BKI Investment Company Ltd (ASX: BKI) today announced the Group’s results for the half-year ended 31 December 2022.

Today’s half-year Operating Result before tax and excluding special dividends of $35.1 million was an increase of 13%.

2022 was a challenging year for global equity markets, with most developed markets closing in the red.

The constant theme throughout the year was ongoing concerns around persistent inflation and hawkish Central Banks. As we closed out 2022, investors remained focused on trying to determine where interest rates finally settle.

Adding to the uncertainty in 2022 was the war in Ukraine and China’s mixed approach to dealing with COVID-19 so we witnessed extreme divergence in performance across different sectors and asset classes. Energy and Resources stocks performed very well while IT names underperformed significantly.

Despite the headwinds, a further improvement in reported company profits and subsequently dividends paid by companies held within the BKI portfolio was a result of the stronger economic conditions throughout 2022, led by resources and energy companies. These increased dividends boosted BKI’s results for the first half of FY2023, with Ordinary Investment Revenue increasing by 13% to $35.8 million.

BKI dividend of 3.7 cents, plus special dividends of 0.5 cents per share

The BKI Board has declared an interim ordinary dividend of 3.70 cents per share and an interim special dividend of 0.50 cents per share, both fully franked at the tax rate of 30%. The ex-dividend date is Friday 10 February 2023, and the Record Date for determining entitlements to the dividends is Monday 13 February 2023. The dividends will be paid to shareholders on Tuesday 28th February 2023.

Total dividends paid for the half year of 4.20cps is up 5% on last year. Including the payment of today’s dividends, BKI has paid out $922 million or $1.27 per share in dividends and franking credits to Shareholders since listing.

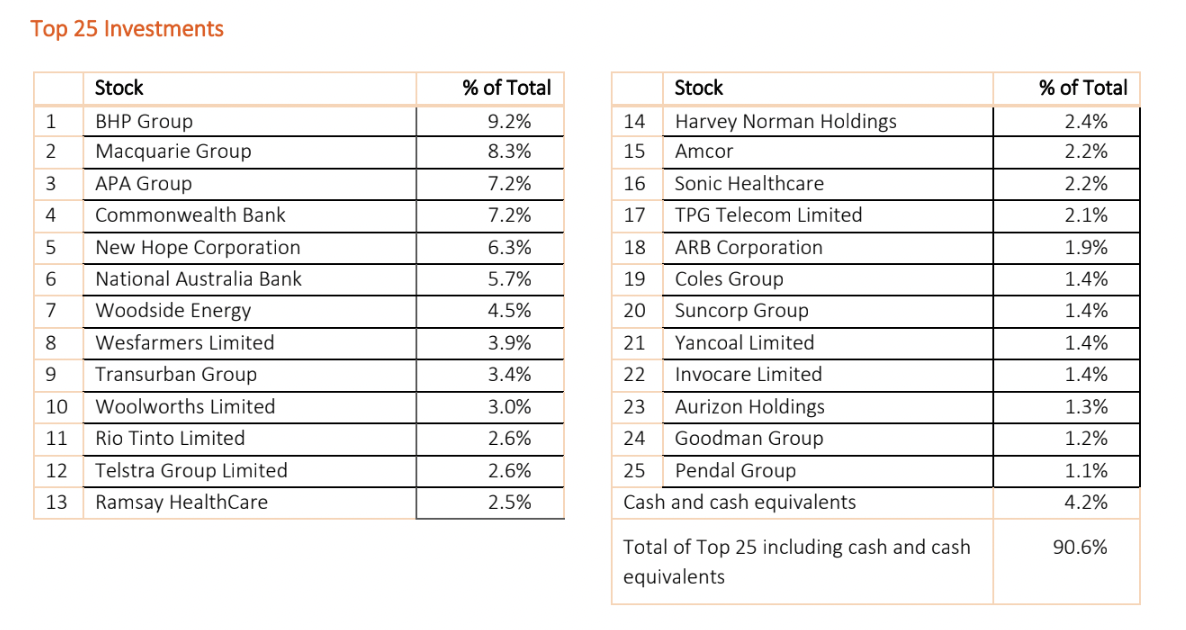

BKI’s Net Portfolio Return (after all operating expenses, provisions and payment of both income and capital gains tax and the reinvestment of dividends) for the year to 31 December 2022 was positive 3.9% compared to the S&P/ASX 300 (INDEXASX: XKO) Accumulation Index, which returned negative 1.8% for the same period, an outperformance of 5.7% for the year.

For the year to 31 December 2022, BKI’s Total Shareholder Return was positive 15.4% compared to the S&P/ASX 300 Accumulation Index, franked at 80% which returned 0.2% for the same period. BKI’s significant outperformance of 15.4% shows investor confidence in BKI as a sensible, low-cost investment option, focused on a quality portfolio of securities.

This article was contributed by Tom Millner of Contact Asset Management, and edited by the Rask Media team. You can view a recent interview with Tom, covering his investing in 2022, below.

Tom Millner on coal stocks, founder-led businesses & true long-term investing