Netflix (NASDAQ: NFLX), Tesla (NASDAQ: TSLA) and Amazon (NASDAQ: AMZN) — all falling over 50 per cent.

Mortgage rates tripling.

Inflation not being ‘transitory’.

We certainly didn’t have those three events on our 2022 bingo card. But as the saying goes: everything is 20/20 in hindsight.

In this guide, we review all the major events from 2022 and how they shaped markets.

We also look back at our 22 watchlist stocks from the beginning of this year to see how our thesis played out and any takeaways for 2023.

More than most years, 2022 felt like markets were driven by the macroeconomic landscape, particularly inflation, instead of fundamentals.

Australia, like many parts of the world, placed COVID-19 and the associated restrictions in the rear vision mirror in the first quarter of this year.

Consumers, buoyed by low unemployment and high savings rates, were eager to return to normal scheduling, leading to unprecedented levels of demand for goods and services. Apart from China − which remained cut-off for the year − the global economy was humming.

Russia’s invasion of Ukraine exacerbated an already tight global supply chain suffering from elevated shipping, food and energy prices. It became clear that inflation wasn’t transitory, and policymakers fretted that inflation expectations would become entrenched.

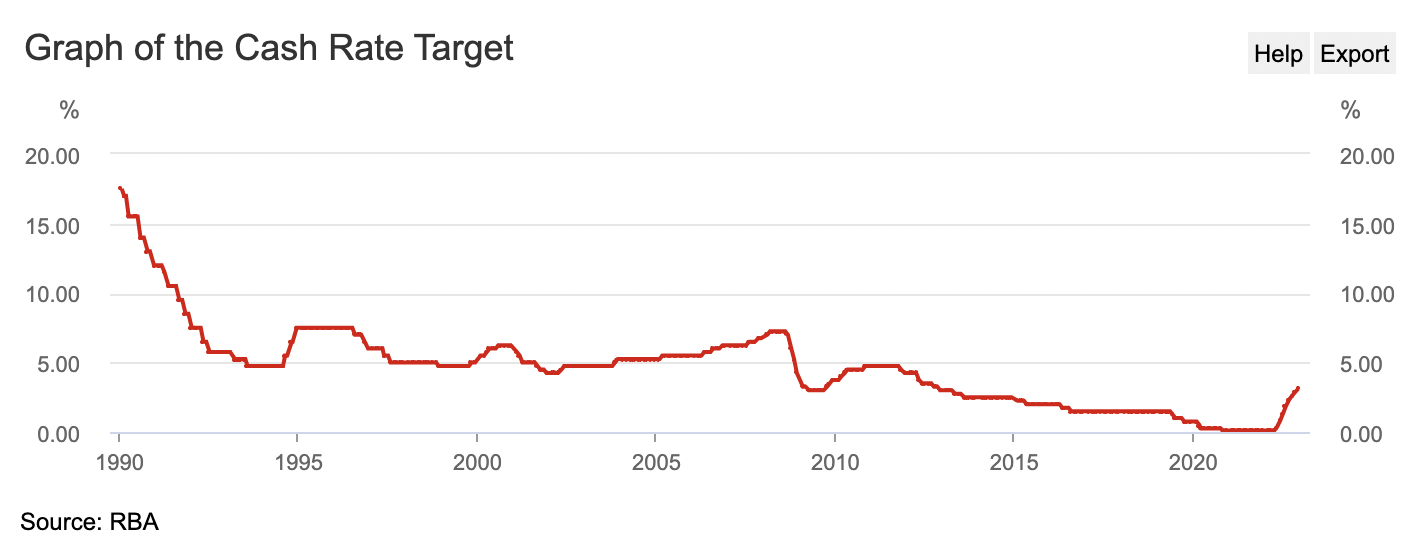

Subsequently, central banks around the globe moved in tandem to hike interest rates and tame demand.

From April, the Reserve Bank of Australia (RBA) increased the cash rate for eight consecutive months to 3.10 per cent, with more increases likely in 2023. This comes after Governor Philip Lowe repeated as late as November 2021 that the conditions for a rate rise weren’t expected until 2024 at the earliest.

The full impact of higher rates on households and businesses has yet to be fully felt — such as higher mortgage repayments and reduced borrowing capacity — however, investors have moved quickly to reprice assets.

Typically, increasing interest rates have an inverse relationship with the value of assets (if interest rates go up, prices of stocks, bonds and property come down). This is because the present value of future cash flows from those assets is being discounted at a higher rate, meaning the cash is worth less today.

It’s also a relative calculation. As investors earn higher returns in lower-risk assets like savings accounts and term deposits, more risky assets (property, stocks, bonds, etc.) don’t look nearly as attractive, leading to a decline in prices.

As a result, almost all asset classes, including property, equities/shares and bonds, recorded negative performance in 2022. The most speculative assets were the hardest hit, with Bitcoin falling 65 per cent.

ASX shares and market performance

Given all the chaos of 2022, it’s somewhat surprising that the benchmark S&P/ASX 200 index fell just ~6 per cent this year, and including dividends and buybacks, only retreated 4.2 per cent. However other major stock market indices did not fair nearly as well:

- S&P/500 is down ~20 per cent;

- NASDAQ 100 fell by ~33 per cent;

- MSCI All World Index declined by ~17 per cent.

The best performers on the local market were energy and commodity producers.

Coal companies performed exceptionally, benefitting from structural underinvestment in supply in addition to bans on Russian high-calorific thermal coal, which Australian producers overweight in.

Lithium companies followed closely behind, attributed to a supply deficit and exponential future demand as electric vehicle adoption accelerates.

Demonstrating the need to secure supply, we saw carmakers such as Volkswagen, Tesla and Ford sign direct off-take agreements from miners for unrefined carbonate and spodumene.

On the other side of the ledger, many of the companies that benefitted from pandemic-induced spending saw sharp retracements in share prices. We also saw the end of the TINA (there is no alternative) trade, where investors chased growth as interest trended towards zero.

Companies that didn’t have profits were punished, while resilient growth companies with real profits and business models were derated.

Reviewing our 22 shares for 2022

This time last year we compiled a list of 22 shares investors should keep an eye on in 2022. At the time it wasn’t our intention to look at it as a portfolio or as stock tips, but we thought it would be helpful to revisit our thoughts from a year ago and see how it played out.

1. Airtasker Ltd (ASX: ART)

Airtasker, the web platform where you can find people who help with work-related tasks or small jobs around the home, picked up where it left off in 2021, growing its transaction value, customers and tasks meaningfully this year.

However, Airtasker also continued to incur cash outflows as management prioritised growth over sustainable profits.

In 2021, this wasn’t an issue. But in 2022, the market derated growth companies, especially unprofitable ones like Airtasker.

The investment case for Airtasker is not dissimilar to when we added it to the watchlist last year, albeit the share price is now a lot lower.

2. Qantas Airways Limited (ASX: QAN)

The flying kangaroo had a strong year, up ~19 per cent on the back of unrelenting demand for airfares.

Qantas capitalised on the lack of any material competition in Australia since Virgin Australia filed for insolvency, in addition to Australians heading abroad for the first time in three years.

It wasn’t all smooth flying though, with the Qantas brand damaged by constant flight changes, lost baggage and price gouging accusations.

This thesis played out largely how we thought it would, but Qantas will need to restore goodwill with the broader population.

3. Whitehaven Coal Ltd (ASX: WHC)

Whitehaven Coal was the standout performer from our watchlist this year, with the Whitehaven share price increasing nearly four times.

Whitehaven benefitted from structural underinvestment in new coal supply. However, the real catalyst were sanctions on Russian coal following its invasion of Ukraine.

Russia supplies the world with high-calorific value coal which has a higher energy density and is not easily replaced by other sources, benefitting Whitehaven disproportionately.

4. Tabcorp Holdings Limited (ASX: TAH)

Tabcorp completed its demerger of the lotteries and gambling divisions this year, which we predicted would unlock shareholder value as the two companies were worth more apart than under one corporate entity. Here’s why Tabcorp (ASX: TAH) is splitting in two

The Tabcorp share price finished in positive territory for the year.

5. (ASX: BAP)

The Bapcor share price bounced up and down like a yo-yo but ultimately settled down ~9 per cent for the year (at the time of writing). New chief executive Noel Meehan, formerly the CFO, took the reigns, implementing a bottom-up leadership style and a plan to extract more economies of scale from the business.

This is a decent outcome for Bapcor, given the company entered the year under a cloud after its former CEO departed unceremoniously.

6. Zip Co Ltd (ASX: Z1P)

We said 2022 would be a formative year for Zip, and unfortunately, it crumbled.

Despite taking the mantle from Afterpay as the number-one listed buy-now-pay-layer play, rising competition and bad debts became the dominant narrative. It also became clear that Zip’s global expansion was not gaining momentum, forcing the business to exit the United Kingdom and focus on the United States and Australia.

The Zip share price fell 86 per cent, easily the worst company on our watchlist.

It won’t be receiving another invitation in 2023.

7. Commonwealth Bank of Australia (ASX: CBA)

The share price of Australia’s largest bank, CBA, hit an all-time high this year as property prices smashed records and were underpinned by a resilient labour force, ultra-low interest rates and a strong domestic economy.

As noted above, since mid-2022 interest rates have risen fast and so far there is little sign of any stress. However, it’s likely CBA and other banks will incur an increase in late repayments and provisions for bad debts as the RBA’s rate hikes flow through to borrowers, and fixed-rate loans roll off.

Although take our prediction with a grain of salt, as we said the same thing would happen last year!

8. Nuix Ltd (ASX: NXL)

The installation of seasoned chief executive Jonathan Rubinsztein to the top job failed to make an impression on the Nuix share price which fell 73 per cent.

“What do you call a stock that’s down 90%? A stock that was down 80% and then got cut in half.” – David Einhorn

The reality for Nuix is that a turnaround takes time, and when new management arrives it usually has a license to clean out the cobwebs and start fresh. Rubinsztein has simplified the business, emphasised the focus on sales and is someway to rebuilding the company culture.

We were on too early on this one, but Nuix still deserves a place on the watchlist once it resolves the option dispute with its former chief executive.

9. News Corporation Class B Voting CDI (ASX: NWS)

The media empire of Rupert Murdoch had a down year, with earnings falling in digital real estate, book publishing and news media.

The break-up of the various divisions into separate companies did not eventuate as we had hoped. Instead, rumours surfaced late in the year of the business merging again with FOX.

The NWS share price was last seen trading down 16 per cent for the year.

10. Magellan Financial Group Ltd (ASX: MFG)

Magellan ended last year with more questions than answers, meaning if it could alleviate the market’s concerns and steady of the ship the tumble would slow.

Instead, those questions remained unanswered.

Co-founder and then Chief Investment Officer Hamish Douglass departed the company, along with more than half the company’s funds under management.

Magellan is still leaking client flows, and so the Magellan share price will continue to follow a similar trajectory if it can’t turn performance around. Turnarounds seldom turn!

11. Praemium Ltd (ASX: PPS)

With markets falling in 2022, the value of Praemium’s funds under administration also fell. Praemium is a leading software platform that’s used by financial advisers to manage their clients’ investment portfolio.

Praemium also underperformed against competitors Netwealth (ASX: NWL) and HUB24 (ASX: HUB), with Praemium’s customer churn relatively high, indicating their product may not be resonating with advisers.

Subsequently, Praemium’s share price fell 46 per cent, compared to 32 per cent for Netwealth and 12 per cent for HUB24. Clearly, we should have stuck with the market leaders.

12. Australian Ethical Investment Limited (ASX: AEF)

Similar to Praemium, Australian Ethical’s funds under management suffered from falling markets, in addition to a rebound in ‘sin stocks’ like coal and mining which impacted performance of ethical investors.

Australian Ethical’s client inflows somewhat offset these two factors, however, company profits ultimately stagnated and the share price decreased 68 per cent.

3 ethical ASX companies with Australian Ethical’s Mike Murray | Ethical Investing in Australia

The longer-term tailwinds of Australian Ethical’s member growth remain, and after the share price capitulation in 2022, it might be worth revisiting again in 2023.

13. Block Inc (NYSE: SQ)

Growth for Block, formerly known as Square, failed to offset the deterioration in the company’s valuation.

Block doesn’t make sustainable profits and it’s not clear if the business model is viable long-term.

Unestablished businesses are not where you want to be in a market sell-off.

Lesson learnt.

14. REA Group Limited (ASX: REA)

The thesis for owning shares of REA, Australia’s largest property website owner, was for continued growth within its portfolio of property portals.

REA Group largely achieved that, however, the market derated the company as valuations recalibrated. For long-term investors, the REA thesis remains intact.

Note that property listings, rather than house prices, are the main determinant of profit.

15. Kogan.com Ltd (ASX: KGN)

Kogan.com, the Covid pandemic beneficiary, suffered in 2022 as shoppers returned to physical stores.

Kogan was subsequently left with warehouses of unsold inventory, which was difficult to sell, even at reduced prices, which impacted profit margins.

Kogan’s sales went backwards and therefore no progress was made towards its longer-term $3 billion sales target.

In hindsight, there are higher-quality retailers which demand our attention.

16. Crown Resorts Ltd (ASX: CWN)

We predicted Australia’s largest casino operator would be taken private, with Blackstone ultimately succeeding.

It was an opportunistic purchase, given Crown’s earnings were impacted in the prior year by lockdowns and low market sentiment as state governments weighed punishments for past wrongdoing.

Blackstone will also benefit from Crown’s irreplaceable property holdings, which weren’t appreciated by the market.

17. NextDC Ltd (ASX: NXT)

Our investment thesis for more demand for data and connectivity played out. However, NextDC shares derated as interest rates increased.

NextDC is effectively a real estate investment trust (REIT) of data centres, therefore any change in interest rates will have a material impact on the company’s valuation (as we saw this year).

18. Uniti Group Ltd (ASX: UWL)

Originally we thought the market was under-appreciating the five years of 20 per cent locked-in growth for Uniti Group.

We were correct. But the value was realised via a takeover.

This isn’t surprising given Uniti had always been rumoured to be a takeover target since it had a reliable and growing stream of profit from leasing fibre to internet providers like Telstra (ASX: TLS) and Optus.

A sugar hit to the share price was sweet, but now longer-term investors won’t benefit from Uniti’s value compounding over time.

19. Alliance Aviation Services Ltd (ASX: AQZ)

We added Alliance Airlines to our watchlist as we thought it would rerate after purchasing 32 new aircraft and tripling its flight hours.

However, this required considerable upfront expenses and cash outflows, which weighed on the share price in 2022.

The company agreed to a $4.85 takeover offer from Qantas, however, the Australian Competition & Consumer Commission (ACCC) raised concerns and halted the transaction pending its findings.

Interestingly, the ACCC already approved Qantas’s acquisition of 20 per cent of the company earlier this year.

20. Temple & Webster Group Ltd (ASX: TPW)

Similar to Kogan, shares of online furniture business Temple & Webster derated as pandemic-induced purchases fell and sales growth moderated.

Our thesis of more shoppers moving their purchases online remains in place, however, the market is more focused on the 3 per cent fall in sales over the first five months of this year than anything else.

Positively, Temple & Webster expects to return to growth in the second half and appears more focused on profitability than some other retailers.

21. Fortescue Metals Group Limited (ASX: FMG)

The Fortescue share price largely traded in line with the iron ore price this year, which finished the year where it started.

Fortescue Future Industries (FFI) − the renewables division pioneering technology such as green hydrogen − performed in line with our expectations by signing further investments and partnerships.

However scant progress was made in terms of actual revenue or profits. FFI is a longer-term story, so Fortescue investors need to be patient in order for this thesis to play out.

22. Deterra Royalties Ltd (ASX: DRR)

Like Fortescue, the royalties business Deterra, saw its share price increase marginally.

Production at Mining Area C (MAC) ramped up considerably, in-line with our thesis, which should underwrite an increase in royalties and subsequently earnings for Deterra over time.

Deterra also flagged acquisitions to the dismay of shareholders, given royalty streams of similar quality are rarely found and rather expensive.

That’s it for our 2022 ASX share review. Stay tuned for our 23 ASX shares to watch in 2023 report — due out in the next few days!