The Woodside Energy Group Ltd (ASX: WDS) share price has fallen around 2% after delivering a strong second quarter.

Woodside is a very large oil and gas business on the ASX, it recently merged with the BHP Group Ltd (ASX: BHP) oil and gas division.

Second quarter

Woodside reported:

- Production of 33.8 million barrels of oil equivalent (MMboe), up 60% from the 2022 Q1

- Average realised price of $95 per barrel of oil equivalent

- Revenue of $3.44 billion, up 44% on the 2022 first quarter

The deal with BHP’s petroleum business was completed on 1 June 2022, turning Woodside into a top 10 global energy producer by hydrocarbon production and making it the largest energy company on the ASX.

Woodside received a net cash payment from BHP of approximately $1.1 billion, which included the cash remaining in the bank accounts of BHP Petroleum immediately prior to completion. The growth reported in this quarter was helped by the contribution from BHP’s petroleum business.

Management said that shareholders are now seeing “first evidence of the increased financial and operational strength the transaction will deliver.”

Projects and decisions

After a lot of talks with potential new partners, Woodside has decided to “discontinue the sell-down” of equity in the Sangomar project.

All major equipment items for Scarborough have been procured and construction has begun at the Pluto Train 2 site. First steel for Scarborough’s floating production unit topsides were cut, pipeline manufacturing is 25% progressed and the subsea trees for initial start-up for the project are all complete.

Installation of the mooring system for the floating production, storage and offloading facility that the Sangomar field has been completed and the second drillship, the Ocean BlackHawk, commenced dripping in July.

In Australia, accelerated Pluto gas transported through the Pluto-Karratha Gas Plant Interconnector has resulted in additional LNG production and sales of uncontracted cargoes in a high-priced market.

Summary thoughts on the Woodside share price

Unsurprisingly, this was a strong quarter for the business with elevated prices after the Russian invasion of Ukraine.

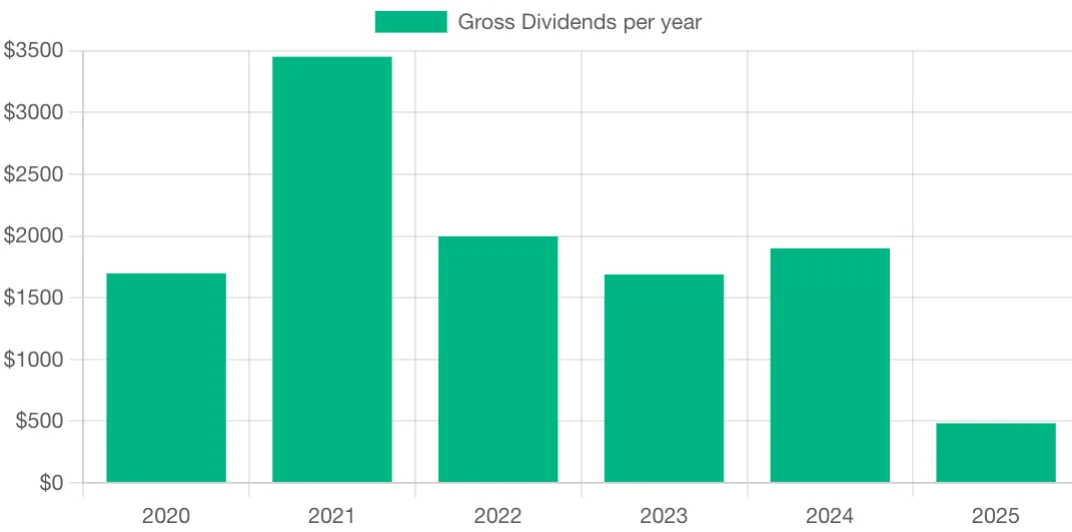

The Woodside share price has risen by 40% in 2022. I’m not sure if it can rise much more, but the dividends are likely to flow strongly in FY22.

I prefer to think about commodity businesses when the commodity and share price is low, not high like it is now. Woodside will probably keep paying good dividends, but I’m not sure whether the business can sustainably rise any further from here.