Is my Tesla, Hilux or any car tax deductible?

On The Australian Business Podcast this week (don’t forget, we go live twice a week), I — Owen Rask — spoke with experienced small business accountants (and my co-hosts) Danil Goloubev and Jordan Kidis about whether, or not, cars are tax deductible.

Podcast show notes for Is My Tesla Tax Deductible?

Danil just had a baby (congrats!), Jordan just bought a Tesla, and Owen… also placed an order for a Tesla (even though he LOVES his banged-up old Subaru).

Almost every person or business owns a vehicle for business and private use. But too many people think a car is 100% tax deductible – which is often not the right answer!

In this episode, Owen, Danil and Jordan explain:

- How to work out if your car is tax deductible

- Why does it make sense to buy a base model Tesla (Model 3) with recent ATO rules?

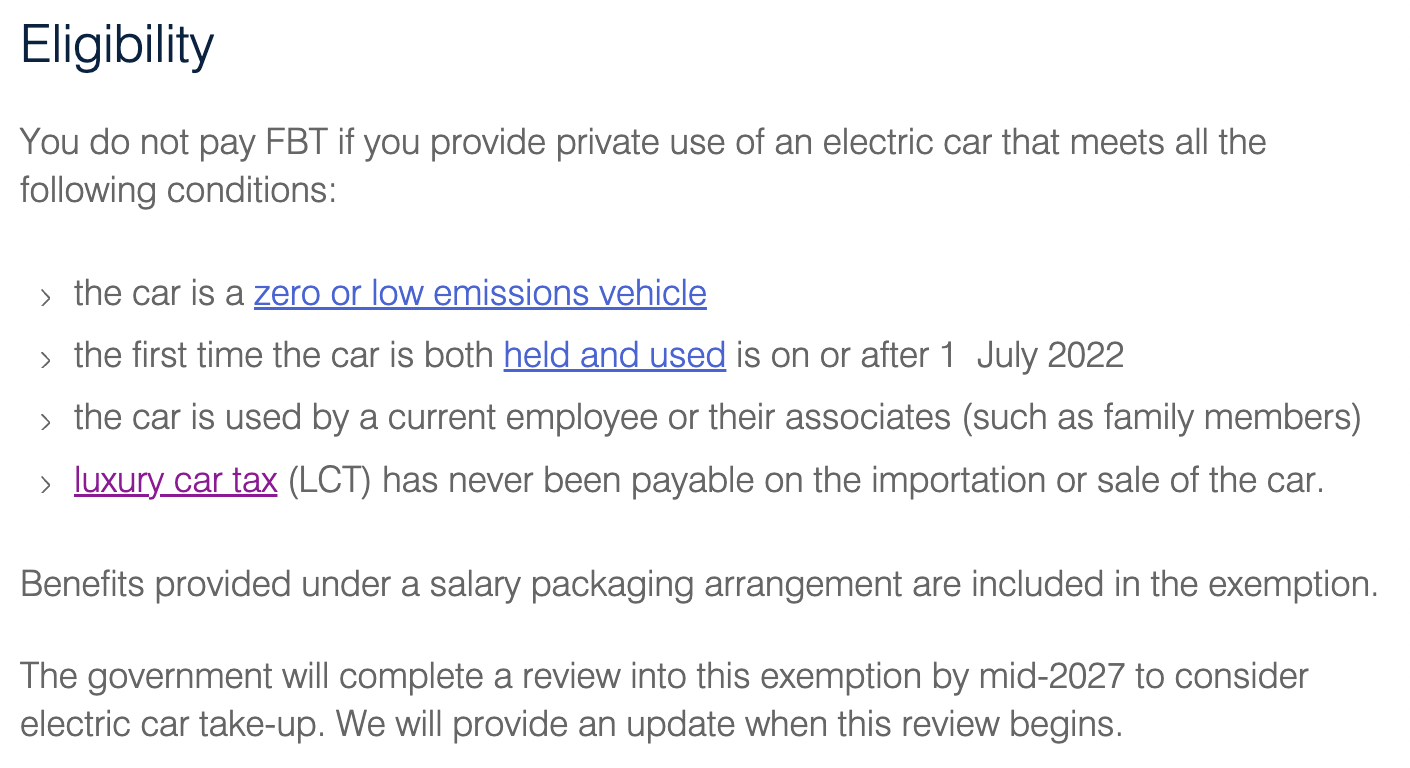

- What does Fringe Benefits Tax (FBT) mean and how to calculate it (most people get really confused, even finance people — but this could save business owners $10k, $20k or more if done right!)

- How to calculate depreciation on your car using the logbook

- How to do a logbook and remind yourself

- How much can tradies claim on their car?

- Can office workers claim the cost of a car?

Grey Space Advisory – snag a $100 health check

Grey Space Advisory – snag a $100 health check Rask – Get Owen’s best investing research

Rask – Get Owen’s best investing research