Richard Dinham is the Head of Client Solutions and retirement at Fidelity Australia. He is a trained actuary, with a wealth of experience across multiple asset classes, countries and advice formats.

In this Australian Investors Podcast episode, Richard speaks with Owen Rask about all things retirement. Before, during and after. Plus we take a look at the big picture.

PDF Download: Retirement report: New life, old life | Investment Insights | Fidelity Australia

Podcast talking points with Fidelity’s Richard Dinham

Quick answer questions/ice-breakers

- What’s the biggest problem facing pre-retirees (e.g. 50+ year holds) over the next 10 years?

- What’s the biggest problem facing new retirees (e.g. 65-year-olds) over the next 10 years?

- If you could only give one piece of advice, say, in under 30 seconds, to a retiree right now, what would it be?

Longer form questions

- To kick things off, can you talk broadly about the demographic challenges facing Australia and how we’ve chosen to deal with them so far?

- We already have some ~4 million retirees. But we’re about to have 120,000 baby boomers per year adding to that. What are the likely consequences for the government, then and now, to be dealt with?

- How could we, as financial professionals, and with government support, get more help to Aussies entering retirement?

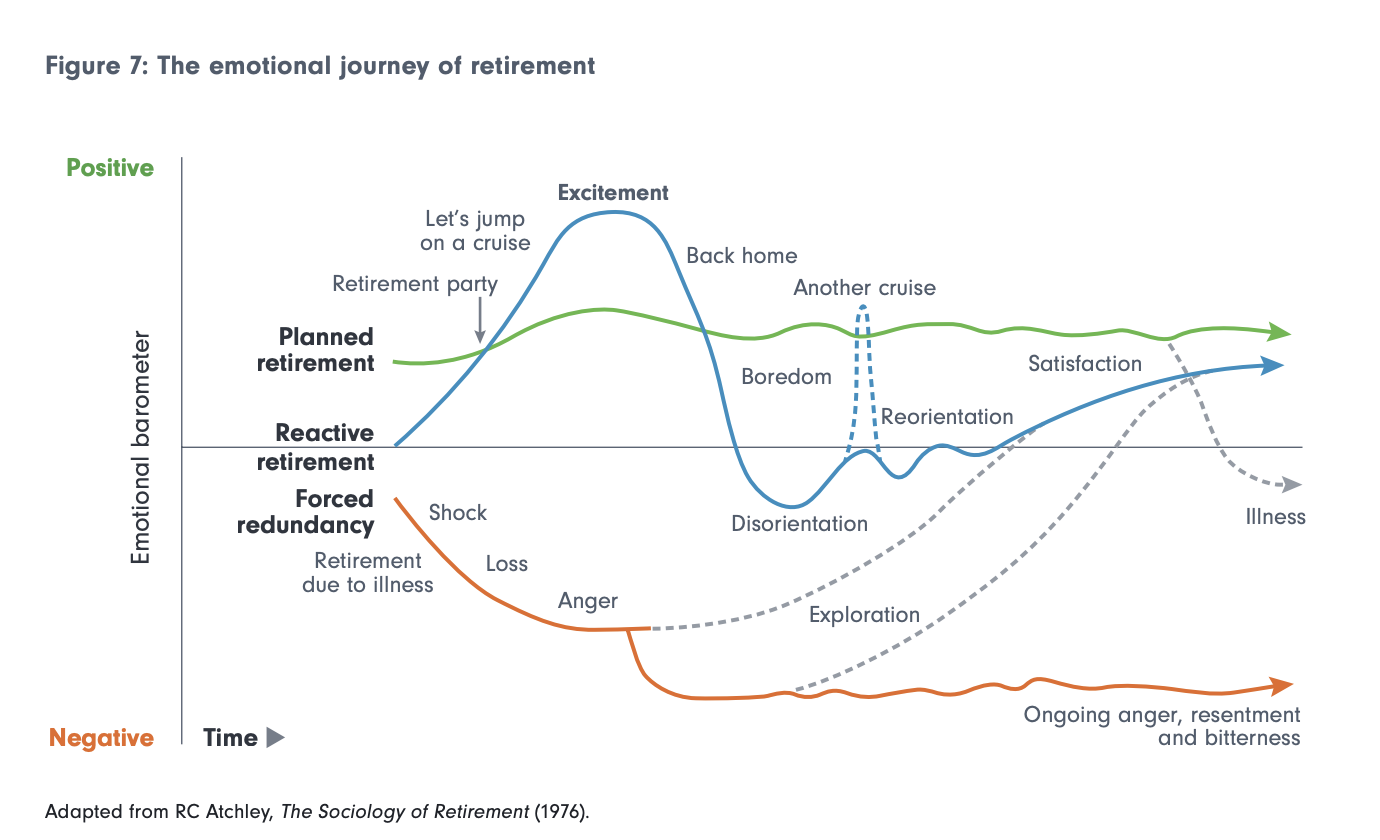

- What are some of the common emotional traps people find themselves in and what would your advice be to combat them?

online pharmacy seroquel online with best prices today in the USA

- I would love it if you can talk about this question broadly, and then talk about the heuristics (and science) behind the assumptions we make as an industry (25 times your final salary, 4% rule, 3% inflation, etc.)?

- I want to ask ‘when people should start planning’ but at the risk of it being ‘right now’, which is the best answer, can you imagine you are talking to me (a 32-year-old), a 45-year-old couple and a 50-year-old? Imagine we’ve all done the basics and saved and invested via compulsory Super, mortgage, and have recently started listening to the podcast. A typical/general course of life. What would be some of your advice to these types of Aussies?

- Can you talk about the importance of a ‘Plan B’ when it comes to retirement planning? Does this also mean building wealth in multiple ways?

online pharmacy order proscar without prescription with best prices today in the USA

- I see a lot of couples or singles who hit retirement, often with a lot of tears or emotions driven by the fear of not having enough. But some of them do have enough! So they avoid spending, avoid the experiences, and avoid doing things they really want to. What message or strategies would you have for people like that?

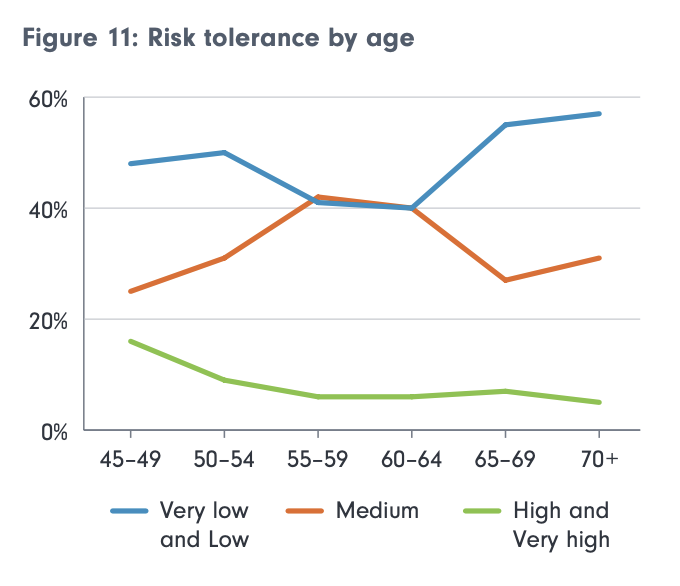

- Can you talk generally about the importance of a risk profile and have the right settings coming into retirement or upon retirement?

- Finally, I’d like to put a bow on this episode and ask you about the 5 biggest mistakes retirees make with their portfolio?