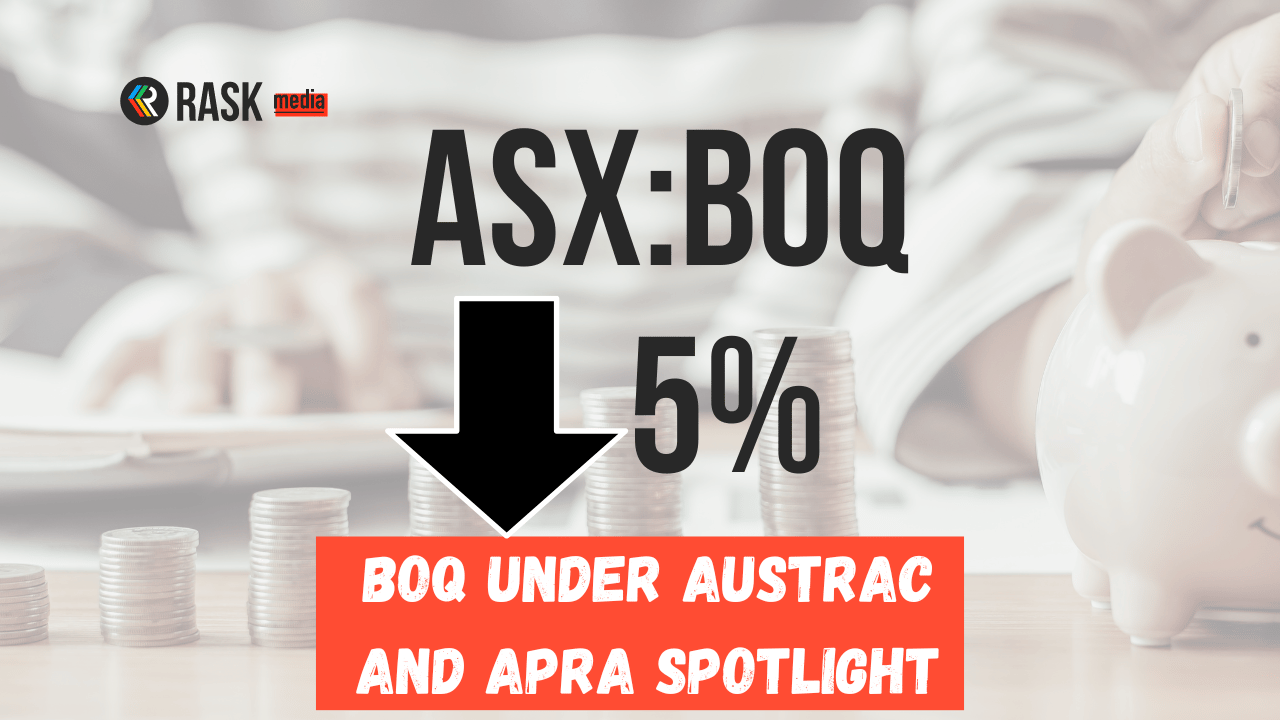

The Bank of Queensland Ltd (ASX: BOQ) share price is suffering on news that it has entered into an enforceable undertaking with AUSTRAC.

BOQ has previously acknowledged that internal and external reviews led to the “identification of deficiencies in its operational resilience, risk culture and governance and anti-money laundering and counter-terrorism financing program”, and its ongoing engagement with APRA and AUSTRAC.

Enforceable undertakings (EU)

BOQ announced that it has entered into an enforceable undertaking with APRA addressing remediation of “weaknesses in BOQ’s risk management practices, controls, systems, governance and risk culture.”

The ASX bank share also said that APRA has determined to apply a ‘capital adjustment’ to BOQ’s minimum capital requirements, adding $50 million to BOQ’s ‘operational risk capital requirement’.

The bank also said that it has entered into a voluntary enforceable undertaking with AUSTRAC addressing remediation of issues regarding BOQ’s anti-money laundering and counter-terrorism financing program

Within 120 days, BOQ must prepare and submit for approval to APRA and AUSTRAC. It will need to include an appropriate timeline for implementing remediation activities, and be specific measurable and achievable.

BOQ said that it remains committed to the remediation noted above and the commitments entered into with APRA and AUSTRAC, but I certainly don’t think it’s a positive for the BOQ share price.

Leadership commentary

BOQ Chairman Warwick Negus said:

We have acknowledged the concerns raised by APRA and AUSTRAC. BOQ remains committed to its multi-year Integrated Risk Program to build a stronger and simpler bank with an uplift in risk culture, frameworks, processes and controls. This program will be independently reviewed as previously announced and we will continue to work proactively and transparently with APRA and AUSTRAC. Our digital transformation is complementary to this strategic priority as we decommission multiple complex legacy systems and reduce our reliance on manual processes.

Final thoughts on the BOQ share price

I’m not surprised that BOQ shares have dropped more than 4% in response to this. It’s not good to be under the spotlight of AUSTRAC and APRA. BOQ will be a better bank after it has improved its operations and so on. It trades on a low earnings valuation with a high dividend yield, but I’m not sure it is going to be able to achieve good long-term earnings growth because of competition and likely rising arrears.