Is Vulcan Energy Resources Ltd (ASX: VUL) still a buy? Luke Laretive from Seneca Financial Solutions dives deep.

Tip: if you’re looking for a podcast on Vulcan Energy (VUL), have a look at the podcast below. Over to Luke…

Traditional lithium brine projects are usually associated with images of South American salt flats in Argentina, Chile, and Bolivia – the ‘lithium triangle’ – where lithium is obtained from evaporation ponds.

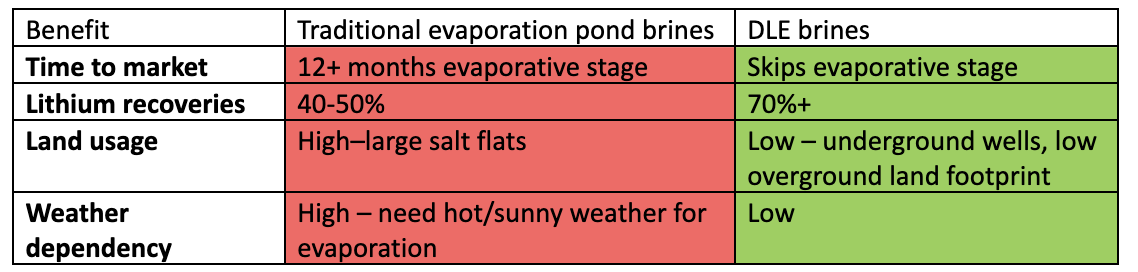

The up-and-coming technological development in the sector is Direct Lithium Extraction (DLE). DLE refers to a chemical process of directly extracting lithium chemicals via adsorption, ion exchange, or solvent extraction.

As a disruptive technology, DLE is not well understood by investors, creating an opportunity to profit from market inefficiency.

ASX lithium brine shares have had mixed success, with Lake Resources Ltd (ASX: LKE) struggling to prove its DLE technology works in a cost-effective manner. Despite its reputation as an unproven technology at scale, it is not an entirely novel technology, with over 50,000 tonnes of lithium carbonate equivalent produced annually from four producing projects. One of the notable DLE projects in a pilot stage is Berkshire Hathaway’s (NYSE: BRK.A) Salton Sea project in the USA.

Benefits of DLE

Brokers are starting to catch-on to the impacts of DLE with a Goldman Sachs note in April 2023 describing the effect DLE is likely to have on lithium brine projects as akin to what “shale did for oil” and a “potential game-changing technology”.

Hot on the heels of Goldman, a UBS initiation note on 29 June titled ‘Demystifying Direct Lithium Extraction’ had a more sceptical view but outlined several key benefits of DLE technology.

We think DLE has the potential to provide an ESG-friendly, low-cost source of lithium to the burgeoning EV battery market.

Oil & gas majors want in on the action

Oil and gas majors are stepping up efforts to diversify their ‘old world’ fossil fuel energy assets into ‘new world’ energy assets with environmental pressure from governments and shareholders alike.

Lithium brine projects represent an opportunity for these companies to gain exposure to future-facing commodities while utilising their existing expertise due to the similar process (pumping, processing, reinjecting fluids) compared to drilling an oil/gas well.

In June, this culminated in oil giant ExxonMobil (NYSE: XOM) paying over US$100 million in cash to acquire oilfield brines containing lithium in Arkansas. Schlumberger (NYSE: SLB) and Equinor reportedly also had interest in the assets. Equinor (NYSE: EQNR) had previously taken a stake in developer Lithium de France in 2021. Elsewhere, US shale giant Occidental Petroleum (NYSE: OXY) jointly owns TerraLithium.

Which ASX lithium shares to buy?

Our preferred exposure to DLE lithium shares is

Vulcan Energy Resources (ASX: VUL).

As a reminder, Vulcan plans to extract low-cost, zero-carbon lithium from a brine field in Germany. Vulcan is well-capitalised, has expert management and is strategically located with the largest lithium resource in Europe. We highlighted why VUL shares have recently traded weaker, in the article below.

Vulcan Energy Resources Ltd (ASX:VUL) share price is getting smacked

The company is taking the necessary steps to address these points and continues to de-risk the opportunity. Vulcan followed up its lithium plant joint venture agreement with chemicals specialist Nobian with a binding agreement with oil & gas major Schlumberger for the renewable energy part of its project in the Upper Rhine Valley of Germany.

Newly announced VUL CEO Cris Moreno said of the lithium sector “whether it’s BP, Shell, Eni, Exxon or Equinor – they are all looking at it”.

The endorsement of these large companies is another qualitative tick for the company which has already achieved offtake agreements with tier 1 customers.

Are VUL shares a buy today?

After accounting for project finance developments, analysts at Canaccord Genuity have updated their price target to $12.50, implying a significant upside from current levels.

We think as the company continues to execute on its operational milestones, the value proposition will de-risk and a ~$4.60 share price will look like a good entry point in the fullness of time.