The Volpara Health Technologies (ASX: VHT) share price jumped 6% today after the company released two important updates to the market: its quarterly cash flow report, and findings from CEO Teri Thomas’ strategic review.

Volpara’s review concludes:

- Volpara sales and development teams will focus on three products and genetics;

- The USA and Australia will be the target markets for large customers or “elephants”;

- The company plans to reach operating cash flow break-even in FY24 (we’re currently in Volpara’s FY23);

- Some staff reductions have taken place; and

- Volpara reported a $NZ3.5 million cash outflow during the quarter.

VHT share price

This chart compares the Volpara share price (green) to the Pro Medicus (ASX: PME) share price (red) and the Vanguard Australian Shares Index ETF (ASX: VAS) share price (yellow) over five years.

My take on the Volpara share price

Rather than repeat the news, I’ll keep this brief and share my concise thoughts.

All updates considered, this is a very positive update for Volpara and it’s exactly what I want to see Teri Thomas doing right now. In the US, the economic situation is more dire than it is here in Australia. In addition, I think the company has been focused on science at the expense of profitability (when it could have both focus points).

I believe Volpara needs to reinvest in research & development (R&D) to maintain its cutting-edge knowledge and capabilities. And its mission of saving lives is crucial to staff, the world and to investors like me.

However, contrary to what a lot of investors believe, there are some high-profile examples that show constantly reinvesting to ‘make a good product even better’ actually doesn’t create value. If you want to understand why — and become a better technology investor — read all of these letters from Mark Leonard back-to-front. It’ll change the way you invest in software.

The table above is taken from that link, the letters of Constellation Software’s President, Mark Leonard. Constellation Software buys mission-critical software in every market it can find, such as logistics, transport, health, etc.

As you can see, without acquisitions, a great software company basically has two levers: new maintenance revenue (i.e. new customers and a lesser extent, add-on modules); and price increases.

The thing is, for truly mission-critical companies, price increases should cost you virtually nothing, so it makes sense to focus on this aspect of a business. Find what works, double down.

For years, Volpara has highlighted its “negligible churn”, which is great. However, there is potentially another explanation for this low churn outside of “its mission-critical software”, and that is it hasn’t flexed its pricing power. Indeed, if you under-charge a customer for your product they’re never going to leave. But existing customers are often the best source of increased revenue (just ask every company you do business with as a consumer on an annual basis… I’m looking at you, car insurance). So if you think Volpara’s pricing power hasn’t been flexed, which I suspect it hasn’t, it makes sense to focus on the core sticky products and double the focus on them.

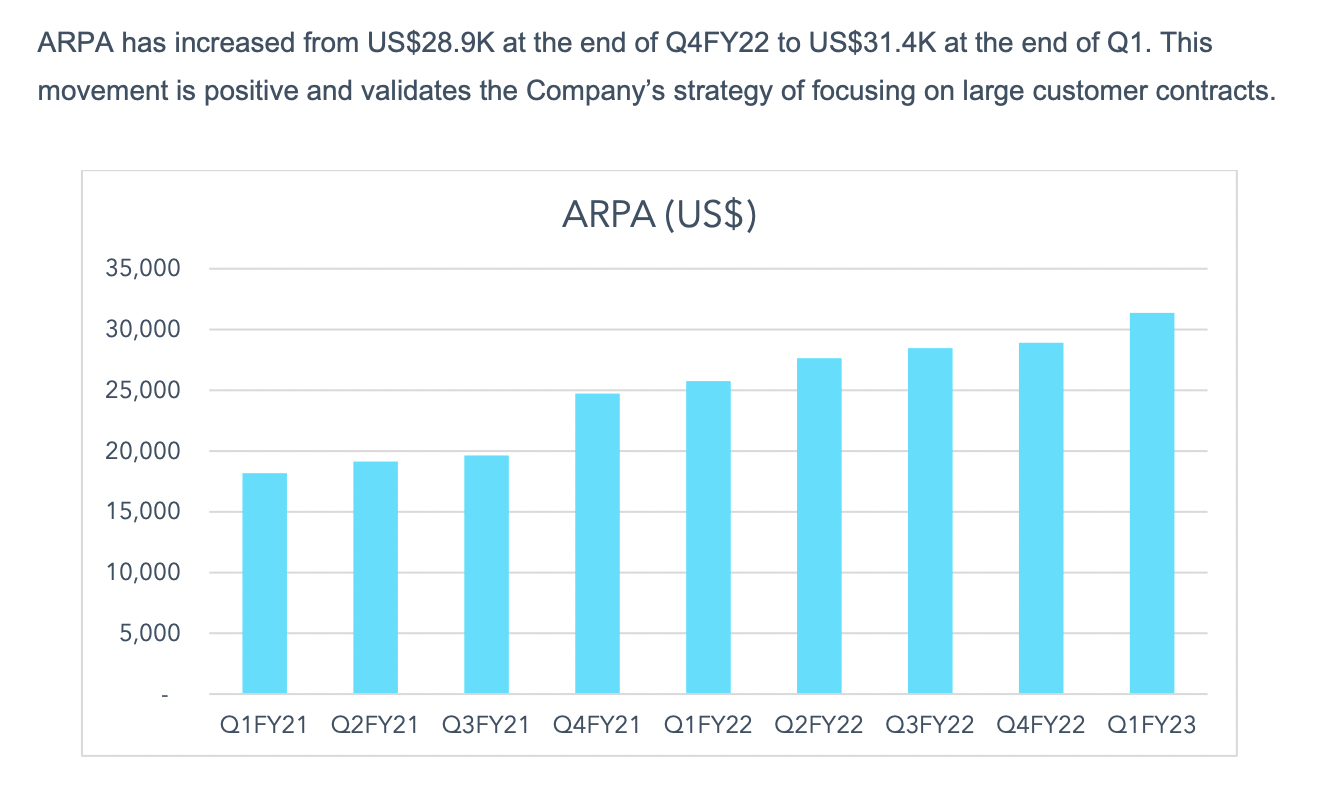

In today’s update, I was impressed because again we saw that “SaaS” churn was negligible but we can also see increasing prices per account (ARPA — shown above), a renewed focus on just three core products, reduced staff in non-core markets, an exit from some markets (e.g. Korea), and a focus on larger deals (“elephants”) in the USA and Australia. This follows Volpara’s impressive RadNet deal.

I’ve found that often as companies scale, their inertia can become a horrible thing. For example, I’d take a team with one A+ marketer/engineer over a team of three B+ marketers/engineers — because the better staff actually tend to cost you less, scale better and resources can be maximised (even if you achieve less output). You may remember this is what Sam Hupert credited for Pro Medicus’ success when I interviewed him quite a few years ago. “Hire fewer great people”.

Volpara’s share price rises

The Volpara share price is up 6% today and it’s easy to see why.

On the surface, Volpara is in quite a precarious financial position, with $3.5 million of cash going out the door every quarter and only $15 million in the bank (4 quarters’ worth) plus a $10 million debt facility. Unless they’re going to tap shareholders on the shoulder for more cash at depressed share prices, which is possible, these cost-outs need to happen now.

While I don’t like to see our companies falling to their knees to reset their business, I’m now more confident Volpara will quickly close the gap on cash burn while also emerging as a leaner and more scalable business that is still science-focused. That said, we need the company to land more big deals over the next 12 months to justify the current valuation.

To measure success, I’ll be watching: revenue per customer, new wins and how/if/when that cost base finally starts to come under control.