Investors looking for exposure to ASX energy shares have undoubtedly asked themselves which company is better placed to generate superior returns – Woodside Energy Group Ltd (ASX: WDS) or Santos Ltd (ASX: STO).

With an underinvestment in traditional sources such as oil and gas, commodity prices remain above historic norms. While this is the case, major producers such as WDS and STO are generating healthy cash flows and dividends.

When it comes to energy exposure, at Seneca, we prefer low-cost producers that can generate cash flow through the cycle as well as capitalise on high prices. A diversified asset base is also preferable to mitigate risks from potential production issues from any one given asset. Due to their scale, the majors such as Santos and Woodside Energy fit this description.

Woodside’s assets

Woodside Energy is a global energy producer capped at $71 billion and has producing assets in Australia (Northwest shelf in Western Australia and Victoria), the Gulf of Mexico, Trinidad and Tobago, and Senegal (in development).

Woodside Energy announced its second cost blowout at Senegal offshore oil project, Sangomar in July 2023. As an offshore deepwater project off the coats of Africa, these projects typically have high upfront capex requirements but relatively low opex.

The cost increases are not insignificant, amounting to +$890 million at the midpoint to between $7.3 and $7.7 billion, blaming “remedial work” on a production vessel.

This is a project that WDS is relying on for production growth (to replace declining reserves). It is a large and complex project that started construction in January 2020 and has been delayed twice, now expected to be delivered by mid-2024.

WDS also carries execution risk on its other large projects including the $16.5-billion Scarborough gas venture in Western Australia and the recently sanctioned $US7.2-billion Trion oil project in Mexico.

Santos’ assets

Santos Ltd is a global energy producer capped at $26 billion and has been producing assets primarily across Australasia. STO completed a merger with Oil Search Ltd (ASX: OSH) in 2022 creating a low-cost, large-scale ASX company.

STO’s production is split across LNG (56%), domestic gas (29%) and crude oil and liquids (15%). The company also has carbon capture and storage projects in its pipeline. STO’s primary asset is a 42.5% stake in a PNG LNG project operated by ExxonMobil, with a variety of other assets in Australia and Alaska, attempting to replenish declining production out of the Cooper Basin.

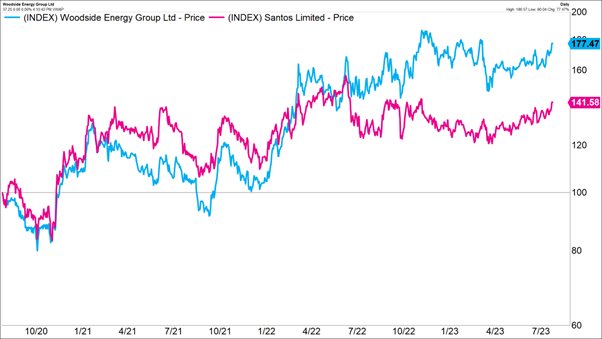

Relative performance

Coming out of covid, the STO share price has traded sideways, diverging from the oil price, and underperforming major oil and gas peers including WDS.

STO has a payout ratio of just 40%, compared to WDS’s 80% in recent periods. WDS’s preference to distribute capital to shareholders via fully franked dividends appears to be favoured by the market, rewarding it with a stronger share price performance.

The primary catalyst for STO shares to play catch-up is capital returns, which should help bridge the valuation gap to peers.

Proceeds from the near-term selldown of a 5% stake in its PNG LNG project could realise US$1.4 billion (A$2.1 billion) for STO. STO updated the market in May that the sale exclusivity period with Kumul has been extended to 31 August 2023. If the deal does complete, STO would have the capacity to buy back a large amount of stock (accretive to shareholders), in addition to the US$350-million buyback already in progress.

Relative valuation

The forward P/E ratio WDS shares is 13x, compared to STO at 11x. The two shares have historically tracked each other’s multiples closely, with room to the upside if STO closes the gap to WDS’s valuation. Once the market sees evidence of STO’s growth projects starting to bear fruit, the multiple should re-rate to accommodate this higher production base.

In addition, the asset sale reflects a valuation of STO ex-PNG of ~US$9/bbl for the remaining assets, significantly cheaper than peers.

What do the brokers say?

WDS has a median target price of $35.64, implying 4% downside, with 4 buys, 4 holds, and 1 sell.

STO has a median target price of $8.70, implying a healthy 10% upside, with 8 buys, 0 holds, and 0 sells.

Macquarie calculated on 20 July that the STO share price trades on a valuation implying an oil price of US$54/bbl (or US$47/bbl if growth projects are un-risked) with a significant margin of safety to the current oil price of ~US$80/bbl.

Is WDS or STO the better buy today?

While both WDS and STO offer exposure to energy amidst higher inflation and a structural underinvestment in energy markets globally, we prefer STO for a valuation discount, and a tangible path to shares re-rating.