If you care about investing in ASX shares with high returns on capital (CFROIC), Breville Group Ltd (ASX: BRG), James Hardie Industries plc (ASX: JHX) and Credit Corp Group Limited (ASX: CCP) should be at the top of your watchlist.

Following the article from Owen Rask on the ASX’s top shares by return on invested capital (ROIC), I shared our way of doing things at Seneca. Here’s what I came up with…

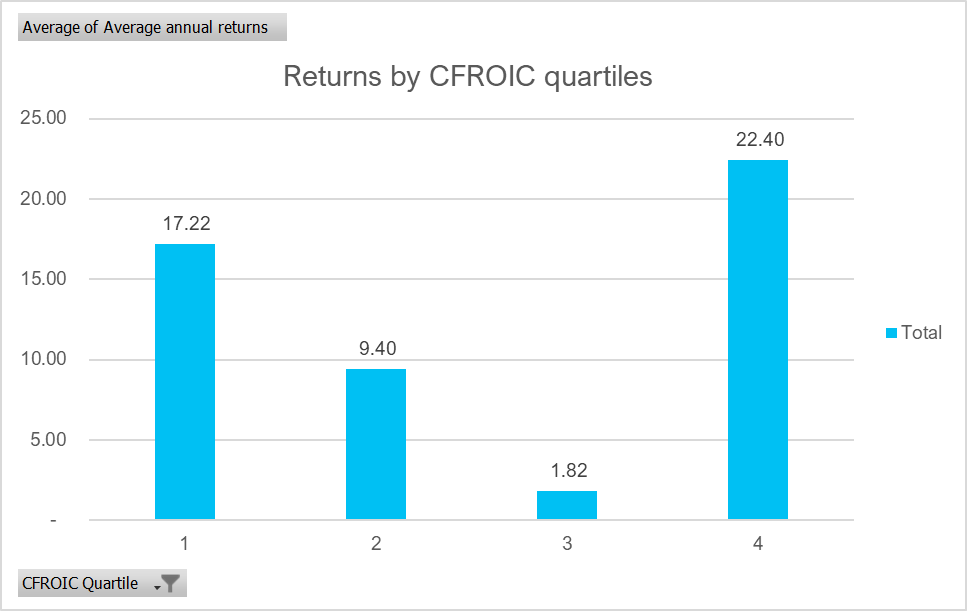

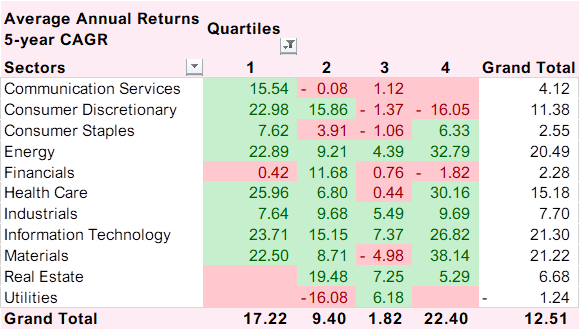

We sorted over $500 million market cap companies from the ASX into quartiles, based on five-year average cash flow return on invested capital (CFROIC) and then compared returns.

The top performers by CFROIC

This is historical data, so even with the implied perfect foresight (i.e., you know what the CFROIC is going to be over the forward 5-year period), picking first quartile CFROIC only results in 17% returns vs an average 12.5% return. You actually do better buying the 4th quartile CFROIC companies.

But then you break it down by sectors it matters even more, you can see that concerning yourself with CFROIC depends on what kind of businesses you are looking at. It’s not equally effective across the whole market…

We think one of the best ways to utilise this metric is to identify potential “cyclical under-earner”. That is, businesses that aren’t generating enough cash flow from their investments but are likely to mean revert (i.e. over-earn) for a period in the future.

Businesses in this category generally have established products, markets and competitive advantages but are subject to the ups and downs of the business cycle. They go through periods of high returns and low returns.

Right now, many businesses are feeling the effects of higher labour costs, higher logistics costs and higher raw material costs, all of which result in profit margins declining. If you believe that their margins normalise over time, a long-term investor can pick up some of these high-quality businesses at discount prices and enjoy not only the uplift in profits but the valuation re-rate as the cycle turns back in their favour.

In our view, Credit Corp (ASX: CCP), Breville (ASX: BRG) and James Hardie (ASX: JHX) would fit into this category.

It’s important to not become wedded to any particular metric as there are lots of high-quality companies that would screen poorly on a CFROIC basis.

Take Macquarie Group (ASX: MQG) for example. Banks are far better compared on a return on equity (ROE) basis, as the ‘invested capital’ calculation (denominator) includes debt – which is abnormally large on a bank’s balance sheet. This is not a bad thing, as debt is a function of a bank’s core business of constantly matching borrowers with lenders.

Macquarie has generated 15% compounded annual returns for investors over the past five years, despite only generating a 4% CFROIC. It has however generated a 15.7% average return on equity.

Then again, there are businesses that screen very well and are horrible investments. Platinum Asset Management (ASX: PTM) has a 45% CFROIC over the past five years, but the PTM share price has declined 16% per year over that period!

Fund managers often screen well on a “return on invested capital” basis because to start a fund management business you just need a few computers and a Wi-Fi connection. You have no real ‘cost of goods sold’ and aside from salaries, most of your management and performance fees drop to the bottom line. You debit those fees every month, so cash flow is never a problem and as long as your returns are good, your clients are generally quite sticky.

The problems arise when you can no longer attract clients, or worse still, start to lose more clients than you attract (normally due to poor historical investment returns). Profits fall and so does your share price.

PTM was earning 34 cents per share (cps) in 2018. PTM is now earning 13cps! It was generating CFROIC’s about 10% higher than it is today and its operating margins have declined from 78% to 58%.

My takeaway

The takeaway here is that no single metric can help you make an investment decision. Buying high CFROIC companies at the wrong price will not insulate you from losing significant amounts of your capital. Similarly, high-quality companies sometimes offer low CFROIC and without a nuanced understanding of the sector, the business, and the cycle, avoiding those names will result in underperformance.

As an investment manager, we (at Seneca) try to match qualitative and quantitative data from primary and proprietary sources. That is, we try and understand what the stock market thinks (i.e., what’s in the share price already) and see if we can find multiple data points outside of the stockmarket that tells us a different story.

That might be as simple as ‘mean reversion’ as discussed above, or something more complex where our understanding of management’s past performance and incentives helps us avoid a company that for now, looks good on paper.