Brian Gildea is the Head of Evergreen Portfolios at Hamilton Lane Inc (NASDAQ: HLNE) and has 20 years of private markets experience. Brian joins Owen Rask on The Australian Investors Podcast to help us understand why the private markets (e.g. private companies) are such a fruitful ground for investors.

If you’re a student of investing and want to broaden your horizons to what’s possible outside the public stock market, this is the episode for you.

Topics covered with Brian Gildea of Hamilton Lane:

Brian’s best investment and worst investment to date — hint, his best was Hamilton Lane itself (it’s a public company).

Living through the GFC with Bear Stearns (an investment bank that collapsed during the GFC) and the differences between then and now.

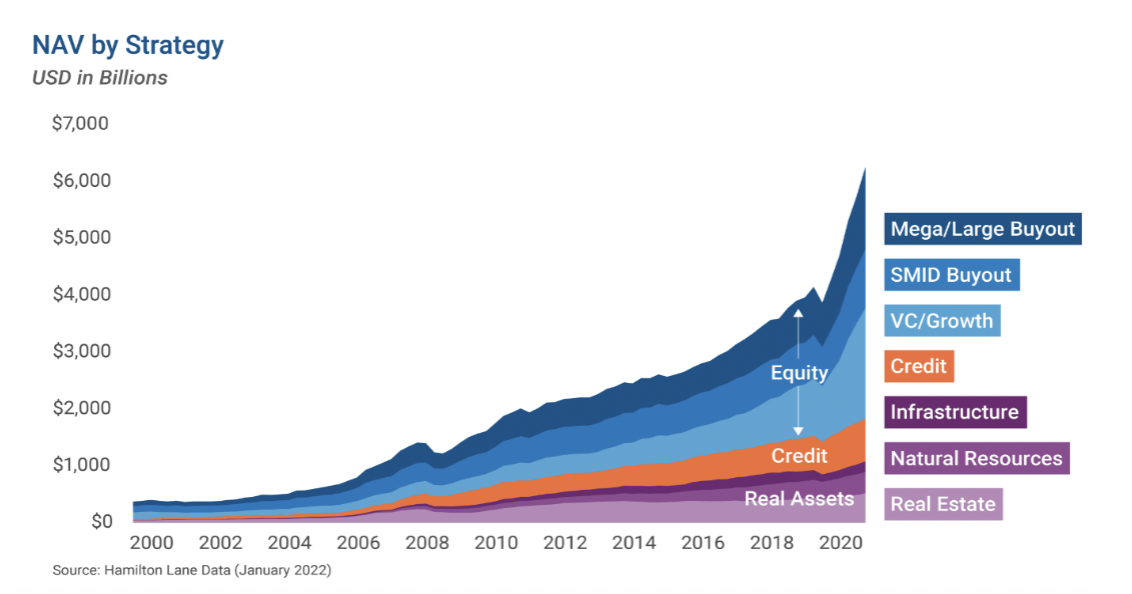

How to think about the private market asset class and which sectors matter (we’ve all heard of venture capital, but it’s not the biggest part of the market).

Why private markets have outperformed, and how to attribute its success to sustainable drivers of returns. Brian says around 2/3 of the returns from private markets is driven by earnings/profit growth — which is very similar to public markets.

There are some 18,000 private companies in the US with revenue over $100 million, versus 2,800 in public markets. More broadly, the number of public companies is declining, from 7,800 in 2000 to 4,800 in 2020.

How Brian and the team at Hamilton Lane find deals and companies to invest in, and the overall investment process.

Brian’s outlook for private markets in the face of rising interest rates.

About Brian

Brian is a Managing Director at Hamilton Lane, and Head of Evergreen Portfolios. Brian has 25 years of private markets investment experience, spanning private markets asset classes and strategies. Brian joined Hamilton Lane in 2009, and previously served as Head of Investments, where he was responsible for oversight and management of all of Hamilton Lane’s investment activities globally. Prior to joining Hamilton Lane, he was a General Partner at Bear Stearns Merchant Banking, and prior to that, at Freeman Spogli & Co. Brian began his career as a Financial Analyst in the Mergers & Acquisitions Group at Salomon Brothers Inc.