The National Australia Bank Ltd (ASX: NAB) share price tumbled down 6.5% after releasing its result this morning. The other banks ANZ Banking Group (ASX: ANZ), Commonwealth Bank of Australia (ASX: CBA) and Westpac Banking Corp (ASX: WBC) all down over 3% in sympathy.

These bank moves dragged the index 0.8% lower, wiping off 56 points to 7149 in morning trade.

NAB’s result

Key points from the NAB result (all numbers for the 1H half-year period) include:

- Headline cash profit +17% to $4.1b due to the strong performance of business banking division and impacts of higher interest rates (benefiting from lagged pass-through to depositors)

- Net interest margin expanded 0.14% to 1.77% YoY compared to 1H22. However, this represents a slight decrease from the previous quarter’s NIM of 1.79%, supporting the rhetoric that NIMs peaked late ~October 2022.

- Cash ROE (a key measure of bank profitability) of 13.7%

- CET1 ratio (liquid bank holdings against its assets) of 12.2%, increased from 11.3% at February quarterly update. This capital ratio comfortably exceeds regulatory requirements brought in by the banking royal commission.

- Credit impairment charges of $393m seem to have the market spooked. Credit impairment charges represent 0.11% of gross loans, still well below long-run averages.

NAB’s outlook was also interesting. The operating environment is expected to be weaker, leading to higher credit impairment charges.

“Early signs that inflation is moderating are encouraging and we remain optimistic about the outlook – our bank and most customers enter this period from a position of strength, and we are well-placed to continue managing our business for the long term,” CEO Ross McEwan.

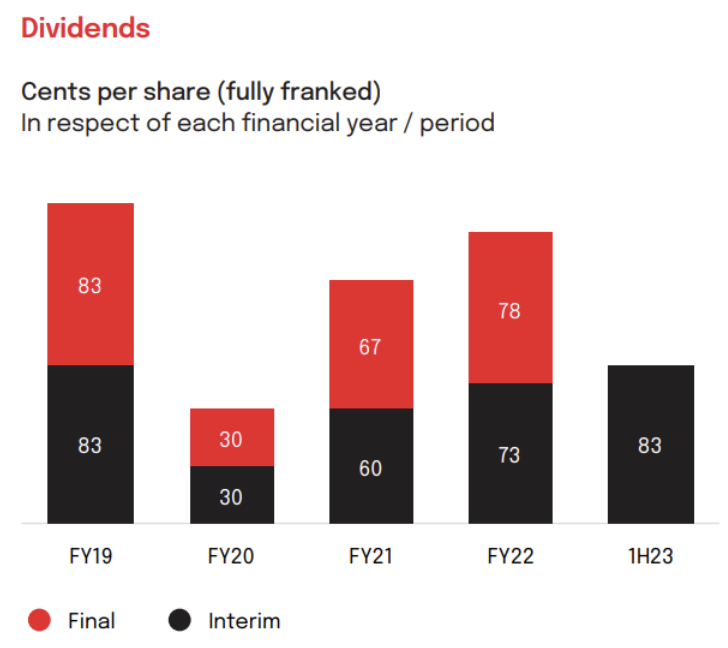

Dividend

An interim dividend of $0.83 (fully franked) was declared, which is a healthy increase from 73c this time last year.

Source: NAB Investor Presentation

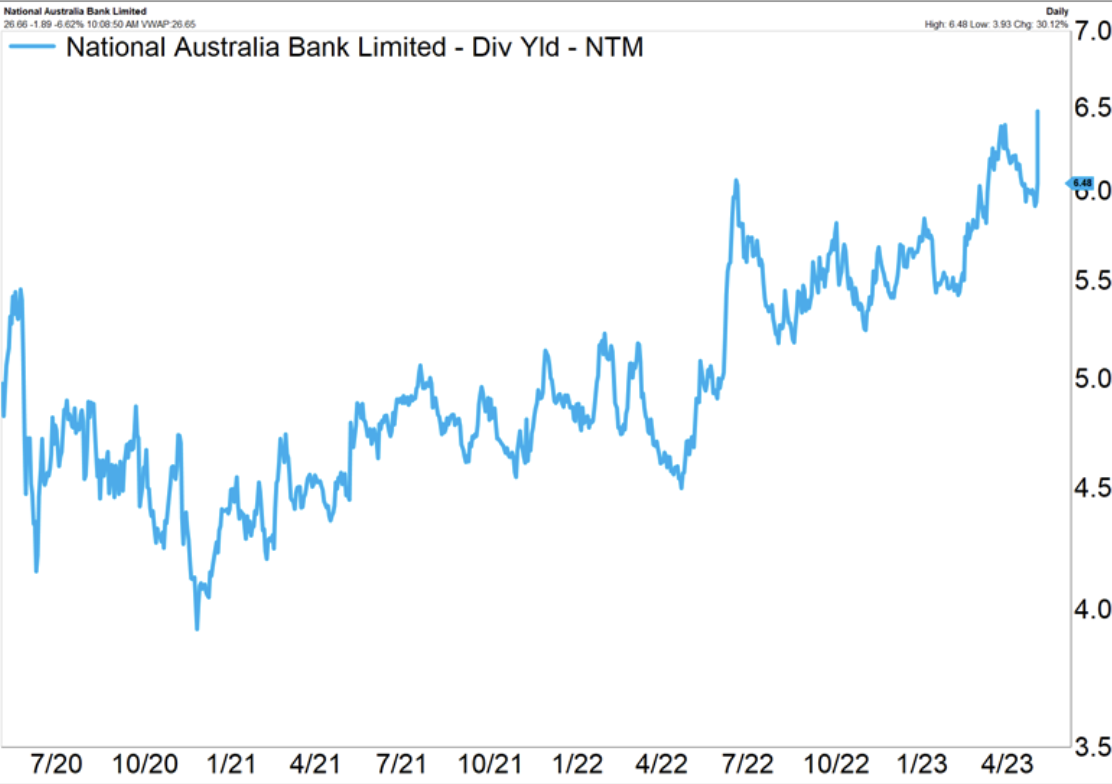

The increased dividend paired with the NAB share price fall has seen the forward looking fully franked dividend yield of 6.5% reach its highest level in three years, as shown below.

Time to buy NAB shares?

Although we at Seneca have been underweight bank shares recently, the negativity in the market seems overdone.

Last night’s US Federal Reserve rate hike (a quarter of a percentage point) may also be contributing to the market’s worries more broadly today. Economic headwinds are known and seem to be well-managed, at least for now.

Looking through the noise, a forward P/E of 11x and fully franked dividend yield of 6.5% should support NAB shares and provide some margin of safety.