The CSR Limited (ASX: CSR) share price has snapped back from a recent decline.

CSR manufactures and distributes building products in Australia and New Zealand. The company has a long operating history since its establishment in 1855.

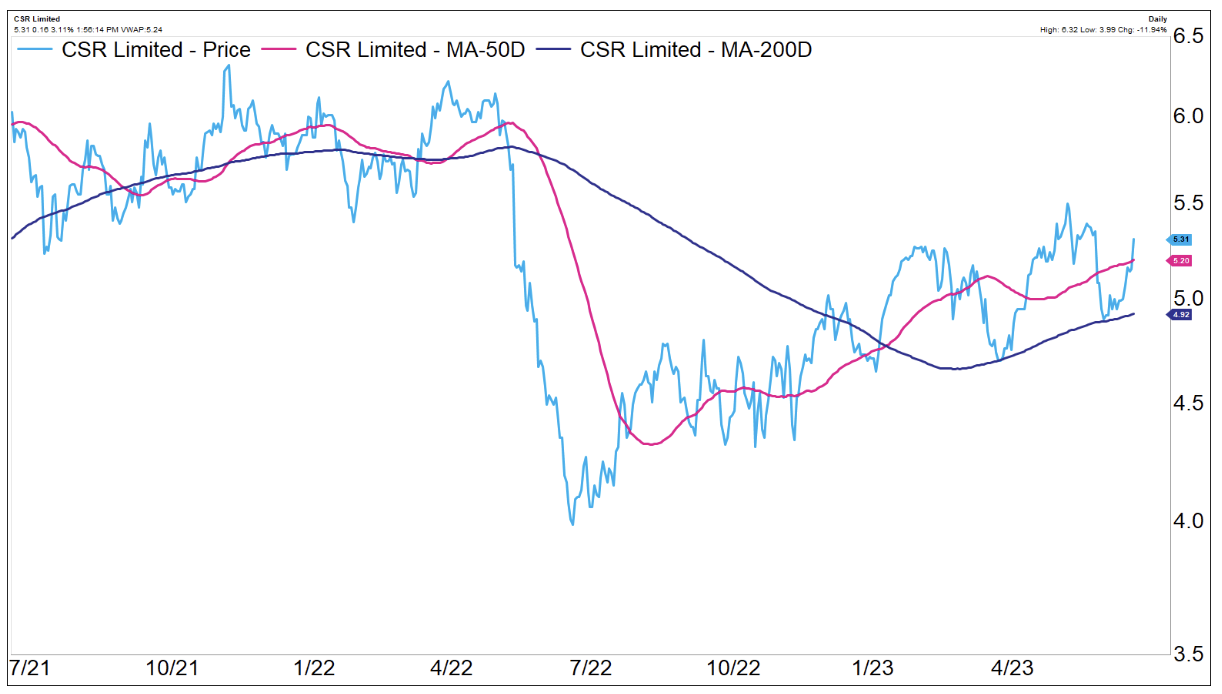

CSR share price

The Building Products segment includes insulation, walling systems, bricks, roofing, among others and made up 78% of earnings in the recent half-yearly result.

The Aluminium segment is a 25% stake in a Newcastle smelter that manufactures ingots, billets and slabs which only contributed to 2% of earnings due to cyclically low aluminium prices.

It also has a small number of property developments in New South Wales, Queensland and Victoria which contributed to 20% of earnings.

From an earnings perspective, the most important building products are plasterboard (Gyprock), bricks, and aerated concrete (Hebel). These three products combine for approximately 75% of EBIT.

CSR presents an opportunity due to the strength of its core products in a resilient Australian property market, a discounted valuation relative to peers and a strong balance sheet enabling capital returns.

CSR: cyclical but priced in?

Rapid interest rate rises globally including in CSR’s core Australia and New Zealand markets have undoubtedly negatively impacted property markets, with valuations weakening and the market for residential property sales cooling down.

CSR’s vertically integrated building products business has historically demonstrated sufficient pricing power to withstand inflationary cost pressures, leading to earnings visibility and continued strong cash flow.

US peer James Hardie Industries (ASX: JHX) reported its full-year results ending 31 March 2023 showing net profit after tax up +12% to US$512m, maintaining robust margins across its key fibre cement and building products lines.

The US has more fixed-rate mortgages than Australia, so should feel less pain from interest rate rises, but it does demonstrate the resiliency of residential construction as an essential service offering.

Fletcher Building Holdings (ASX: FBU) reported slightly weaker outlook numbers in June 2023, with solid EBIT guidance of $727m, despite flagging lower turnover of New Zealand housing development sales with 650 increasing to 750-800 homes in FY24.

Other data from peers — REA Group Ltd (ASX: REA) and Maas Group (ASX: MGH) — reflects lower housing sales, but underlying construction and development markets holding up better than feared.

The shortage of housing and well publicised ‘rental crisis’ in key Australian capital cities is keeping demand for residential developments high.

While CSR earnings will likely be impacted by these interest rate rises, there appears to be sufficient resilience and a margin of safety, with a forward dividend yield of 5.82%, fully franked from two dividends per year paid in July and December.

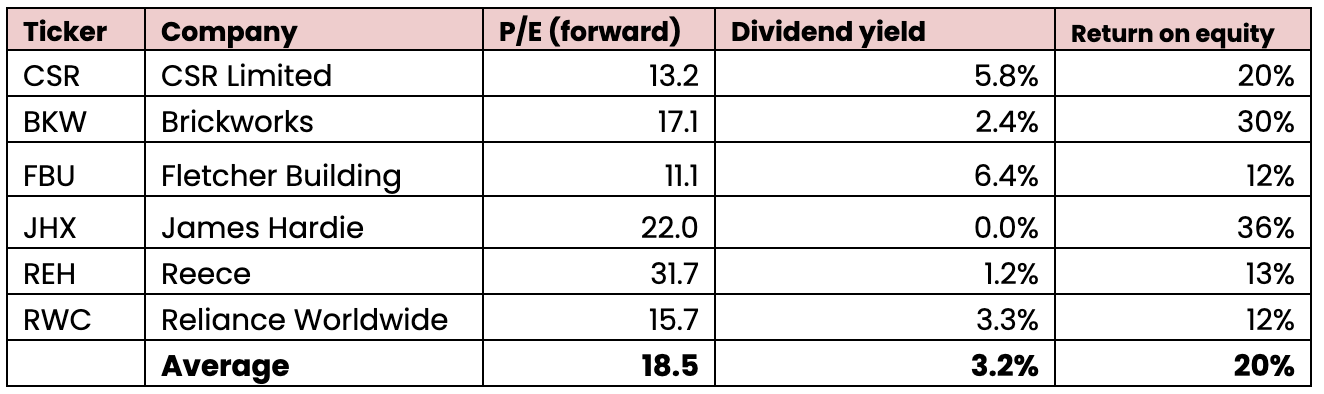

CSR share price valuation

CSR trades on a forward price-earnings ratio (P/E) of 13.2x, below the building materials peer group average of 18.5x, and below the broader market multiple of 16x. Despite delivering a 20% return on equity, in line with peers, CSR boasts a lower P/E, and a substantially higher dividend yield of 5.8%.

Further, CSR has a property book that was independently valued at $1.5b as at September 2022. This comprises $1.1 billion for 450ha of Western Sydney property as well as an additional $400m for freehold properties.

For reference, the market cap of CSR is just $2.47 billion, or $2.31 billion an enterprise value basis. Investors are paying little for the earnings stream from the operating business, which historically generates a return on equity of ~15%.

The company has a rock-solid balance sheet with $167m net cash, so is well-positioned to handle the market cycle.

We think CSR shares have scope to re-rate a couple of P/E points higher, which combined with the ~5.8% (fully franked) dividend yield represents an attractive rate of return.

Are CSR shares a buy today?

CSR shares have partially recovered some of the decline that occurred following the release of its full year result in May 2022 (CSR reports a March year-end).

A buyback was put in place on 30 June 2022 and shares have rallied higher financial year to date. We think that CSR has good price momentum support, which, paired with a valuation margin of safety creates a good risk/reward proposition at current levels.