Spun out of BHP Group Ltd

(ASX: BHP) in 2002, BHP shareholders received Bluescope Steel (ASX: BSL) shares in a 1-for-5 bonus issue.

Despite an $8.8 billion market cap, Bluescope (BSL) flies under the radar of many Australian investors focused on the major miners and banks.

How does Bluescope Steel make money?

BlueScope Steel manufactures a variety of steel products including both flat products (sheets, plates, structural beams) and long products (rail, wire).

BlueScope operates 3 divisions:

- North Star: steel mill in North America. Around 2 million tonnes of hot rolled coil are produced annually from North Star’s dual electric arc furnaces, using scrap metal, pig iron and alloys. In October 2015, BlueScope acquired the remaining 50 per cent of North Star BlueScope Steel from Cargill Inc. to move to full ownership of this business.

- BlueScope Recycling: BSL is involved in metal recycling where it converts scrap steel into ‘good as new’ steel.

- Building Products: steel roofing products, fencing, flooring, formwork, wall supports, and many more.

Steel is a critical material in the construction sector, used in buildings, infrastructure, machinery and transport. It is also central to the electrification thematic – EV’s require a lot of steel. On average, one vehicle uses 0.9 tonnes (900kg) of steel. Due to its widespread use, steel demand is closely linked to global growth and particularly the Chinese and Indian economic growth engines.

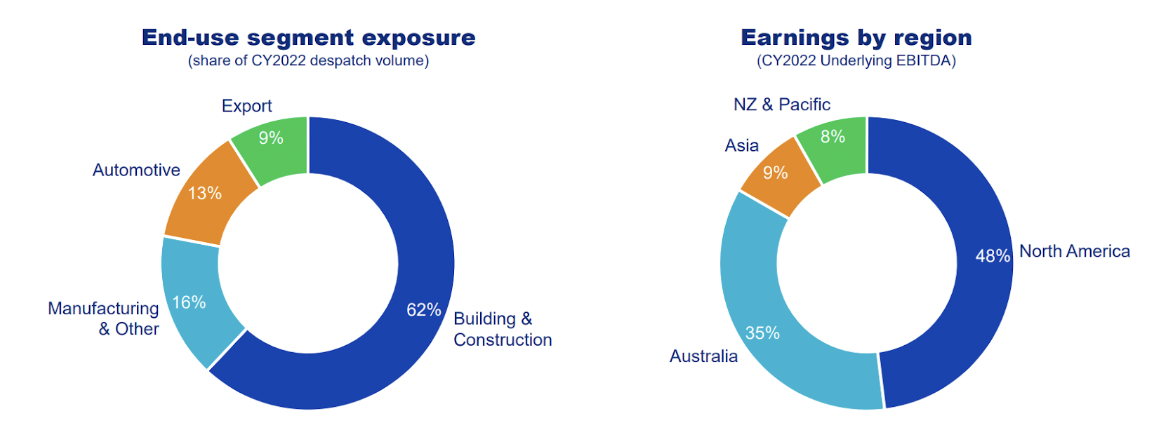

BSL has operations in multiple locations in the US, Australia and Asia.

Decarbonisation and steel demand

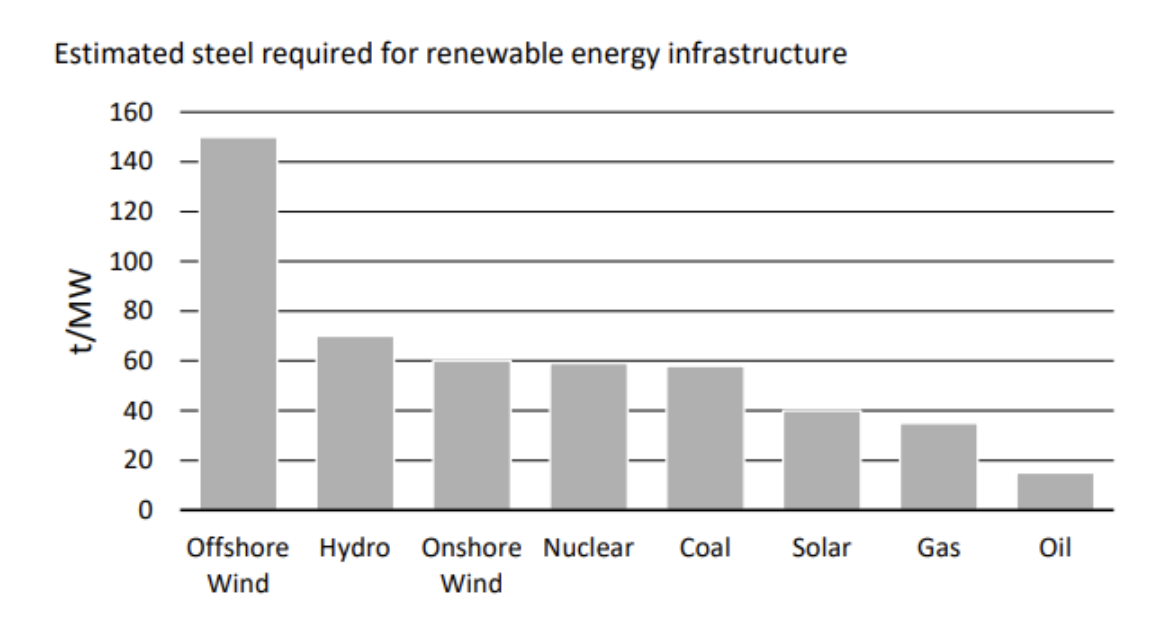

Steel is a key commodity when assessing the beneficiaries of the energy transition, despite the media headlines dominating other commodities such as lithium and copper. Renewable energy sources such as offshore wind and the associated infrastructure are over 3x more steel-intensive than traditional sources such as oil and gas.

Meanwhile, government support for energy transition-facing commodities is building. The Inflation Reduction Act (IRA) in the US is set to accelerate capital flow into the sector, with legislation outlining US$370 billion over the next decade, paired with private investment of almost double that amount. 80% of the IRA requires the use of steel.

The New Zealand government recently announced NZ$140M of funding to go towards 50% of the cost of installing a ‘green’ electric arc furnace into NZ Steel’s Glenbrook mill, the parent company of which is BSL.

BSL is working towards its internal ESG targets, including by committing $1 billion to upgrading its Port Kembla blast furnace in New South Wales to meet carbon abatement targets.

BSL investment case

Outside of just valuation, which we touch on below, we like BSL for its combination of:

1. Strong brand position in its core markets

North Star is the primary North American steel production hub for BSL, which ranks fifth by volume in the production of hot rolled coil in North America, and is consistently voted the number one flat rolled steel supplier in North America in the annual Jacobson Survey of steel customers measuring customer satisfaction.

Bluescope recycling and materials enables North Star to improve the quality and quantity of obsolete scrap steel. Inputs can be purchased at low prices increasing the self-sufficiency of the business.

Bluescope’s new and recycled steel can be coated and painted by its third business division, with a high margin value add offering.

2. Underappreciated strategic assets.

We think the market remains cautious on BSL, tossing it into a basket of ‘low quality cyclicals’. One broker gives BSL a ‘no-moat’ rating due to steel products being “highly commoditised, undifferentiated products with low barriers to entry and high operating costs of running a blast furnace”.

On a contrarian view, we think that while there are some commoditised elements of the business, there are also differentiated, higher margin characteristics. Approximately 40-50% of BSL’s steel production consists of high-margin (>20%) painted and coated steel, contributing to higher group margins compared to their US counterparts. If BSL can increase Coil Coatings capacity utilization to over 80%, global painted steel production would comprise approximately 50% of BSL’s overall steel volumes.

However, BSL’s stock is undervalued at around 3x trailing EBITDA compared to the painted/coated steel peer group, which typically trades at 4-5x EBITDA. Recent transactions involving painted steel, such as Precoat, have been valued at around 8 times EBITDA, aligning with US building industry comparables.

Factors affecting earnings

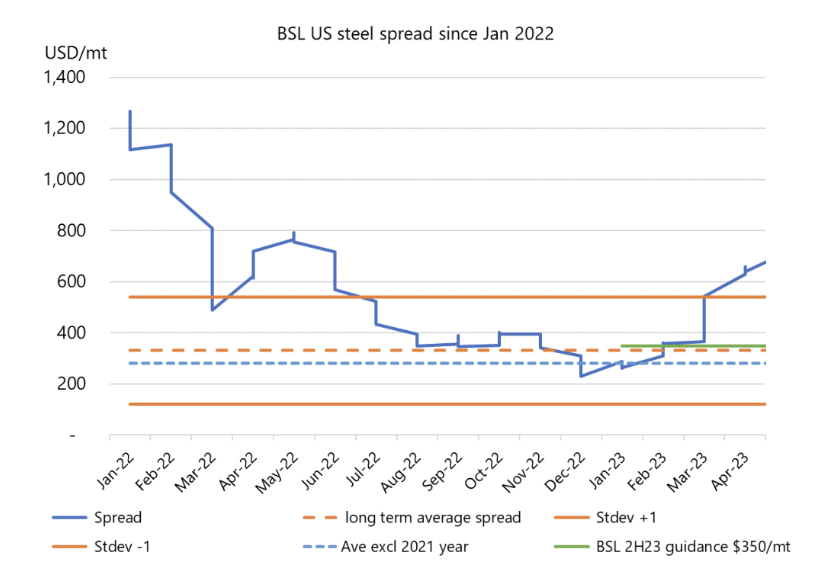

Earnings are dependent on ‘steel spreads’ which refers to the difference between the input cost of scrap steel or pig iron (the product of smelting iron ore, the raw material) and the price received for steel end products produced by BSL. In other words, this is the driving factor behind BSL’s profit margins.

We identified earlier in the year that steel spreads were tracking well above the assumption baked into earnings guidance provided to the market. Sure enough, earnings upgraded April 2023 by ~50% to A$700-770m EBIT for 2H FY23 (up from A$480-550m), above the consensus of A$626m.

In terms of the broader business cycle, earnings have held up well amidst rising interest rates and damper housing sentiment due to resilient steel demand in the US and Australia. Once the interest rate hike cycle rolls over, housing new builds and developments should pick back up.

China’s reopening may also be a catalyst for the steel market. MST economist Hasan Tevfik recently noted that manufacturing in the US, and globally, typically strengthens when stimulus is injected into the Chinese economy which should benefit BlueScope Steel.

Bluescope also has multiple growth initiatives that should support earnings into the medium term despite the underlying cyclicality of the business. As steelmaking spreads revert towards long term averages, increased investment in North Star’s manufacturing capacity, the bolt on acquisition of MetalX ferrous business and the US$500m acquisition of Coil Coaters should support earnings growth going forwards.

Meanwhile, BSL shares are pricing in a long-run US steel spread average of approximately US$260/t vs. the 10-yr historical average of US$250-300/t respectively.

BSL share price valuation

BSL currently trades on just ~6.4x consensus FY23 EV/EBIT, vs a long term average of 8x. We think on 9x consensus FY23 P/E, or 12.5% on a free cash flow yield basis, BSL shares are undervalued.

A dividend yield of 2.7% may look skinny compared with the gaudy free cash flow yield, but can be explained by the organic investment in expanding the business and the company electing to pursue alternate capital management via its $985m share buyback. We think this signals management’s shared view that BSL shares remain undervalued.

On an asset basis, Goldman Sachs has BSL’s net asset value estimated at $22.90 per share, for a price/NAV ratio of 0.85x. We think this business should trade in line or at a small premium to NAV, implying upside from current levels. These are highly productive assets that have consistently generated well over A$1 billion in operating cash flow for the last 6 years (excluding covid-affected FY20 which was $818 million).

The replacement cost of such assets in today’s environment with cost inflation across the board is substantial.