You bought your first share or ETF in 2022, and now it’s down 30% 📉

You’re wondering if you made a mistake. Did you buy the wrong thing, buy it at the wrong time or just stuff up with investing in the first place…

Do you sell? Buy more? Decide to hold? Or avoid thinking about it?

Before we discuss whether or not you made the right play, let’s look at the bigger picture.

Let’s zoom out a bit…

The investment research team at Rask can tell you the facts and figures behind the investment case for a particular company or ETF, alongside all the reasons why you should consider investing more right now, but let’s zoom out a bit and look at the bigger picture.

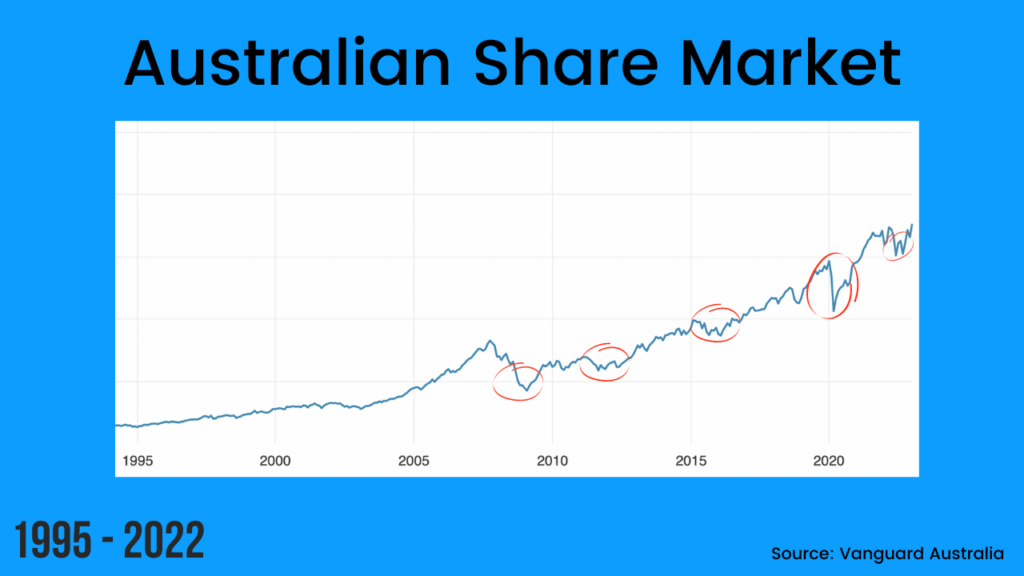

Take a look at this chart, showing the performance of Australian shares over the past few decades.

The red circles show periods of time when the market fell, and people were feeling the same way you are now.

This is a normal part of investing.

Your company or ETF may have declined in value purely because the entire market fell 10% yesterday, so find out what’s happening in the Australian and global economy before you make any big decisions.

Did I make a mistake investing in XYZ?

To begin with, check back in with your investment plan and why you invested in the share or ETF.

If you’re just getting started, you might not have this – so just write down any of the reasons you can remember which led to your investment decision.

Then consider whether anything material has changed about your investment, outside of external market forces you can’t control.

Investments can fall in value for many reasons, and as an investor, part of the challenge is to identify what happens and whether it changes your reasons for owning the investment.

Here are a few examples to consider:

- Has the CEO left? Was it planned or abruptly announced? Who is the new CEO and what is their track record in previous roles? Does the new appointment change the company’s prospects for growth in the future?

- Have massive layoffs and cost-cutting in the industry impacted your tech ETF? Do you still believe that the industry will grow in the future? How can you support your investment case with data or research?

- Did the AFR just publish a big expose on the company because they had been falsifying contracts? How much truth is there to the story? How does the company respond? Can the company recover? Will there be a lawsuit?

At the end of the day, each investor will have to make their own decision to hold, buy more or sell an investment when it falls significantly in value. But I really encourage you to write down your decision and the reasoning behind it, because even if you make the wrong call, you still learn from the experience.

If you’re struggling to deal with the volatility of the market, here’s what I’d suggest.

Get your head out of the cloud

And by cloud I mean your devices.

Time for some tough love.

Staring at your portfolio all day isn’t going to change anything, and sometimes the simplest thing you can do is just switch it off.

The world isn’t going to end if you don’t check your brokerage account for a day, and if it does, then your portfolio won’t be able to help you anyway.

Understand what you can and can’t control

A piece of advice that you can implement across many areas of life is to differentiate between what you can and can’t control, and then focus on the things you can do something about.

You can control the way you plan your portfolio, what you invest in, and how you handle yourself during a period of market volatility, but you can’t control how the market behaves at any given time.

Get comfortable with uncertainty

The fun thing about investing is that you have no idea what will happen tomorrow, but you can get a rough idea of what will happen over a more extended period.

Remember that chart above? ⬆️⬆️⬆️

Even though there have been many challenging months and years for investors, at the end of the day, history has rewarded investors for staying the course.

So it’s good to get comfortable with the idea that you’re never going to know the right day to buy and sell, but if you invest small amounts on a regular basis, you’ll be ahead of the game.

Be sure to share your thoughts and experiences with our Rask Core Community, who are always happy to offer their perspective and encouragement 💸