Keep your cool, revisit your investing goals and zoom out to see the bigger picture is still positive.

Dear Money Mentalists,

Kate here, co-host of The Australian Finance Podcast and the person ready to help you invest your money and time, better. This piece was originally shared in my newsletter with Rask Education students – simply sign up to a course (like our free Psychology of Money course) to get these insights directly in your inbox each fortnight.

Did you know: over the past 122 years, the Australian stock market has gone up 81% of those years? I think that’s great. But it also means it went down nearly 20% (or one in five) years!

***

With the stock market a little shaky this year, it seems like a good time to be saving, investing or even paying extra off a home loan.

To me, it feels like there are changes in market conditions and interest rates on a daily basis. And yet history (see above) tells us that savers/long-term investors, like us, will be the ones who benefit.

Unfortunately, it’s also times like these when some of the hardest challenges we face as investors come about.

They are within our minds.

The financial choices we make during rough times will often have a meaningful impact on our financial future.

So today I want to give you some tools for managing the mental game of investing (which can have an outsized impact on our investment returns).

Investing well is based on EQ, not IQ.

One of the biggest misconceptions about investing is that it has to be complicated.

In reality, decent returns can be found using simple no-frills ETFs to build a core portfolio. You don’t need a PhD, Masters or CFA qualification to build a respectable long-term portfolio that sets you up financially. But everyone needs to have a basic understanding of what they are doing and manage their behaviour.

There are going to be challenging times. Such as when your portfolio falls in value for days, months or even years at a time.

The thing is, that’s just part of long-term investing. You’ll have to accept it — if you’re looking to build wealth.

During these times your brain will be shouting at you to “JUST DO SOMETHING!”

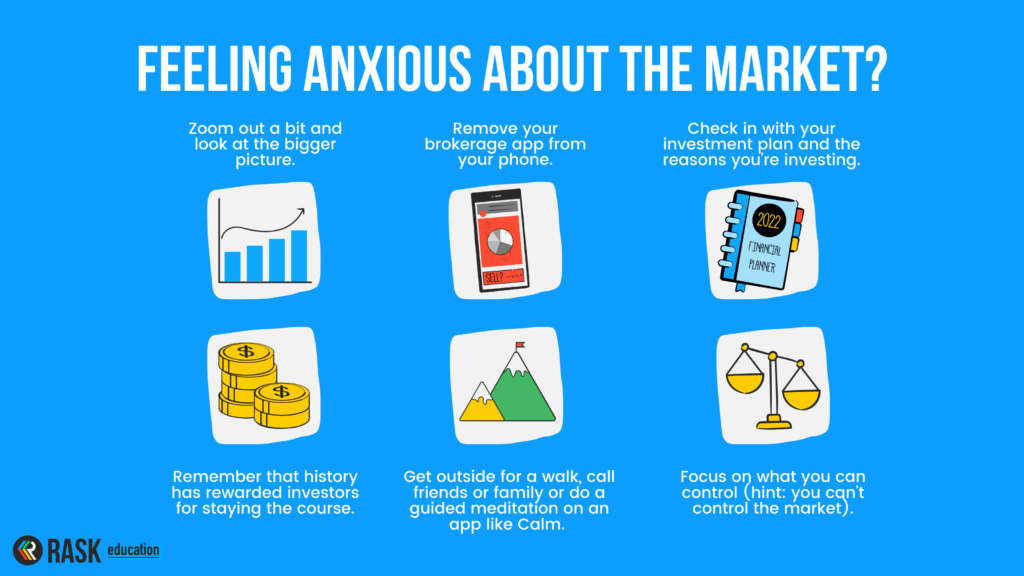

Yet you’ll need to keep your cool, revisit your reasons for investing in the first place, and zoom out to see the bigger picture.

How to overcome our irrational brain

Charlie Munger once said: “A lot of other people are trying to be brilliant and we are just trying to stay rational. And it’s a big advantage.”

The challenge is when we know what we should (or shouldn’t) do, but we struggle to action it.

When things are going well, it’s easy to say we’ll stick to our strategy when the market falls… but you know what they say about the best laid plans…

(Or for fans of The Flash, make the plan, execute the plan, expect the plan to go off the rails and throw away the plan.)

So what are some ways to stay focused on our goals when our brain is acting irrationally?

Here are some easy wins for countering your brain’s impulses:

- Write down your investing goals and your reasons for investing in each company, ETF, or Super. Put this document somewhere you can easily refer to it in times of volatility, fear or FOMO.

- Remove your micro-investing and brokerage apps from your phone. This doesn’t mean stop investing. But removing the apps will stop you from making impulsive decisions and deviating from your plan without properly thinking through your actions.

- Reduce the noise you allow into your life. Don’t let the AFR, CNBC and Bloomberg headlines and notifications alter your strategy without taking the time to properly do your research to work out if anything has changed to your original investment case. Genuinely actionable news is extremely rare.

- Stay humble. It’s easy to start overestimating your skills and knowledge once you’re further into your investing journey, but that’s when you can start making mistakes. Keep your strategy simple, don’t try to outsmart the professionals (or your colleagues, if you’re a professional).

✅ Your challenge: Put in the work to better understand your investing behaviour

Guess what? We’ve just released our brand-new Rask Roadtrip.

Rask Roadtrip is awesome.

It will give you (or your friends/family) a rock solid financial foundation. If you’re just getting started on your journey (or keen to get a family member or friend involved), we believe our Roadtrip courses are the best in Australia.

(Well, that’s what Owen tells me).

I’d recommend starting with our Psychology of Money course, which goes into further detail on some of the ideas in today’s newsletter. Plus, it’s free, so what do you have to lose?

Each of the six Roadtrip courses are designed to be finished in one sitting. Making them perfect for a commute, after the kids have gone to bed or at lunch with a cuppa.

Click the image below to jump on the road to a better financial you!

If you’re wanting to unpack this topic further, I’d highly recommend the following three books:

- The Psychology of Money by Morgan Housel

- The Little Book of Behavioral Investing by James Montier

- The Behavioral Investor by Daniel Crosby

🎧 Like this? Listen to it!

Interested in better understanding your investing behaviour? Well, have we got some podcast episodes for you! Check out the following episodes from the Finance Podcast:

- Behavioural Investing | Dr Daniel Crosby, PhD

- How to make better financial decisions

- Can you win the money game? | High performance mindset coach

- The psychology behind your money goals (& FREE money mindset workbook)

🌱 Need help with your investing?

Keen to learn more? Check out our investing courses on Rask Education. Shares, ETFs, super and more!

Do you have more questions about investing? Jump into our FB Community to let me know!

Cheers to our financial futures,

Kate