Give your tax return a job this year!

Dear Money Mentalists,

I’ve been going down a rabbit hole this year trying to discover ‘the why’ behind our financial decisions.

Why?

Because it’s never quite as clear cut as it appears on the surface.

There are so many mental traps and mindsets that catch us out on our money journey, so it’s only right to start identifying and tackling them as soon as possible.

Something I like to remind myself is that the perfect conditions for our financial decisions don’t exist. If we look closely there will always be a reason not to pay off debt, save extra money, or invest.

When if we realise there will never be a ‘perfect time’ to do something, it takes a lot of pressure off our shoulders to make sure we have everything lined up before we make and execute on a decision.

For example, many people will wait for the right time, the right amount of money and the right price before investing for the first time.

Today in particular, given many of us are starting to receive our tax refunds (or maybe you’re on top of things and already have), I want to discuss the idea of mental accounting.

Your tax refund is your money, so I want you to treat it with the same intention you would give to your normal 9 to 5 income.

What is mental accounting?

$1 always equals $1… right? Not so fast…

There’s a concept called mental accounting, which basically means there’s a lot more to each $1 than meets the eye.

Depending on where the $1 came from and where it’s going, it can sometimes feel like 50 cents or $1.50.

You might have experienced mental accounting without realising it.

For example, have you ever received a gift card and realised how much easier it is to spend the money versus, say, if you were paying upfront?

I personally find it difficult to spend money on a massage, but it’s a whole different experience if I receive a gift card, or give a voucher to my friends.

Weird how that works…

It turns out, assigning different values to the various parts of our financial life is a very human trait.

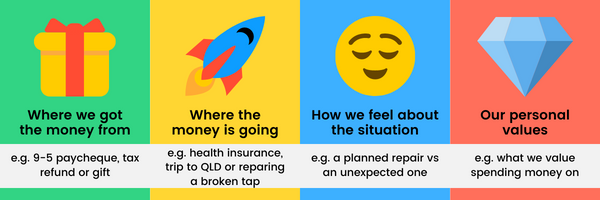

We give money rules and assign it a value in our brain based on:

🎁 Where we got the money from (e.g. 9-5 pay cheque, tax refund or gift.)

🚀 Where the money is going (e.g. health insurance, trip to QLD, or repairing a broken tap.)

😌 How we feel about a situation (a planned repair vs an unexpected one.)

💎 Our personal values (what we value spending money o.n)

Since our brains are wired this way, it’s important to understand the way we frame a situation.

Mental accounting can cause us to spend illogically and more extravagantly, because it alters our perception of the value of the money we receive and spend.

Imagine you just got a $1,000 tax refund…

Did the ATO just tell you $1,000 was heading your way? After you dutifully saved your receipts and submitted your tax return on time?

If you’re like some Aussies, when you hear the news of a tax return coming your way you might have started daydreaming about all the ways you could spend that money…fancy sneakers, another NFT, concert tickets…

Many of the things you think of may be things you had no intention of buying 10 minutes ago. That’s mental accounting in action…

Breaking free of mental accounting

It all comes down to spending your money with intention.

If you check-in with your money goals when you receive an unexpected sum of money (e.g. a tax return), you can make sure it’s allocated in a way that makes current and future you proud.

Whether that’s putting money into your super or spending it on a new holiday (maybe even both), don’t let the trap of mental accounting warp your perception of the money you receive (or spend!).

🤔 What is the next best step you can take with your money?

Kate’s tip.

From me, make a plan for unexpected income you receive, like tax refunds, bonuses and gifts.

Don’t let the money fall into general revenue or get spent on something that doesn’t align with your goals and values.

Take a moment right now to create a note on your phone, and quickly jot down how you’re allocating your imaginary money. You never know, it might happen sooner than you think!

If this email takes your fancy, here are more resources you’ll love:

- Winning the mental game of investing

- Are limiting money beliefs holding you back?

- Ep 97. How to make better financial decisions

- Actionable ways to improve your financial decision-making skills

- Ep 125. Behavioural Investing | Dr Daniel Crosby, PhD

- Mental Accounting – The Decision Lab (fantastic explainer article on this topic)

Cheers to our financial futures,