In Australia, you now need to get yourself an Director ID number and report it against your name. Here’s what you need to know about how to get the Director ID.

As I say in the podcast, I did it in 5 minutes but it might take you a little longer.

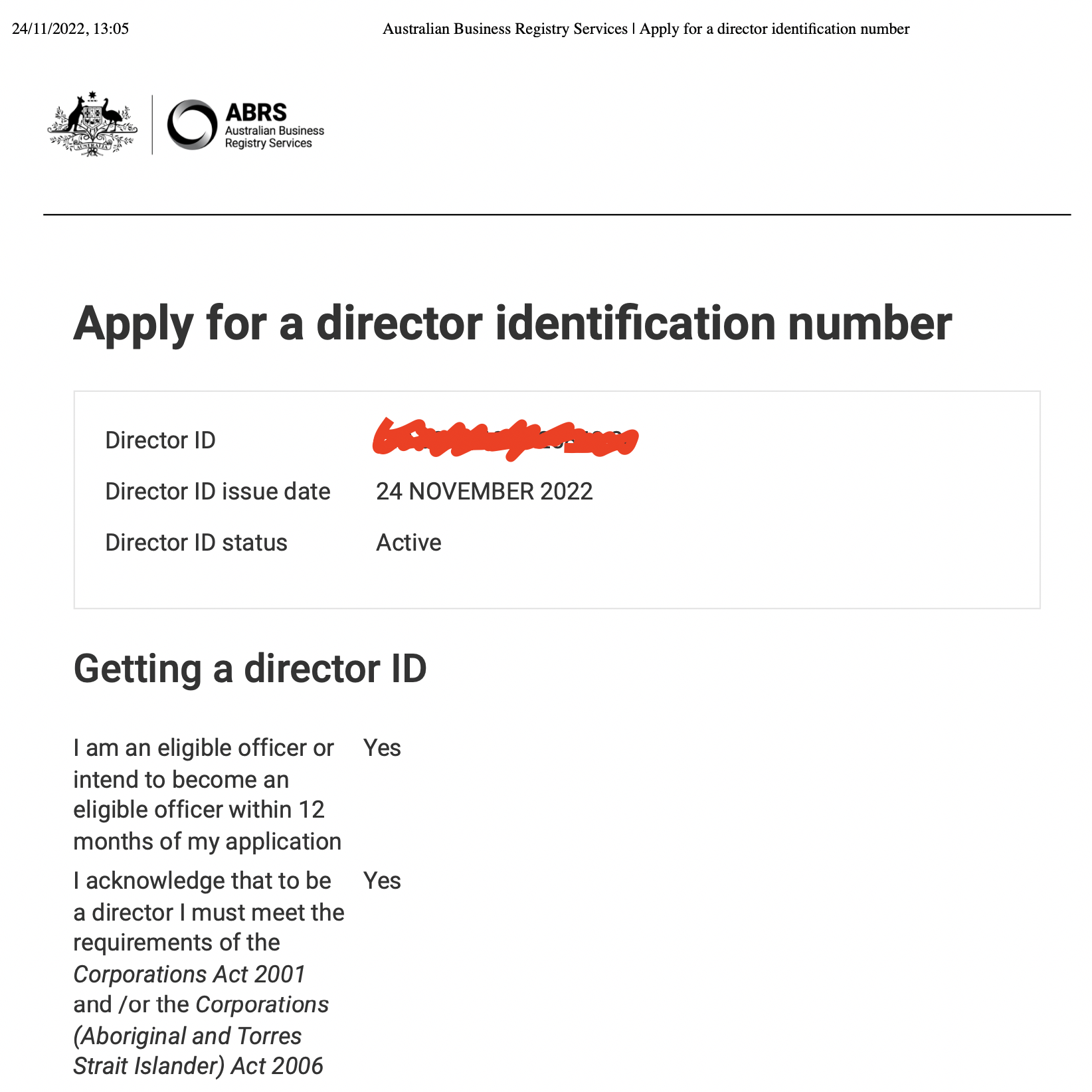

Director ID example PDF

What is an ATO Director’s ID?

A Director’s ID is a unique number that identifies you as a person who runs or oversees:

- A company in Australia

- A corporate trustee of an SMSF

- Charity or not-for-profit

- Other types of organisations (like sporting clubs)

How do I apply for a Director’s ID?

- Step up your MyGovID (if you haven’t already) (you will need at least a “standard” level of ID strength)

- Apply for a Director’s ID

When do I need my Director ID?

Now! By November 30th, every Australian company director needs an ID or face steep fines.

How long does it take to get a Director’s ID?

About 5 minutes if you have the ATO identify app already set up.

A little longer if you don’t use the app, don’t have documents handy, or have to verify.

Where can I get help with my ID?

- Speak to your accountant.

- Follow the ATO’s guide for Director’s ID.

- ASIC information page (pretty basic)

What do I need to apply?

You will need your tax file number (TFN), MyGovID app and your residential address registered with the ATO.

You need to verify your tax identity, which may require you to have two forms of information:

- Bank details (which has a registered tax file number or TFN)

- Your Superannuation information

- Tax notice of assesssment

- A dividend statement

- Centrelink payment summary

- PAYG payment summary

What do I need to do with my director ID?

According to ASIC, “There is no requirement to provide your director ID to ASIC unless otherwise requested.”

However, if you ask me:

- Keep it somewhere safe.

- Print or save the PDF that’s produced after you apply

- Email it to yourself and your accountant and/or company secretary – so you’ve got a record

- I also took a screenshot on my phone.

For more time-saving (or life living!) ideas, subscribe to The Australian Business Podcast and we’ll do our best to help you whenever we can (and make you a better business owner).

Grey Space Advisory – snag a $100 health check

Grey Space Advisory – snag a $100 health check Rask – Get Owen’s best investing research

Rask – Get Owen’s best investing research