8 questions to ask yourself before investing in ETFs

Dear ETF Heroes,

Kate here, co-host of The Australian Finance Podcast and the person ready to help you invest your money and time, better!

You will be familiar with Exchange Traded Funds (ETFs) after taking our Beginner’s ETF Course on Rask Education. But if you’re not familiar (or want to explain it to a friend) this article gives you a rundown of the basics.

We’re gearing up to record our new “ETF Investing Checklist” mini-series on the podcast, which is aimed at building your confidence when it comes to researching and comparing ETFs, to then an ETF portfolio.

One way to build your confidence is by having a checklist, to make sure you cover everything during your research process.

While various studies have shown that checklists can help reduce mistakes in the operating theatre or cockpit, an investing checklist can be viewed more like a springboard for your research and curiosity, while giving you a framework to avoid wandering off the path too far.

As you build up your confidence as an investor you can start to create your own investing framework. In the meantime, it’s helpful to have a starting point when you’re ready to get started investing.

📝 ETF investing checklist

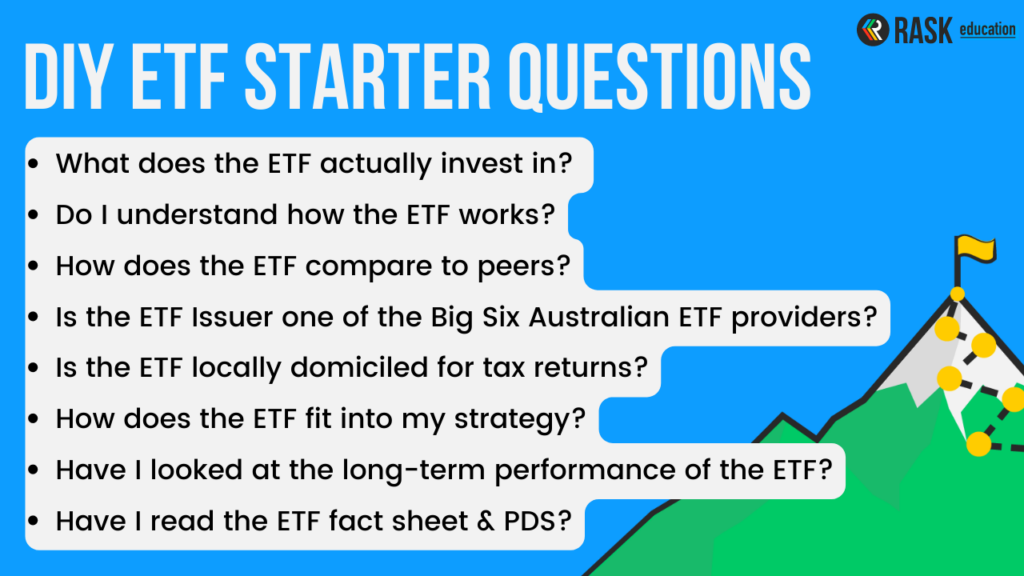

So what are some of the questions that currently sit within my ETF investing checklist?

🔍 What does the ETF actually invest in? (Note: don’t just take their word for it, look inside the portfolio using the ETF provider’s website).

📈 Have I looked at the following facts about the ETF: fees, index, inception date, distribution history (if any), unit registry and top holdings list?

🍏 How does the ETF compare to peers? For example, what are two/three similar ETFs and how do they compare for long-term returns, low fees and tight spreads.

🏆 Is the ETF Issuer one of the Big Six Australian ETF providers? Think Vanguard, BetaShares, SPDR, iShares, VanEck & ETF Securities.

🇦🇺 Is the ETF locally domiciled for tax returns? Search the Best ETFs website for your favourite ETF and similar ETFs.

👖 How does the ETF fit into my strategy? That is, is it a tactical/growth ETF, or a Core/bottom-drawer ETF? Describe how the ETF fits in with your strategy, keeping in mind you should be prepared to own the ETF for a very long time.

📊 Look at a long-term share price chart for your ETF. On the Best ETFs website, study the biggest falls that ETF has experienced. Now answer this question: “When the stock market crashes or falls a long way (e.g. every 2-3 years), I will keep my cool by remembering to…”

📜 Have I read the ETF fact sheet and Product Disclosure Statement (PDS)? This is available on the ETF provider’s website.

What else would you include on your ETF Investing Checklist?

🎧 Upcoming ETF podcast mini-series

We’re gearing up to record our new ETF Investing Checklist mini series, which will be a 5-part podcast series, aimed at building your confidence when it comes to investing in ETFs.

Over the course of 5 podcast episodes we’ll cover the basics of ETF investing that you really need to know about, give you the tools to figure out what type of ETF you’re looking for and how to research and compare them.

We’ll also chat about the things you need to know as an ETF investor on an ongoing basis, including ways to make the admin and taxes less painful.

We want to know every question you have about ETFs, so we can put together a really helpful (and free) resource.

You can send an email to me or Owen via [email protected] with the subject line ETF PODCAST. Or you can DM us on Twitter or Instagram @RaskAustralia. If you’re a Rask member, jump into our members-only forum.

🛠️ ETF investing resources

My goodness… we have lots of ETF investing resources coming out of our ears over here at Rask! Depending on what you need or want, we’ll have something to match…

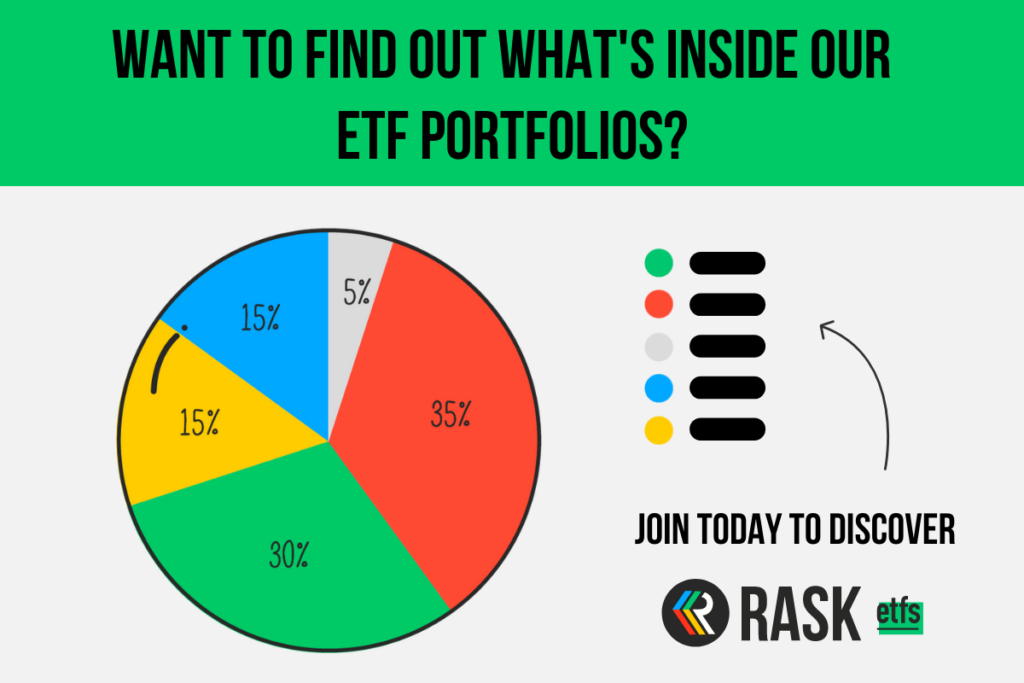

Rask ETFs – this is our membership community for ETF investors which contains model portfolios, monthly Q&As with Owen and a lively discussion forum. If you want to know what we’d invest in first, join us.

ETF investing course – ready to understand how ETFs work? Take our popular online course over on Rask Education.

Or if you prefer to listen…

We’ve got countless ETF episodes on The Australian Finance Podcast – from the beginner ETF investor to deep diving into popular ETFs like VAS, we’ve got you covered. Tune in today.

Cheers to our financial futures!

Kate