Does your company have a moat?

In this episode, Kate & Owen discuss what an investment moat is, share Morningstar’s 5 moats and companies that fall within each category, along with how to identify and stress test a company’s moat.

Here at Rask, one of the key pillars in our investment philosophy is investing in companies with strong advantages or moats.

A moat is a throw-back to the good ol’ days when castles (business franchises) needed a ring of water (competitive advantage) to protect them from the attack of enemy armies (competitors) who had heavy armour and weaponry.

A moat is a feature of a business that enables it to generate excess returns on capital for a sustained period. Under the rules of capitalism, usually a competitor would enter the market and eat away at those returns.

As you might expect, Warren Buffett popularised the moat metaphor and its importance in long-term investing.

“What we’re trying to find is a business that, for one reason or another — it can be because it’s the low-cost producer in some area, it can be because it has a natural franchise because of surface capabilities, it could be because of its position in the consumers’ mind, it can be because of a technological advantage, or any kind of reason at all, that it has this moat around it.”

– Warren Buffett, as quoted by Guru Focus

Examples:

- Coca-Cola is just sugar + soda water – but we pay $4 for it

- MacDonalds is just crappy beef & bread – but we pay $8 for a Big Mac

- Apple iPhone is (kinda) just like a $100 Android — but we pay $2,500 for the latest model

- Tiffany’s diamonds are surprisingly low quality but they sell for more than anything — the joke is that you can buy a $5,000 diamond and a $20,000 box from Tiffany’s

The Little Book that Builds Wealth | Pat Dorsey | Talks at Google

An author and investor by the name of Pat Dorsey, of Dorsey Asset Management and former Director of Equity Research at Morningstar, is one of the strongest proponents of identifying moats in investing.

Dorsey worked at Morningstar, the financial data and research provider, between 2000 and 2011 and helped their team of 90 analysts shape how a moat can be quantified and understood.

Morningstar identified 5 sources of a competitive or economic moat, including switching costs, network effect, intangible assets, cost advantage, and efficient scale.

Some of Kate’s key takeaway’s from this video:

- High profits attract competition. With the absence of a moat, competition destroys excess returns.

- In most businesses, you see returns on capital decrease over time as competition comes in. However, there are a small minority of businesses that enjoy many years of high returns on capital. These companies defy economic odds, by creating structural competitive advantages (or economic moats).

- A company that can’t raise prices is a test of a strong moat. Is the company struggling to raise prices? This is a flag to dig deeper – losing pricing power may be a sign the company’s moat is eroding.

- Brands are valuable if they deliver a consistent (e.g. Kraft) OR aspirational (e.g. Tiffany’s) experience.

- Managers matter in the context of a moat —> Great management doesn’t matter if the company is terrible to begin with

- Get inside the customers head – why do they buy from XYZ company?

How to stress-test a moat

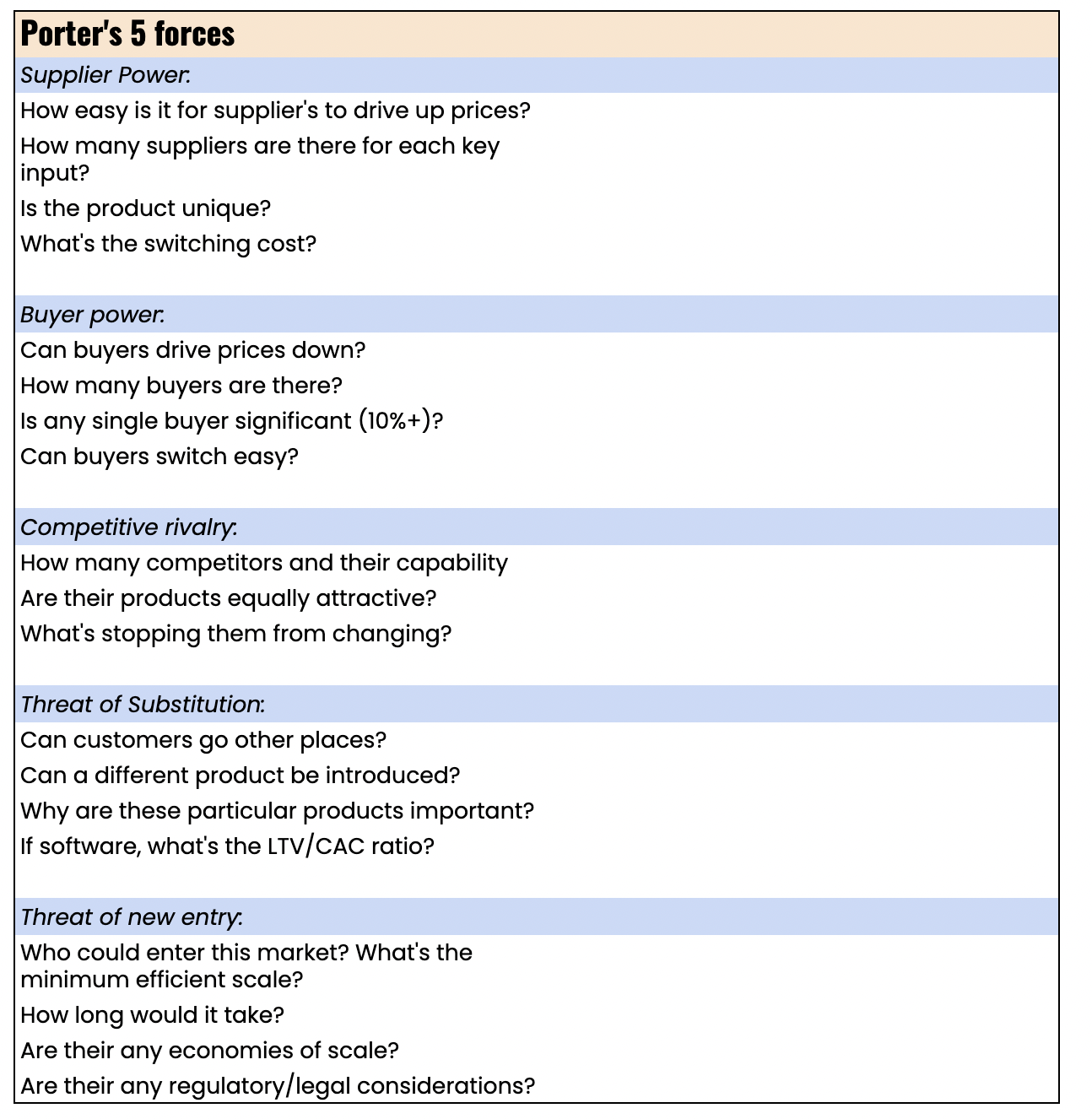

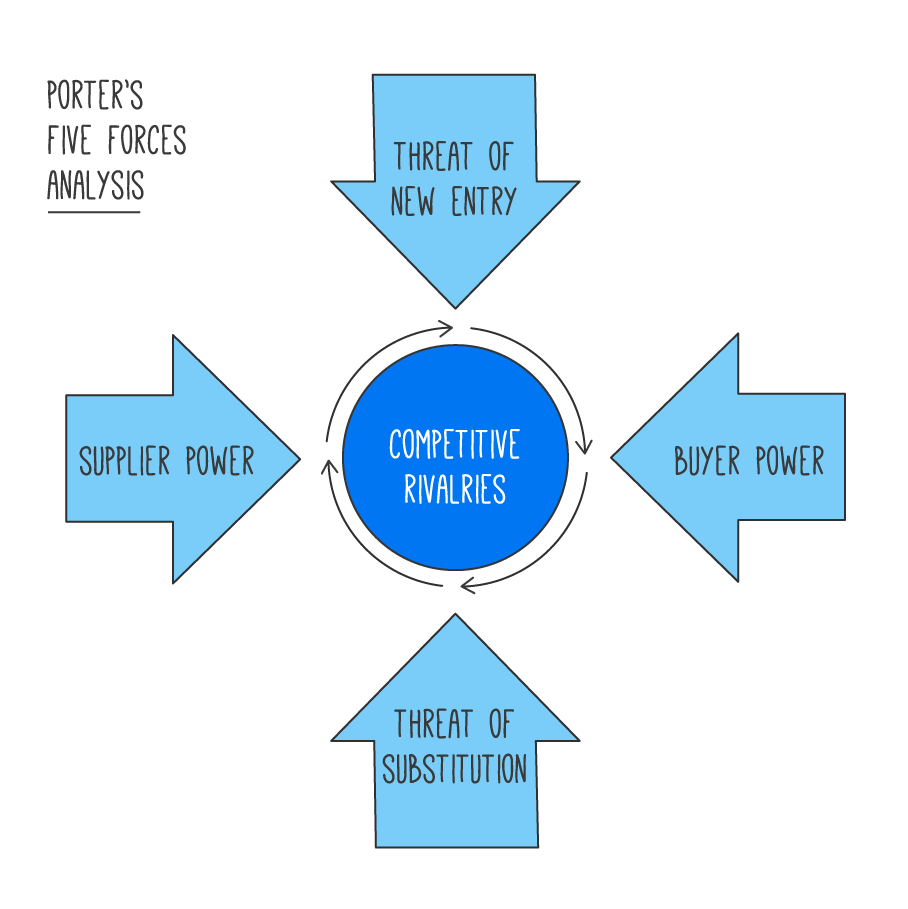

Porter’s Five Forces is one of the most powerful tools that portfolio managers and analysts should use to understand the opportunity for a business.

In short, the true test of a moat is an ability to increase prices and retain/grow the customer base. This proves to you that the company has a “sticky” product and pricing power.

But how do you determine if a company may have pricing power in the future? How do you identify if a company has the potential to create a wide moat in time?

Porter’s Five Forces can be used to prompt you to identify where a moat may be weak or strong, after considering all of the usual forces that can impact it.