Is Xero still the best for accounting? Is Xero better than Quickbooks and MYOB? I think I speak on behalf of my co-hosts Jordan and Danil when I say: Absolutely!

In today’s episode of The Australia Business Podcast, Jordan, Danil and I extend on the Xero guides and tutorials I put in my free business course (including how to pay Super and employees), and share our review of deep integrations.

If you want to automate more than just payroll, automatically reconcile invoices and receipts, and know how Xero’s Super payment function works so well, this is the episode for you.

Remember, if you are stuck with the basics of paying Super, HR, paying Workcover, and how to do basic (but important) accounting things, please check out my free business course — we’ve already enrolled 2,500 businesses!

Below, I’ve included my guide for paying super through Xero.

Jordan, Danil & Owen’s top 5 reasons to use Xero

- Payroll hub and Super clearing house – once you save your employee’s info, do a pay run, download the ‘aba’ file from Xero, and pay your employees with your bank. Simple!

- Software integrations – there are SO many Xero integrations, it really is the Xero backbone. I like the Xero integrations for receiving online payments.

- Quoting, Invoicing and reminders. You can do all this — and connect them (see below).

- Track your bills/payables with DEXT or Hubdoc Xero integration. This allows you to automatically batch your payments and reconcile them. So easy!

- Online and easy/ same file as your advisor. While this might sound odd, Xero revolutionised the accounting world — it enabled you and your accountant (e.g. Danil and Jordan) to make careful and important financial decisions, in real-time.

If you’re a small business owner who, like us, is constantly stuck in day-to-day and then gets bogged down by financials and things like invoicing, you will LOVE this episode.

What about Hnry? Isn’t that a threat to Xero?

If you watched/listened to our episode with Hnry, you should know it’s a little different. I like both apps, but Xero is much more suited to small and medium businesses while Hnry is limited to sole traders or micro businesses. Watch the hnry episode here.

How to pay Super with Xero 👴

You have the choice to pay

Super monthly or quarterly or even weekly if you want to. It doesn’t really matter what you choose or when you do it (e.g. you might pay Super when you pay monthly wages), provided you meet the ATOs quarterly deadlines.

So, provided you are managing your cash flows properly, my advice is to pay Super quarterly. It’s just one less thing on your mind every week, fortnight or month. But set a recurring calendar reminder once every three months so you don’t forget!

How to pay Super

- You can pay Super via your Xero account. It’s by far the easiest option.

- Determine IF you have to pay Super. See ATO website.

- Decide how much Super you want to pay (there are legal minimums) – Rask has always paid slightly more than what’s required. As of 2022, 10% is the minimum.

- When you create a new employee in Xero, enter their Super information (using their Super Choice form in the Welcome Pack). Note: if an employee has a Super fund you haven’t paid to before, you will need to create a new Super account in Xero >> settings >> payroll settings >> Superannuation. Do this before you create a new employee.

- Do your monthly pay runs as usual (Payroll >> Pay Employees)

- Pay your employees using your bank information. Note: if you have more than a few employees you can “download ABA file” from Xero once you have created a Pay Run. Upload that file to your bank’s (e.g. NAB) “multiple funds transfer” page. This way you don’t need to enter all the details one by one.

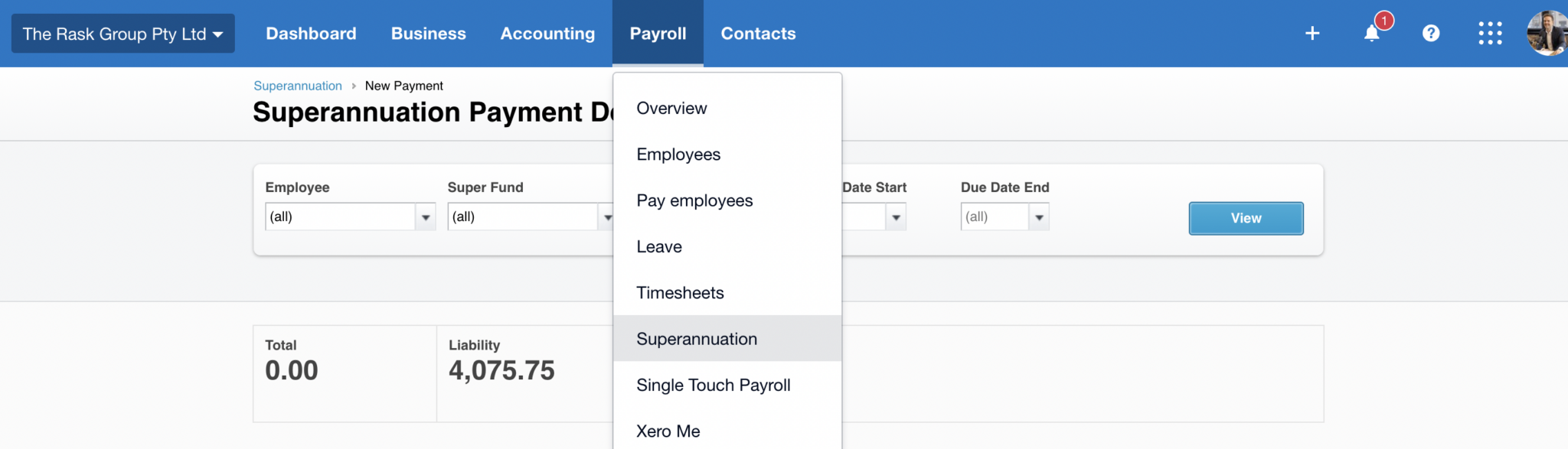

- Once wages are paid (or every quarter) go back into Xero >> Payroll >> Superannuation. Select all of the payments you want to process and follow the prompts to pay them.

- ⚠️ Make sure you have enough money in your linked bank account, and it can take a few days for Xero to process your Super payments. Make sure you process your Super payments early, so you don’t go over the ATO’s quarterly deadline.

- Wait a couple weeks and check to make sure the payments went through.

- You can also pay Super via a service called “Quick Super”. Basically, you:

- Register your business with a large Superannuation fund (e.g. Hostplus, AustralianSuper, CBUS, etc.). NOTE: you only need one account (e.g. Aussie Super) and from there you can pay all employees (e.g. someone using Hostplus).

- Add each employee’s superannuation details.

- Login every few months to pay Super.

Honestly, if you use Xero. Just use Xero. It’s easier.

Grey Space Advisory – snag a $100 health check

Grey Space Advisory – snag a $100 health check Rask – Get Owen’s best investing research

Rask – Get Owen’s best investing research