Danielle Ecuyer

online pharmacy lexapro over the counter with best prices today in the USA

of Shareplicity joins Owen Rask and Kate Campbell on this special episode of The Australian Finance Podcast to share 10 things to look for when researching ASX and global shares/companies.

Kate Campell plays host to Dani and Owen as they talk about 5 positive (green) and 5 concerning (red) ‘flag’ indicators to add to your share investment checklist.

🟢 5 Green Flags

- Solid leadership team (insider ownership)

- Open communication with shareholders

- Positive employee experiences, diversity & retention rates

- Internal focus on the long-term future of the company

- Growing market share & industry

🔴 5 Red Flags

- High staff turnover (especially key roles)

- Director and management selling

- Poor Investor & media communications (ASX Announcements and Annual Reports)

- Worsening financials (debt on balance sheet, sales falling)

- Industry shrink (e.g. Blockbuster)

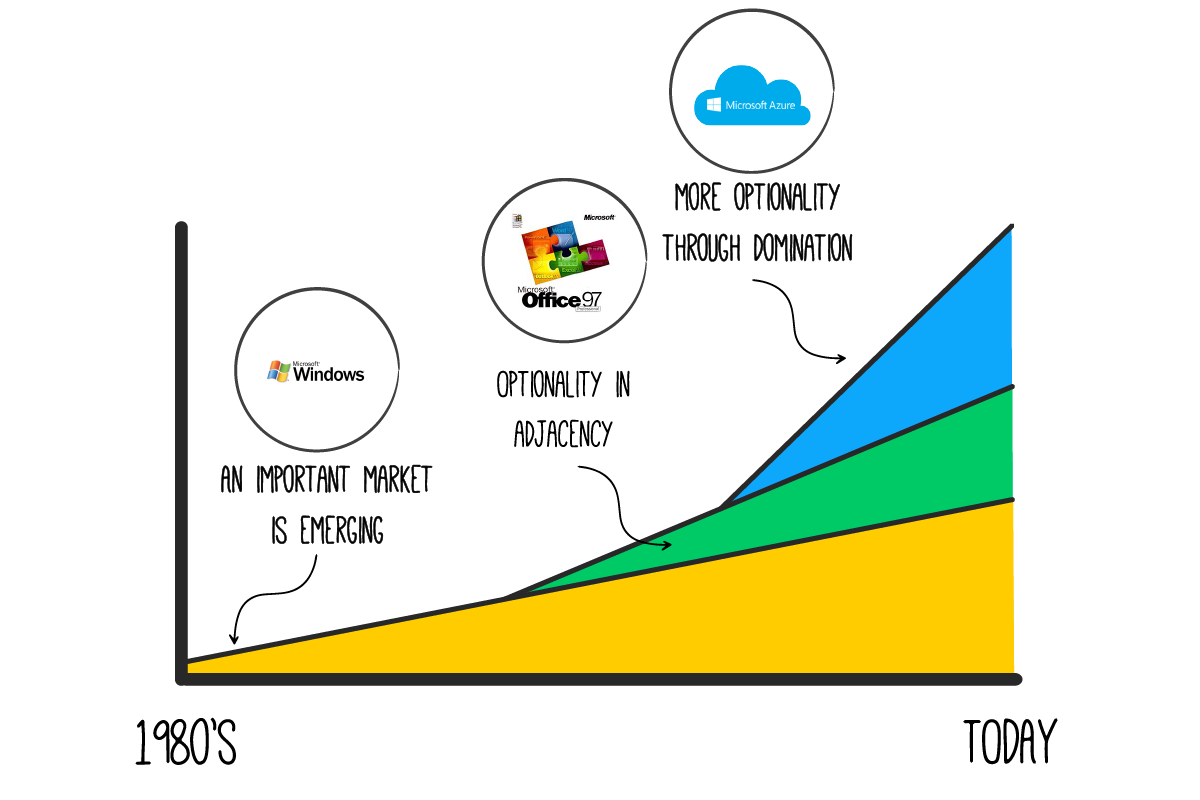

Owen’s chart for Microsoft

Speaker disclosures

- Dani: CSL, GMG, BHP

- Owen: XRO, PME

- Kate: XRO, AMZN, BHP, CRWD, MELI, OKTA, FMG, EML