start saving and investing today. You’ll have built your financial confidence, put solid financial foundations in place, learned something, and hopefully have given your investments a solid kickstart.

Would you regret trying, even if you miss the goalposts? Will you be in a better position than you were before? Project yourself forward into the future, and look back on this decision. Then ask yourself, “will I regret not doing this?” Then make a decision and act accordingly.

Your 1 challenge for today

What’s one long-term financial goal you have?

Take some time to really think about what you’re working towards, rather than settling on an arbitrary number.

Write down the why behind your goals and how you’re planning to achieve them.

Maybe it’s a new house. A comfortable retirement. Supporting your children. Or “I want to be a millionaire!”

Whatever it is. Write it down now.

Your future self will thank you for it.

🌱 Want help with the investing stuff?

Keen to learn more? Check out our investing courses on Rask Education. Shares, ETFs, super and more!

Do you have more questions about investing? Jump into our FB Community to let me know!

Cheers to our financial futures,

Kate